- United States

- /

- Capital Markets

- /

- NasdaqGS:HOOD

Robinhood Markets (NasdaqGS:HOOD) Surges 21% As Fed Holds Interest Rates Steady

Reviewed by Simply Wall St

Robinhood Markets (NasdaqGS:HOOD) experienced a significant share price increase of 21% over the last week. This upward trend coincided with favorable market conditions, as the major indexes, including the S&P 500 and Nasdaq Composite, began to recover losses following a four-week decline. The Federal Reserve's decision to hold interest rates steady and update its economic outlook positively impacted investor sentiment, fostering a conducive environment for stock appreciation. As broader markets displayed positive momentum, Robinhood's recent performance aligns with the general trend, benefiting from renewed market confidence and the resolution of previous uncertainties.

Robinhood Markets (NasdaqGS:HOOD) has achieved a total return of 236.88% over the past three years. This performance reflects strategic initiatives such as innovative product launches and geographic expansion. The introduction of the Robinhood Gold Card has contributed to increased subscription revenue and higher average revenue per user, enhancing the company’s financial profile. Moreover, the successful rollout of the Robinhood Legend platform for active traders has driven significant transaction volume and revenue growth.

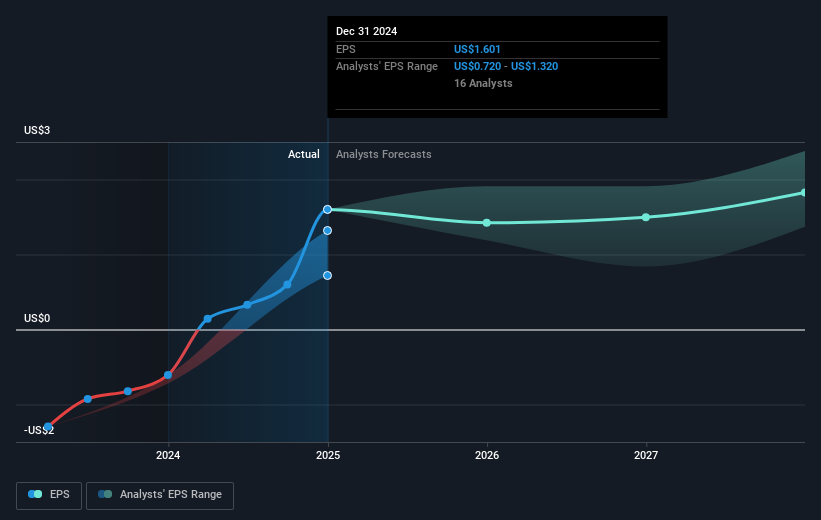

In the most recent year, Robinhood outperformed the US Capital Markets industry, which returned 17.9%, and the broader US market, which achieved 7.6%. The company’s profitability was bolstered by a series of strong quarterly earnings releases, including a full-year 2024 revenue of US$2.95 billion. Share buybacks amounting to US$256.53 million starting in Q3 2024 further supported share price appreciation, reinforcing the company’s commitment to enhancing shareholder value.

Understand Robinhood Markets' track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOOD

Robinhood Markets

Operates financial services platform in the United States.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives