- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

How the BVNK Acquisition Talks Could Impact Coinbase’s Current Valuation

Reviewed by Bailey Pemberton

Thinking about what to do with your Coinbase Global stock? Whether you are a long-term believer in crypto or just tracking big movers, Coinbase has given investors a lot to talk about. With shares recently closing at $357.01, the stock has seen some serious action. Over the last year, it is up an incredible 102.4% and boasts a jaw-dropping 461.4% gain over the past three years. Even after a bumpy week with the price down 6.1%, Coinbase has climbed 38.8% so far this year and posted a strong 10.5% gain over the past month.

This swirling momentum may have something to do with recent headlines. From talks of acquiring fast-growing crypto firms like London's BVNK and India's CoinDCX to navigating new government stances on digital assets, Coinbase is clearly aiming to strengthen its presence in the global crypto ecosystem. The updates out of Washington about changes to 401(k) rules and upcoming crypto policy reports have also been catalysts, stirring the waters for both opportunity and risk.

But here is the million-dollar question: is Coinbase fairly priced right now, or could it be a bargain? According to one commonly used value score (where 1 is good and 6 is perfect undervaluation), Coinbase only checked one box. This suggests it might not look cheap based on classic metrics. Still, valuation is rarely black and white. Let us take a closer look at how different methods assess the company, and stick around until the end for an even more insightful way to think about Coinbase's true worth.

Coinbase Global scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Coinbase Global Excess Returns Analysis

The Excess Returns model focuses on how effectively a company generates returns above its cost of equity. In simple terms, it measures whether Coinbase is creating real value for shareholders after covering the expected return investors demand for owning the stock.

Here is how the model shakes out for Coinbase Global based on the latest analyst estimates and company data:

- Book Value: $47.17 per share

- Stable EPS: $9.15 per share (sourced from a weighted average of future Return on Equity estimates from 7 analysts)

- Cost of Equity: $4.82 per share

- Excess Return: $4.33 per share

- Average Return on Equity: 15.52%

- Stable Book Value: $58.96 per share (based on future projections from 3 analysts)

