- United States

- /

- Capital Markets

- /

- NasdaqGS:HOOD

Robinhood Markets (NasdaqGS:HOOD) Shares Fall 5% As Revenue Surpasses US$1 Billion

Reviewed by Simply Wall St

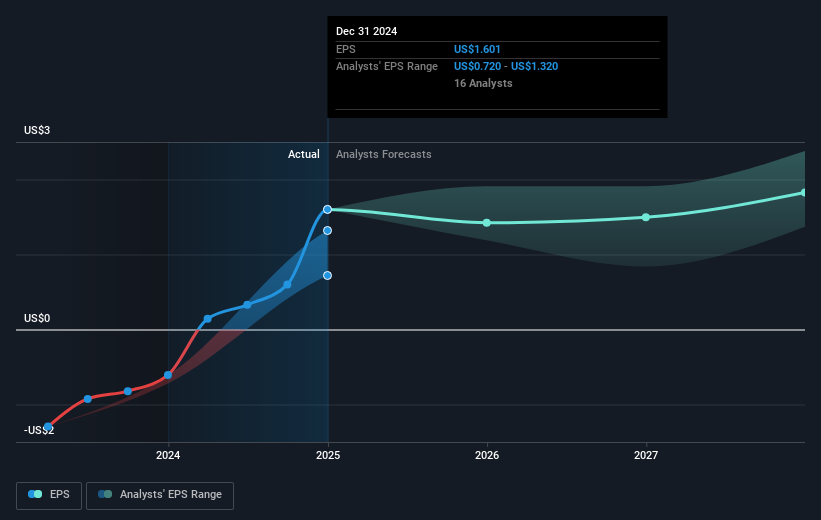

Robinhood Markets (NasdaqGS:HOOD) has experienced a 4.63% decline in its share price over the last quarter, even as it reported impressive financial growth for 2024, with revenue more than doubling to $1,014 million in the fourth quarter and net income reaching $916 million. These figures reflect the company's shift from a net loss in the previous year, showcasing substantial earnings improvements. During the same period, Robinhood repurchased over five million shares in a strategic buyback effort aimed at enhancing shareholder value. Meanwhile, broader market factors such as increased tariffs announced by the Trump administration and growing concerns about a potential recession have contributed to overall market volatility, with the Dow dropping by 1.2% and the S&P 500 by 0.8%. Amid this backdrop of economic uncertainty and fluctuating market sentiment, Robinhood's recent achievements have been overshadowed by external pressures affecting the broader market landscape.

Click to explore a detailed breakdown of our findings on Robinhood Markets.

Over the last three years, Robinhood Markets has delivered a total shareholder return of 234.55%, a substantial gain during this period. This performance exceeded both the broader US market and the Capital Markets industry over the past year.

A key contributor to this return was Robinhood's transition to profitability over the past five years, with earnings growing impressively by 37.2% per year. Additionally, the company demonstrated a strong commitment to enhancing shareholder value through significant share buybacks, repurchasing over ten million shares since May 2024. Leadership changes, such as the addition of Christopher Payne to the Board, and the company's focus on acquisitions to drive growth also influenced market sentiment. These factors collectively underscore the company's robust performance, even amidst legal challenges and a volatile economic climate.

- Learn how Robinhood Markets' intrinsic value compares to its market price with our detailed valuation report.

- Gain insight into the risks facing Robinhood Markets and how they might influence its performance—click here to read more.

- Is Robinhood Markets part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOOD

Robinhood Markets

Operates financial services platform in the United States.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives