- United States

- /

- Diversified Financial

- /

- NasdaqGS:DLO

3 US Stocks Estimated To Be Up To 36.6% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market experiences a downturn, with major indexes like the S&P 500 and Nasdaq recording significant weekly losses, investors are increasingly focused on identifying opportunities amidst volatility. In this environment, stocks estimated to be trading below their intrinsic value may present potential for growth, as they offer an attractive entry point for those looking to invest in fundamentally strong companies despite current market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First National (NasdaqCM:FXNC) | $23.80 | $46.25 | 48.5% |

| Capital Bancorp (NasdaqGS:CBNK) | $27.85 | $53.44 | 47.9% |

| Business First Bancshares (NasdaqGS:BFST) | $28.20 | $55.07 | 48.8% |

| West Bancorporation (NasdaqGS:WTBA) | $24.02 | $46.82 | 48.7% |

| Afya (NasdaqGS:AFYA) | $16.005 | $31.50 | 49.2% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.80 | $63.87 | 48.6% |

| Smith Douglas Homes (NYSE:SDHC) | $30.52 | $60.48 | 49.5% |

| Datadog (NasdaqGS:DDOG) | $126.09 | $243.25 | 48.2% |

| WEX (NYSE:WEX) | $179.08 | $345.87 | 48.2% |

| Marcus & Millichap (NYSE:MMI) | $40.63 | $78.74 | 48.4% |

We're going to check out a few of the best picks from our screener tool.

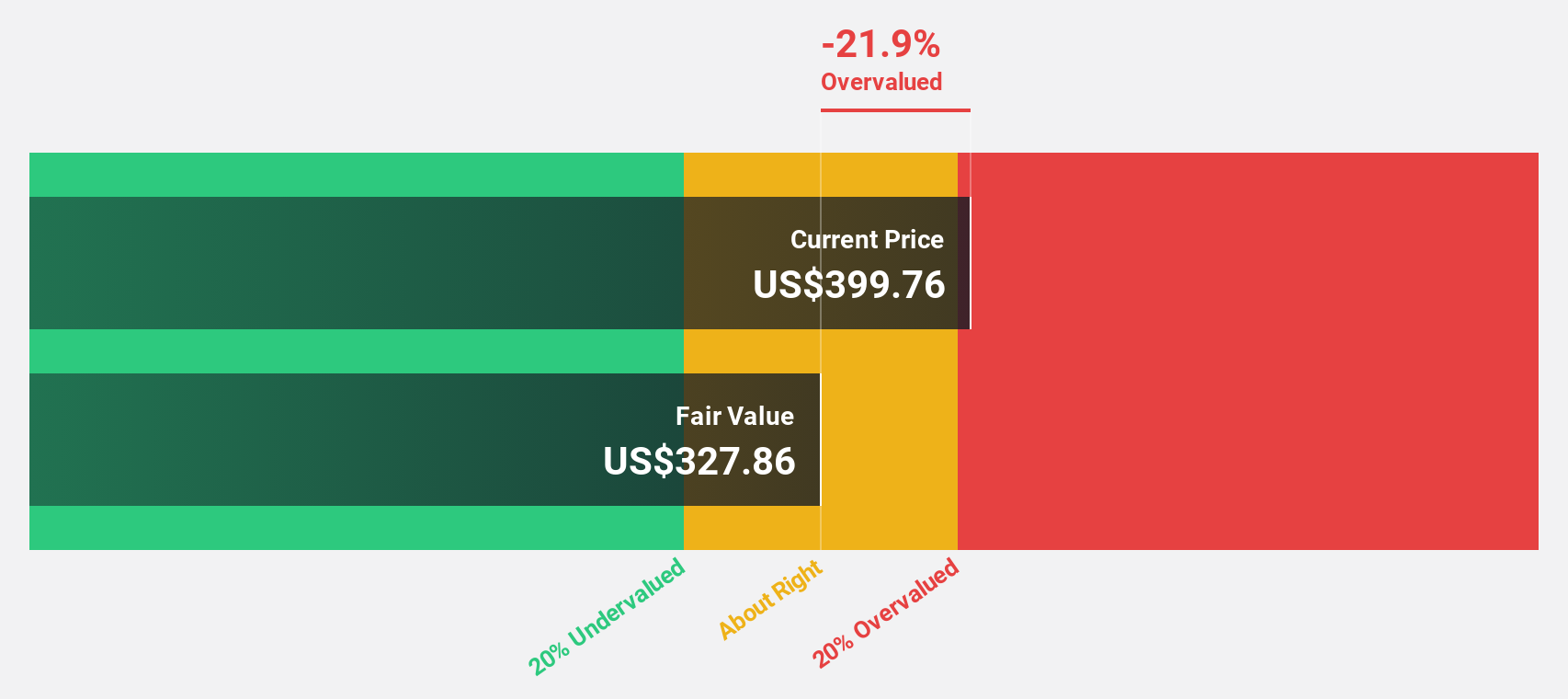

CyberArk Software (NasdaqGS:CYBR)

Overview: CyberArk Software Ltd. develops, markets, and sells software-based identity security solutions and services globally, with a market cap of approximately $13.20 billion.

