- United States

- /

- Consumer Finance

- /

- NasdaqGS:ECPG

We Think Shareholders May Want To Consider A Review Of Encore Capital Group, Inc.'s (NASDAQ:ECPG) CEO Compensation Package

Key Insights

- Encore Capital Group's Annual General Meeting to take place on 7th of June

- CEO Ashish Masih's total compensation includes salary of US$861.1k

- The overall pay is comparable to the industry average

- Encore Capital Group's EPS declined by 79% over the past three years while total shareholder loss over the past three years was 6.6%

The results at Encore Capital Group, Inc. (NASDAQ:ECPG) have been quite disappointing recently and CEO Ashish Masih bears some responsibility for this. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 7th of June. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. The data we present below explains why we think CEO compensation is not consistent with recent performance.

Check out our latest analysis for Encore Capital Group

Comparing Encore Capital Group, Inc.'s CEO Compensation With The Industry

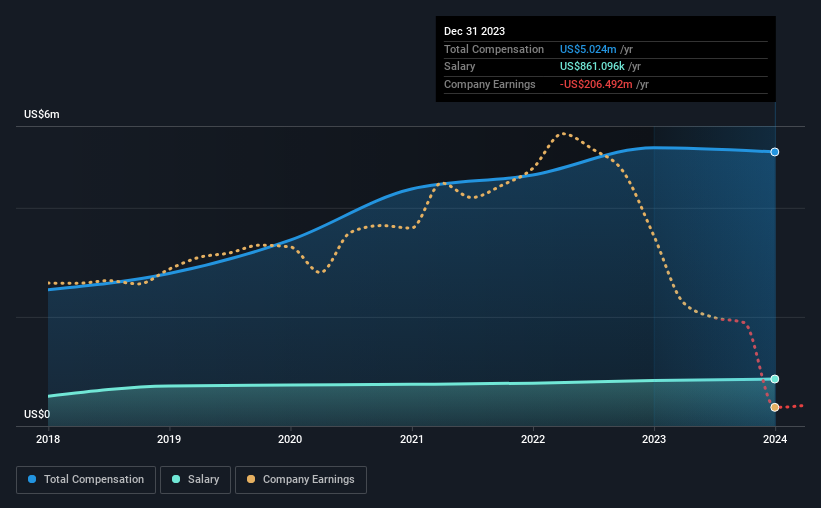

Our data indicates that Encore Capital Group, Inc. has a market capitalization of US$1.0b, and total annual CEO compensation was reported as US$5.0m for the year to December 2023. That is, the compensation was roughly the same as last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$861k.

On comparing similar companies from the American Consumer Finance industry with market caps ranging from US$400m to US$1.6b, we found that the median CEO total compensation was US$4.8m. This suggests that Encore Capital Group remunerates its CEO largely in line with the industry average. What's more, Ashish Masih holds US$11m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$861k | US$832k | 17% |

| Other | US$4.2m | US$4.3m | 83% |

| Total Compensation | US$5.0m | US$5.1m | 100% |

On an industry level, roughly 17% of total compensation represents salary and 83% is other remuneration. Our data reveals that Encore Capital Group allocates salary more or less in line with the wider market. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Encore Capital Group, Inc.'s Growth

Over the last three years, Encore Capital Group, Inc. has shrunk its earnings per share by 79% per year. Its revenue is up 2.2% over the last year.

The decline in EPS is a bit concerning. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Encore Capital Group, Inc. Been A Good Investment?

Since shareholders would have lost about 6.6% over three years, some Encore Capital Group, Inc. investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 1 warning sign for Encore Capital Group that investors should be aware of in a dynamic business environment.

Important note: Encore Capital Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Encore Capital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ECPG

Encore Capital Group

A specialty finance company, provides debt recovery solutions and other related services for consumers across financial assets worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026