- United States

- /

- Capital Markets

- /

- NasdaqGS:CSWC

Broker Revenue Forecasts For Capital Southwest Corporation (NASDAQ:CSWC) Are Surging Higher

Capital Southwest Corporation (NASDAQ:CSWC) shareholders will have a reason to smile today, with the analysts making substantial upgrades to next year's statutory forecasts. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects. Investor sentiment seems to be improving too, with the share price up 5.2% to US$19.81 over the past 7 days. Could this big upgrade push the stock even higher?

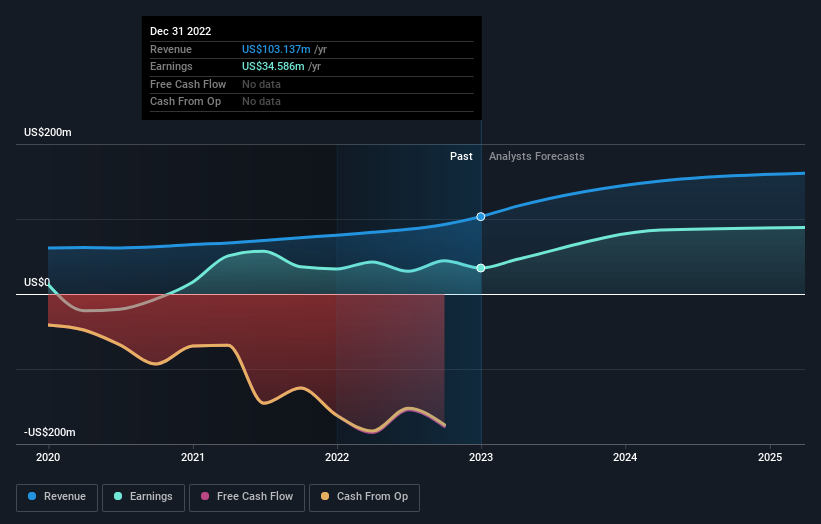

Following the upgrade, the most recent consensus for Capital Southwest from its seven analysts is for revenues of US$156m in 2024 which, if met, would be a major 51% increase on its sales over the past 12 months. Per-share earnings are expected to soar 133% to US$2.49. Prior to this update, the analysts had been forecasting revenues of US$139m and earnings per share (EPS) of US$2.36 in 2024. The forecasts seem more optimistic now, with a nice gain to revenue and a small increase to earnings per share estimates.

View our latest analysis for Capital Southwest

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The analysts are definitely expecting Capital Southwest's growth to accelerate, with the forecast 39% annualised growth to the end of 2024 ranking favourably alongside historical growth of 19% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 8.0% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Capital Southwest to grow faster than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for next year, expecting improving business conditions. They also upgraded their revenue estimates for next year, and sales are expected to grow faster than the wider market. Seeing the dramatic upgrade to next year's forecasts, it might be time to take another look at Capital Southwest.

Analysts are clearly in love with Capital Southwest at the moment, but before diving in - you should be aware that we've identified some warning flags with the business, such as the risk of cutting its dividend. For more information, you can click through to our platform to learn more about this and the 2 other concerns we've identified .

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CSWC

Capital Southwest

A business development company specializing in credit and private equity and venture capital investments in middle market companies, mezzanine, later stage, mature, late venture, emerging growth, buyouts, industry consolidation, recapitalizations and growth capital investments.

Undervalued moderate.