Operations: The company's revenue is primarily derived from its Security Software & Services segment, which generated $909.46 million.

Estimated Discount To Fair Value: 36.6%

CyberArk Software is trading at US$305.27, significantly below its estimated fair value of US$481.53, suggesting it may be undervalued based on cash flows. The company has recently become profitable and forecasts indicate strong revenue growth exceeding 20% annually, outpacing the broader U.S. market. However, shareholder dilution occurred over the past year. Recent strategic partnerships and acquisitions are expected to bolster growth further, evidenced by raised earnings guidance for 2024 following a successful acquisition of Venafi.

- Our growth report here indicates CyberArk Software may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of CyberArk Software stock in this financial health report.

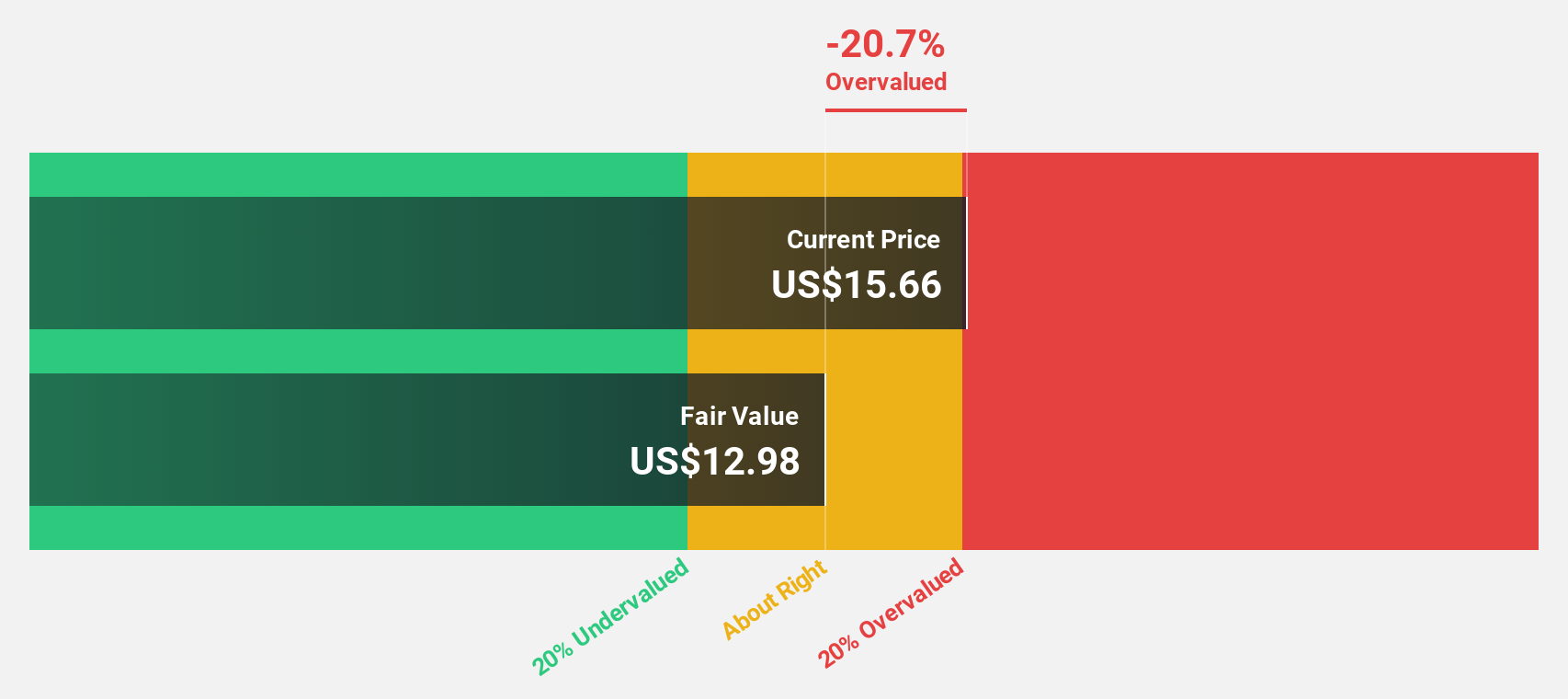

DLocal (NasdaqGS:DLO)

Overview: DLocal Limited operates a global payment processing platform and has a market cap of approximately $2.82 billion.

Operations: The company generates revenue from its payment processing segment, amounting to $729.49 million.

Estimated Discount To Fair Value: 10.9%

DLocal is trading at US$9.89, slightly below its estimated fair value of US$11.1, indicating potential undervaluation based on cash flows. Despite a decline in net profit margin from 24.1% to 16.3%, the company forecasts robust earnings growth of over 27% annually, outpacing the U.S. market average. Recent earnings reports show increased sales but decreased net income year-over-year, highlighting challenges amidst expected high revenue growth exceeding 20% per annum.