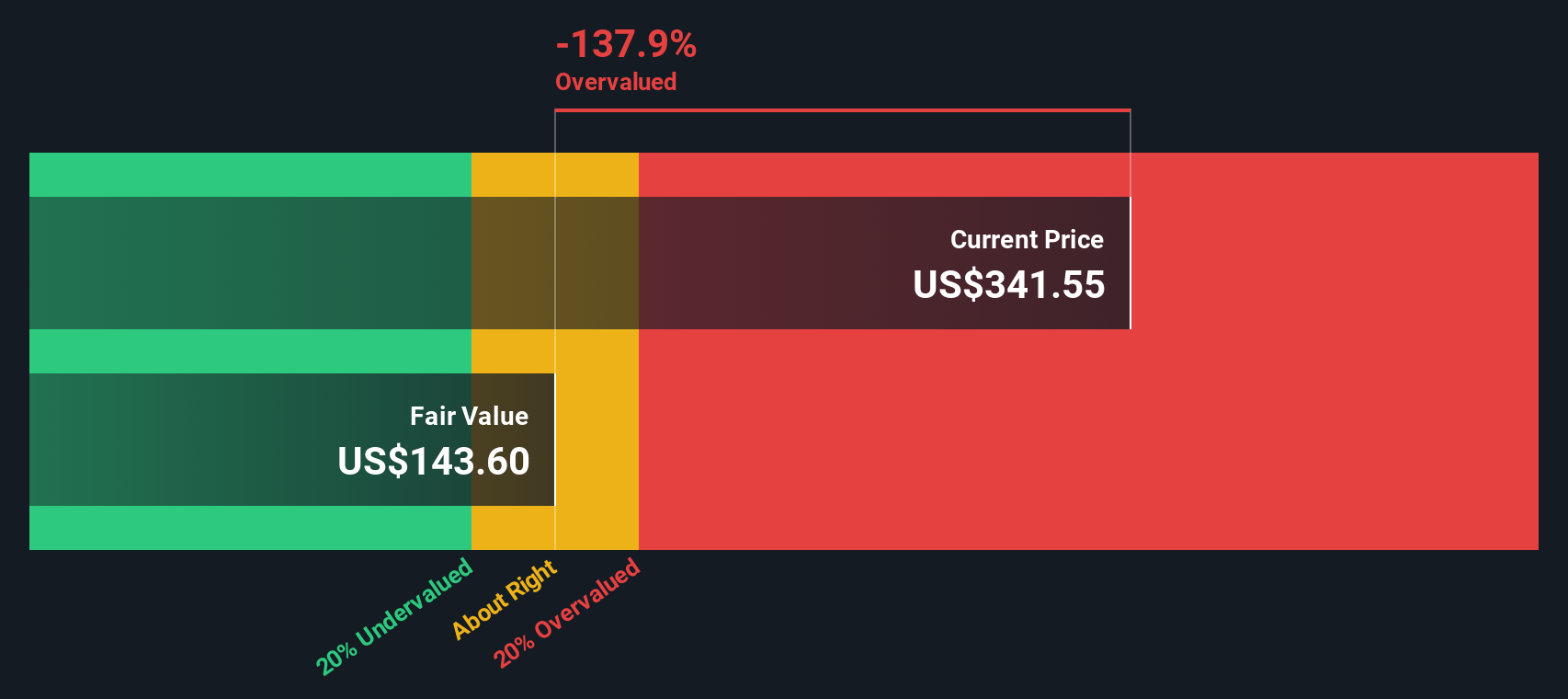

According to this methodology, Coinbase’s estimated intrinsic value per share is $144.05. With the stock trading at $357.01, this means Coinbase is currently about 147.8% overvalued on an excess returns basis, a significant gap.

Result: OVERVALUED

Our Excess Returns analysis suggests Coinbase Global may be overvalued by 147.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Coinbase Global Price vs Earnings

For companies like Coinbase Global that are reporting profits, the price-to-earnings (PE) ratio is a widely used yardstick. It is particularly effective because it ties the market price directly to a business's current earnings. This makes it easier to gauge how much investors are paying for each dollar of profit.

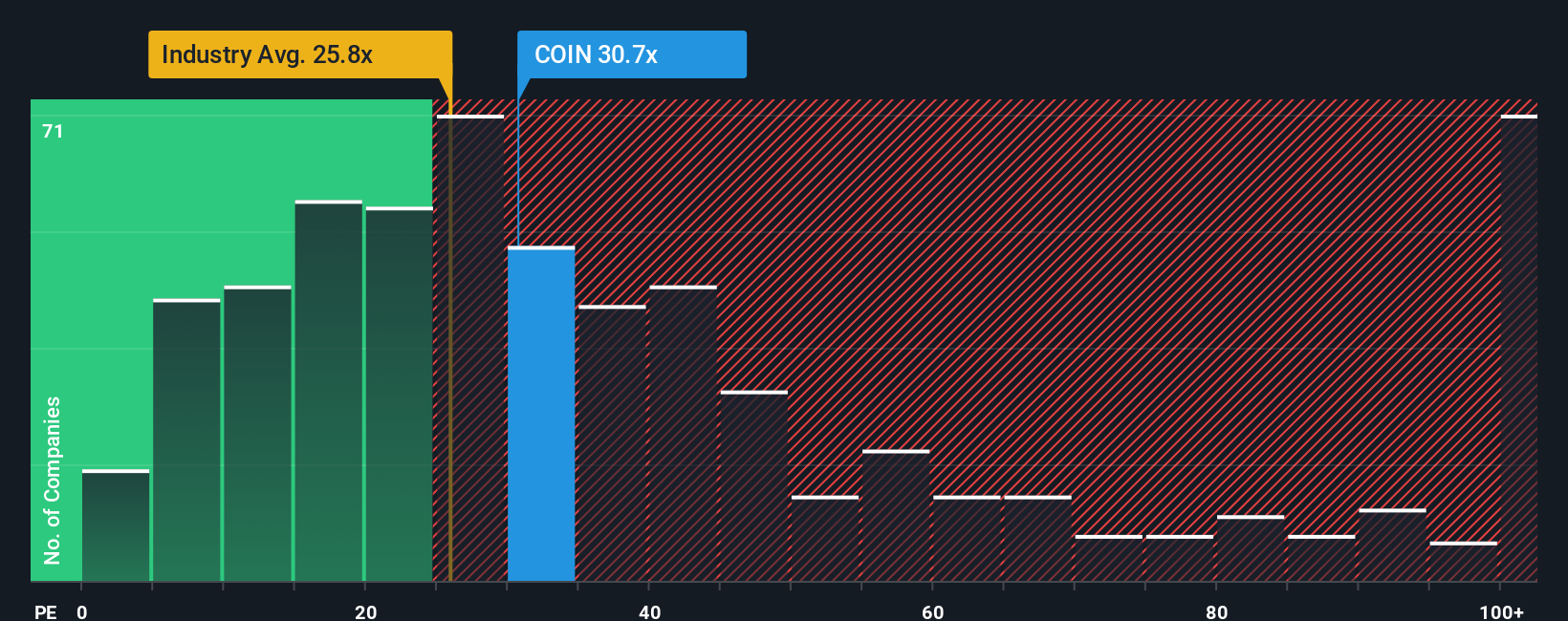

Growth potential and risk play a major role in what qualifies as a “normal” or “fair” PE ratio. Higher growth prospects or lower risk typically justify a loftier multiple, while slow growers or riskier companies tend to trade at a discount. Coinbase currently has a PE ratio of 32.07x. Put into context, this is close to the peer average of 33.51x, but significantly above the Capital Markets industry average of 24.86x.

To go a step further, Simply Wall St’s proprietary Fair Ratio sets the benchmark PE at 19.83x for Coinbase. The Fair Ratio provides more insight than just comparing industry averages or peers, as it thoughtfully considers Coinbase’s own track record of earnings growth, profit margins, business risks, size, and its unique position within the industry.

Comparing Coinbase’s actual PE ratio (32.07x) with its Fair Ratio (19.83x), the stock appears to be trading well above what the company’s fundamentals suggest is fair value based on growth and risk.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coinbase Global Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are simply the story or perspective you have about a company, connecting your view of its future prospects, such as revenue growth, profit margins, and risks, to a financial forecast and, ultimately, a fair value estimate.

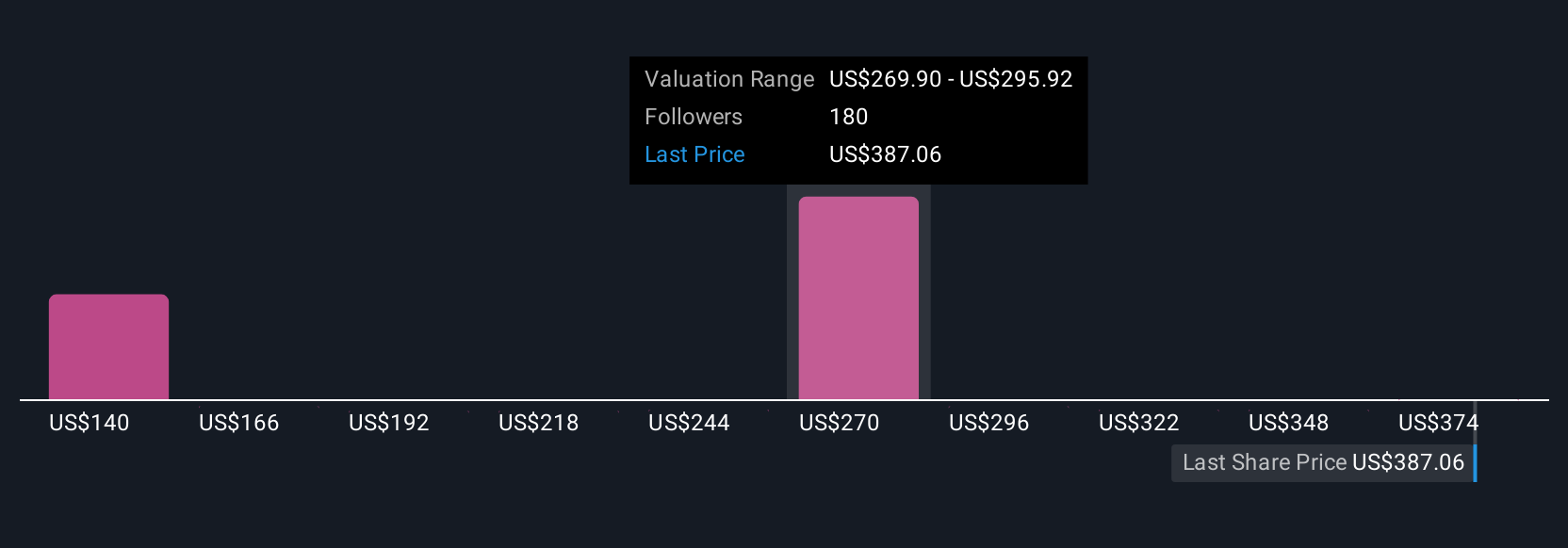

Instead of just crunching numbers, a Narrative lets you lay out why you believe Coinbase Global is set to thrive or struggle and see exactly how that story shapes your fair value for the stock. Narratives are an easy and accessible tool found in the Community page on Simply Wall St, where millions of investors share and compare their perspectives.

As new information, such as earnings or major news, hits the market, Narratives update dynamically, helping you decide whether to buy, hold, or sell by directly comparing each Narrative’s fair value with the current share price. For example, some investors see Coinbase’s fair value as high as $510 based on rapid adoption and ecosystem expansion. Others, more conservative in their outlook, set it at just $185, reflecting concerns around trading volumes and regulation, which highlights how different stories lead to different valuations.

Do you think there's more to the story for Coinbase Global? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives