- United States

- /

- Capital Markets

- /

- NasdaqGS:HOOD

Robinhood Markets (NasdaqGS:HOOD) Sees Q1 Revenue Surge To US$927 Million

Reviewed by Simply Wall St

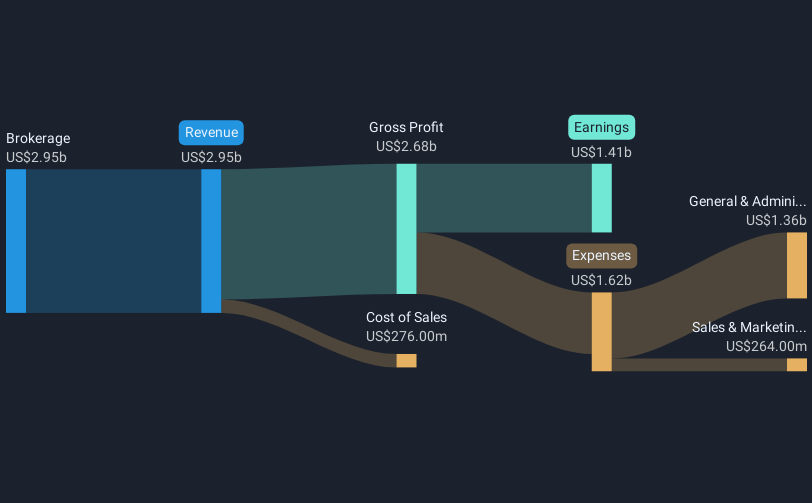

Robinhood Markets (NasdaqGS:HOOD) recently announced significant first-quarter earnings growth, with revenue jumping to $927 million and net income reaching $336 million. These robust financial results were complemented by an increase in their share buyback program by $500 million, signaling a strong commitment to shareholder value. During this period, Robinhood's stock saw a striking 52% increase, surpassing the overall market's 5% rise in the past week and beating the 12% market growth over the last year. These developments illustrate a strong alignment with Robinhood's growth trajectory and investor confidence.

With Robinhood Markets (NasdaqGS:HOOD) showing significant earnings growth in the recent quarter, the company's expanded share buyback program and platform enhancements, including new financial offerings like futures and crypto, are crucial in enhancing revenue streams. These initiatives, alongside international expansion efforts, are likely to impact revenue and earnings forecasts by driving trading volumes and diversifying income streams. In the face of regulatory challenges and competitive pressures, Robinhood aims to strengthen its market position and increase long-term shareholder value.

Over the past three years, Robinhood has experienced a very large total shareholder return of 512.70%, illustrating remarkable growth compared to a more moderate 24.9% return from the US Capital Markets industry over the past year. This significant performance indicates strong investor support and effective company strategies. Despite a recent share price surge, the current price is trading at a slight discount to the consensus analyst price target of US$62.08, reflecting potential upside. Considering the anticipated growth in revenue to US$4.60 billion and a projected, albeit flat, future earnings target of US$1.50 billion by 2028, Robinhood's strategic initiatives could further validate its valuation and analyst expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOOD

Robinhood Markets

Operates financial services platform in the United States.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives