- United States

- /

- Consumer Finance

- /

- NasdaqGM:DAVE

Dave (DAVE) Launches CashAI v5.5 Enhancing Risk Analysis And Credit Performance

Reviewed by Simply Wall St

Dave (DAVE) experienced a price move of 19% over the past month, potentially influenced by the launch of its CashAI v5.5, which enhanced its AI-driven underwriting capabilities significantly. This development likely bolstered investor confidence as the company touted lower delinquency rates with early implementations. Additionally, a new share buyback plan worth up to $125 million indicated a firm commitment to shareholder value. These internal advancements added to the company's positive trajectory amidst a broader market that hit all-time highs, as exemplified by the S&P 500 and Nasdaq, bolstered by generally optimistic market sentiment reinforced by a lowering producer prices index.

We've identified 2 risks for Dave that you should be aware of.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

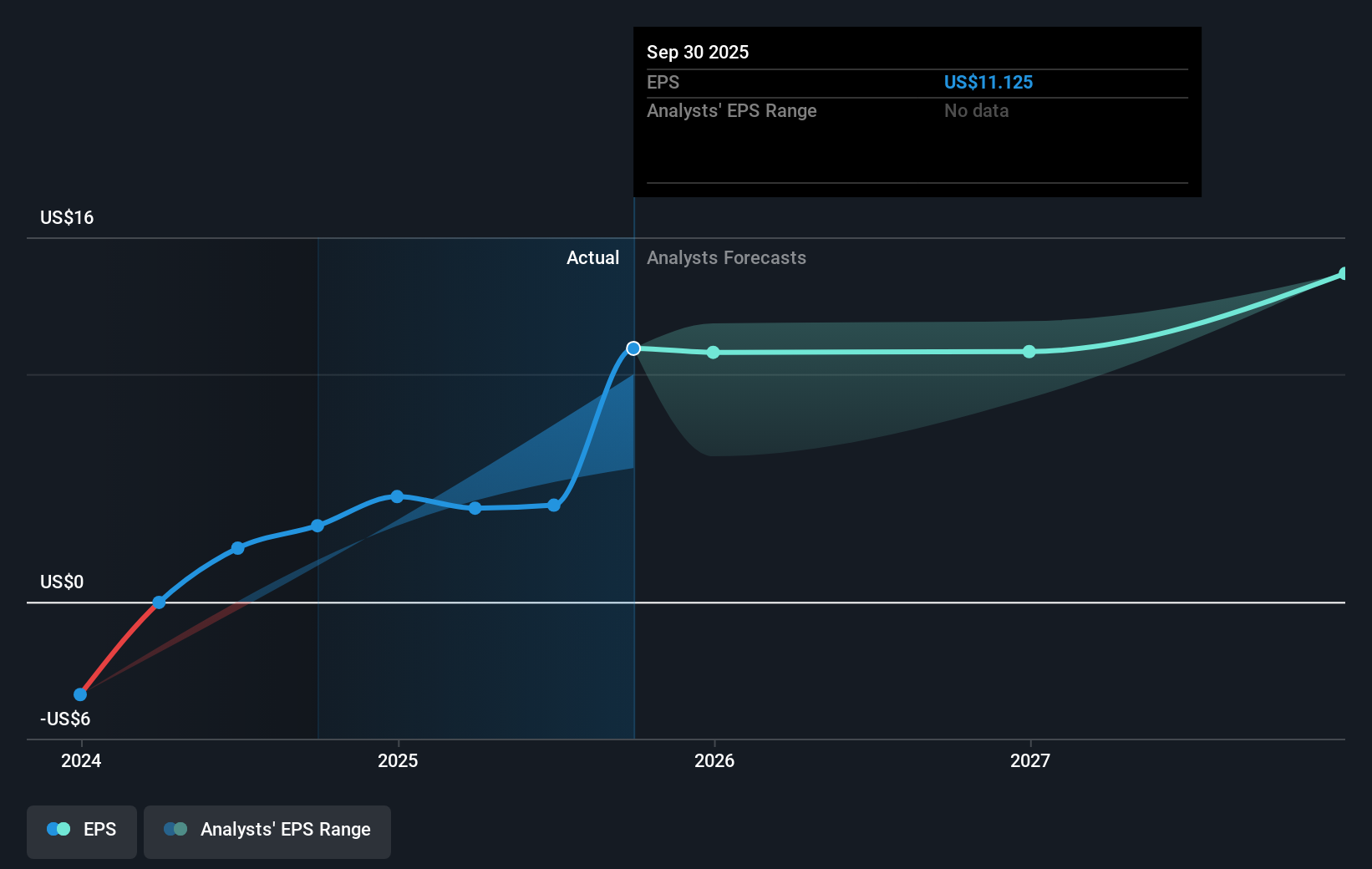

The recent advancements including the launch of CashAI v5.5 and the substantial share buyback plan are poised to influence Dave's narrative by strengthening its AI-driven underwriting, potentially lowering delinquency rates. Such innovations could not only boost investor confidence but also drive increased revenue and enhance earnings forecasts by expanding customer value and improving net margins. These advancements align with expectations that revenue will grow by 17.9% annually over the next three years, potentially bringing earnings up to US$193 million from US$55.1 million, and support the anticipated improvement in profit margins.

Looking at Dave's longer-term performance, the company has seen a very large total return of over 1311.74% over the past three years. This indicates robust shareholder value creation, contrasting starkly with the broader US Consumer Finance industry, which posted a return of 43.7% over the past year. In comparison, Dave exceeded last year's return of both the Consumer Finance industry and the broader market, which were 43.7% and 20% respectively. Despite the recent share price appreciation, it still trades at a discount to the consensus price target of US$271.86, suggesting potential upside. The current share price represents a 25.2% anticipated increase to achieve the analyst average target, reinforcing an optimistic outlook for continued growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:DAVE

Dave

Provides various financial products and services through its financial services platform in the United States.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.