- Insights from our recent growth report point to a promising forecast for DLocal's business outlook.

- Dive into the specifics of DLocal here with our thorough financial health report.

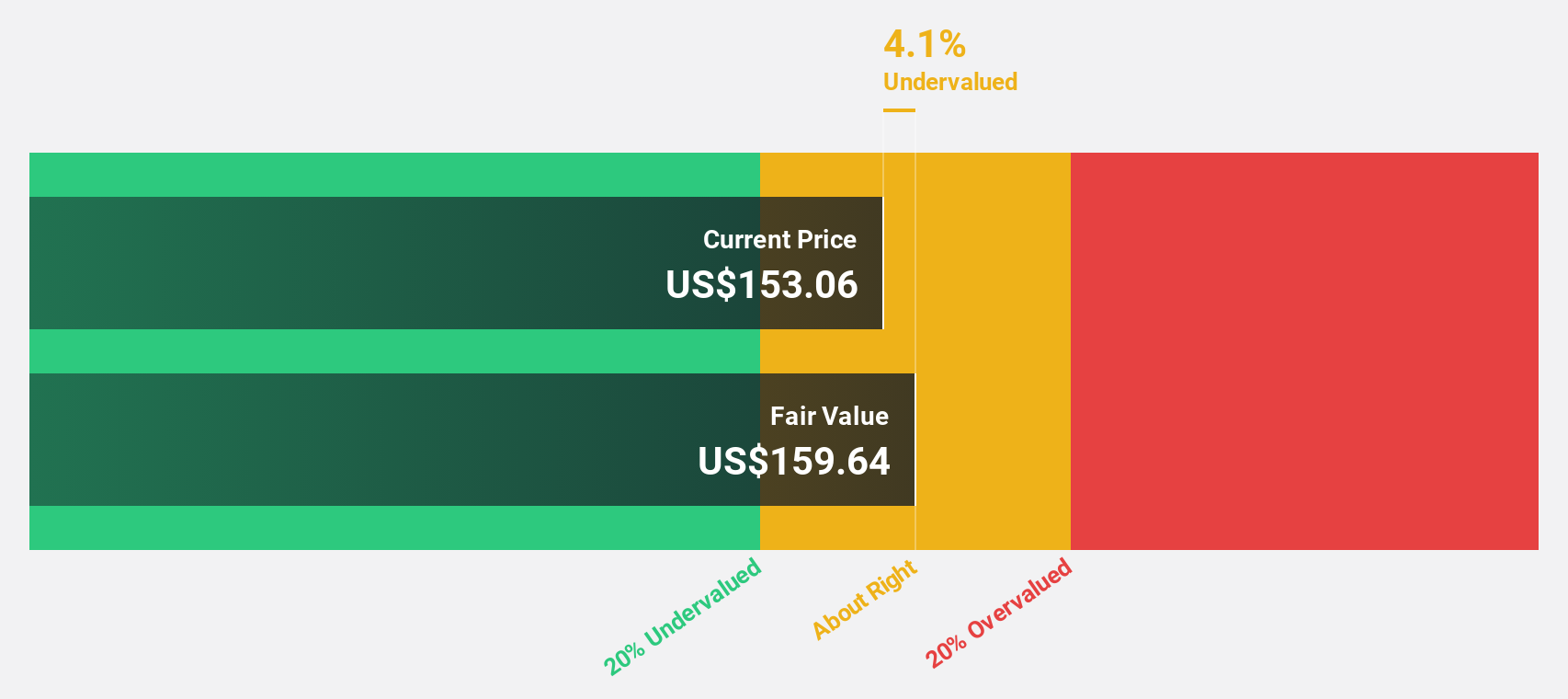

Live Nation Entertainment (NYSE:LYV)

Overview: Live Nation Entertainment, Inc. is a global live entertainment company with a market cap of approximately $29.75 billion, focusing on concert promotion, venue operations, and ticketing services.

Operations: The company's revenue is primarily generated from three segments: Concerts ($19.33 billion), Ticketing ($2.89 billion), and Sponsorship & Advertising ($1.17 billion).

Estimated Discount To Fair Value: 33.4%

Live Nation Entertainment is trading at US$129, significantly below its estimated fair value of US$193.65, suggesting it may be undervalued based on cash flows. Despite a decrease in net profit margin from 1.7% to 0.9%, earnings are forecast to grow substantially at 31.4% annually, surpassing the U.S. market average of 15.3%. Recent reports show decreased quarterly sales and net income year-over-year but highlight strong revenue growth over nine months.

- Our earnings growth report unveils the potential for significant increases in Live Nation Entertainment's future results.

- Delve into the full analysis health report here for a deeper understanding of Live Nation Entertainment.

Turning Ideas Into Actions

- Click here to access our complete index of 199 Undervalued US Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLO

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives