- United States

- /

- Capital Markets

- /

- NasdaqCM:CWD

Little Excitement Around CaliberCos Inc.'s (NASDAQ:CWD) Revenues As Shares Take 25% Pounding

CaliberCos Inc. (NASDAQ:CWD) shares have had a horrible month, losing 25% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 65% share price decline.

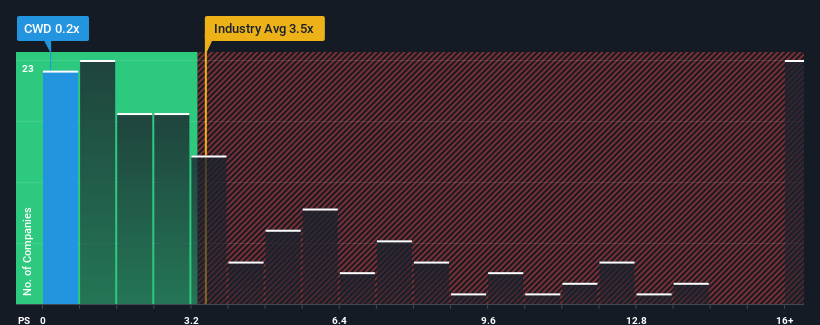

Since its price has dipped substantially, CaliberCos may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Capital Markets industry in the United States have P/S ratios greater than 3.5x and even P/S higher than 9x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for CaliberCos

How CaliberCos Has Been Performing

CaliberCos hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think CaliberCos' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For CaliberCos?

CaliberCos' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's top line. Still, the latest three year period has seen an excellent 97% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth is heading into negative territory, declining 60% over the next year. With the industry predicted to deliver 9.3% growth, that's a disappointing outcome.

In light of this, it's understandable that CaliberCos' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does CaliberCos' P/S Mean For Investors?

CaliberCos' P/S looks about as weak as its stock price lately. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of CaliberCos' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, CaliberCos' poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 4 warning signs for CaliberCos you should be aware of.

If these risks are making you reconsider your opinion on CaliberCos, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade CaliberCos, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CWD

CaliberCos

A real estate investment, and an asset management firm specializes in middle-market assets.

Moderate and fair value.

Market Insights

Community Narratives