- United States

- /

- Capital Markets

- /

- NasdaqGS:HOOD

Will Robinhood Markets' (HOOD) Global Expansion Shape Its Long-Term Competitive Edge?

Reviewed by Sasha Jovanovic

- In October 2025, Robinhood Markets showcased its leadership at TOKEN2049 Singapore and announced further product expansion, including the international rollout of prediction markets through a partnership with Kalshi and new crypto offerings after acquiring Bitstamp.

- A key shift highlighted is the growing analyst optimism driven by Robinhood’s accelerated earnings growth, diversified revenue streams, and ambitious push into global markets and alternative financial products.

- We’ll explore how Robinhood’s rapid product diversification and strong analyst sentiment could reshape its investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

Robinhood Markets Investment Narrative Recap

To be a Robinhood shareholder today, you need to believe that the company’s rapid product expansion and global reach, from new crypto tools to prediction markets, will sustain robust user growth and recurring revenue despite intensifying competition and recent pressure on brokerage margins. The October conference and product announcements provide short-term excitement, but the key catalyst remains accelerating user and revenue growth, while the elevated valuation and signs of weakness in the core brokerage business stand out as the most pressing risks. So far, the news around prediction markets does not materially alter these near-term drivers for the stock.

One of the most relevant announcements was Robinhood’s partnership with Kalshi to launch new prediction markets, including for the NFL and college football. This move plays directly into the market’s current catalyst of product diversification, while also highlighting how Robinhood is targeting alternative revenue streams outside traditional brokerage fees.

But against these growth ambitions, investors should be mindful that...

Read the full narrative on Robinhood Markets (it's free!)

Robinhood Markets' outlook projects $5.3 billion in revenue and $1.8 billion in earnings by 2028. This reflects analysts' expectations of 14.0% annual revenue growth, with earnings forecast to remain unchanged from the current $1.8 billion.

Uncover how Robinhood Markets' forecasts yield a $128.94 fair value, a 7% downside to its current price.

Exploring Other Perspectives

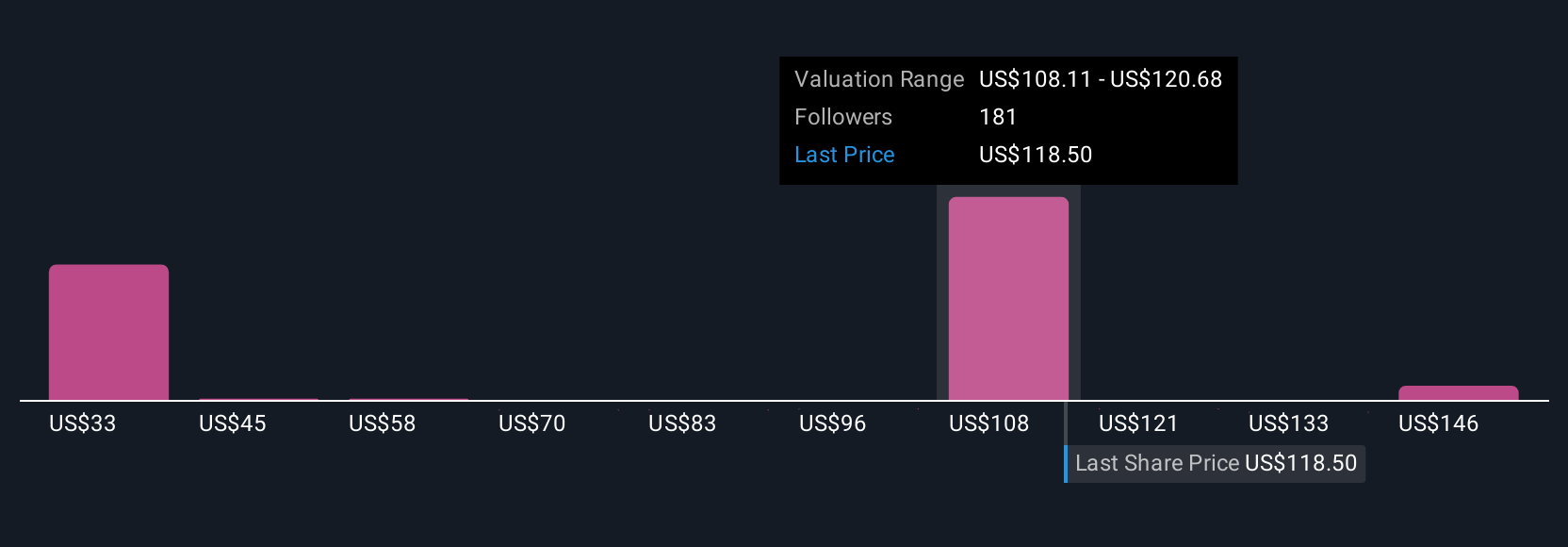

Simply Wall St Community members submitted 43 fair value estimates for Robinhood ranging from US$40.12 to US$158.37 per share. Given this wide spectrum, consider how sustained margin pressure from brokerage competition could influence these differing outlooks on the company’s long-term performance.

Explore 43 other fair value estimates on Robinhood Markets - why the stock might be worth as much as 14% more than the current price!

Build Your Own Robinhood Markets Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Robinhood Markets research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Robinhood Markets research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Robinhood Markets' overall financial health at a glance.

No Opportunity In Robinhood Markets?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOOD

Robinhood Markets

Operates financial services platform in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives