- United States

- /

- Consumer Finance

- /

- NasdaqGM:DAVE

3 Growth Companies With High Insider Ownership And 83% Earnings Growth

Reviewed by Simply Wall St

As the U.S. stock market navigates a volatile landscape marked by fluctuating indices and economic uncertainties, investors continue to seek opportunities in growth companies that demonstrate robust potential. In this context, high insider ownership often signals confidence in a company's future prospects, making such stocks particularly appealing amidst the current market dynamics.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Prairie Operating (PROP) | 31.3% | 75.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.1% | 52.6% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.1% | 30.3% |

| Celsius Holdings (CELH) | 10.8% | 31.8% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

Let's dive into some prime choices out of the screener.

Dave (DAVE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dave Inc. operates a financial services platform offering various financial products and services in the United States, with a market cap of $2.79 billion.

Operations: The company generates revenue of $433.07 million from its service-based and transaction-based operations within the United States.

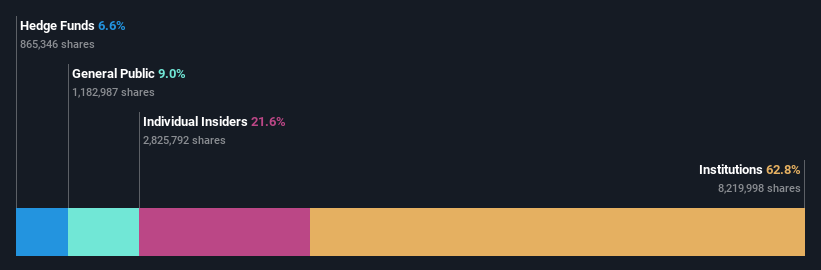

Insider Ownership: 18.8%

Earnings Growth Forecast: 40.4% p.a.

Dave Inc. demonstrates potential as a growth company with significant insider ownership, reinforced by its recent strategic advancements. The full implementation of CashAI v5.5 is expected to enhance credit performance and profitability through improved risk assessment and approval processes. Despite some insider selling, the company's revenue and earnings are projected to grow faster than the US market, supported by raised revenue guidance for 2025 between US$505 million and US$515 million.

- Get an in-depth perspective on Dave's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Dave is priced higher than what may be justified by its financials.

Amneal Pharmaceuticals (AMRX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Amneal Pharmaceuticals, Inc. is a global biopharmaceutical company that develops, manufactures, markets, and distributes generics, injectables, biosimilars, and specialty branded pharmaceutical products worldwide with a market cap of approximately $3.12 billion.

Operations: The company's revenue segments include Avkare at $665.33 million, Specialty at $472.81 million, and Affordable Medicines at $1.71 billion.

Insider Ownership: 39.2%

Earnings Growth Forecast: 83.7% p.a.

Amneal Pharmaceuticals shows promise with high insider ownership and recent strategic advancements, including FDA approvals for key products like sodium oxybate and risperidone. The company's earnings are forecast to grow significantly faster than the US market, despite slower revenue growth projections. Recent submissions, such as the BLA for a biosimilar to XOLAIR®, highlight its potential in expanding product offerings. However, interest payments remain a concern due to limited coverage by earnings.

- Click to explore a detailed breakdown of our findings in Amneal Pharmaceuticals' earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Amneal Pharmaceuticals shares in the market.

Daqo New Energy (DQ)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Daqo New Energy Corp. manufactures and sells polysilicon to photovoltaic product manufacturers in China, with a market cap of approximately $1.80 billion.

Operations: The company's revenue is primarily generated from the sale of polysilicon, amounting to $592.96 million.

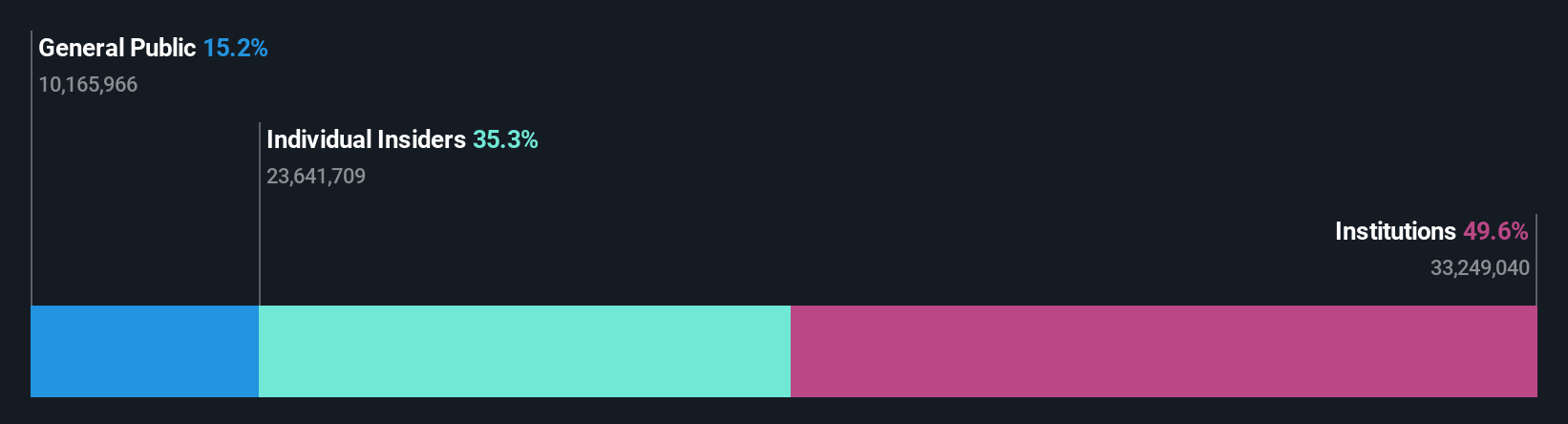

Insider Ownership: 35.3%

Earnings Growth Forecast: 81.5% p.a.

Daqo New Energy highlights its growth potential with high insider ownership and strong revenue forecasts, expected to grow 33.6% annually, outpacing the US market. Despite recent financial challenges, including a net loss of US$148.32 million in the first half of 2025, the company remains focused on expansion with production guidance for up to 140,000 MT of polysilicon this year. A new US$100 million share repurchase program reflects confidence in future prospects amidst volatile share prices.

- Navigate through the intricacies of Daqo New Energy with our comprehensive analyst estimates report here.

- Our valuation report here indicates Daqo New Energy may be undervalued.

Where To Now?

- Investigate our full lineup of 204 Fast Growing US Companies With High Insider Ownership right here.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:DAVE

Dave

Provides various financial products and services through its financial services platform in the United States.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives