- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

How Declining Liquidity may Further Pressure Coinbase Global, Inc. (NASDAQ:COIN)

Summary:

- Coinbase seems to be highly exposed to the price of bitcoin.

- Both retail and institutional investors may be pulling away from high-risk investments.

- The tightening cycle may further drain liquidity, decreasing transaction volumes on Coinbase.

Coinbase Global, Inc. (NASDAQ:COIN) is a global crypto exchange, that earns a portion of each transaction made on the platform. In this article, we will look at the risk of the decreasing crypto trade volume and what factors may contribute to the decline.

Coinbase is quite a volatile stock and investors are in the red after the decline of the price of crypto assets, especially Bitcoin. For Coinbase, this is significant, as Bitcoin is the highest contributing income crypto traded on the platform. We can even go so far as to observe that the stock is trading in close proportion to the change in the price of Bitcoin, as shown by the chart below:

From this, we can see that every analysis of Coinbase is a derivative analysis of the current most popular crypto - which today is still Bitcoin. For the most part, there are two major types of investors in Coinbase: institutional investors (companies, investment banks), and retail investors that can employ their own savings.

After initial reluctance, institutional investors started increasing their exposure to crypto assets as they felt pressure from their clients to take part in the 2021 gains. A notable example of this, is the recommendation issued by JPMorgan Chase (NYSE:JPM) in 2021 for investors to own 1% crypto in their portfolio.

At the other end of the spectrum, we have retail investors, which are possibly more risk-taking and some even trade exclusively with crypto. The funding capacity of retail investors increased as they gained liquidity from the government in 2021, and part of those funds were spent on crypto investments. After new liquidity was halted and the tightening program was announced, we notice the decline in growth tech stocks, which was also reflected in Coinbase and bitcoin.

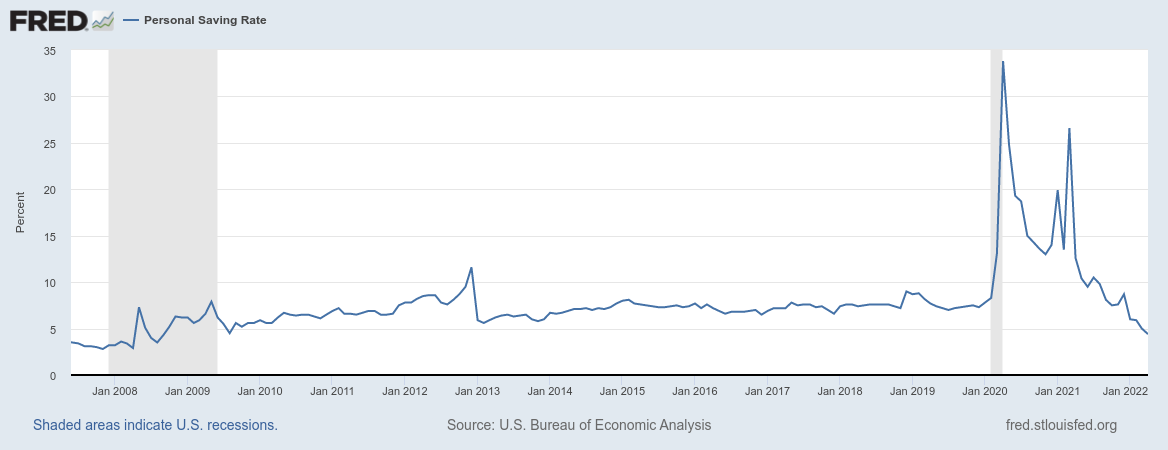

We can use the decline in the savings rate of people - e.g. how much they have left over from their income, to infer that retail investors have a harder time funding crypto investments and are cashing out of their investments, which further pressures the price. If the savings rate is an indicator of the price stability of crypto, then we may want to be cautious about the near-term future of both bitcoin and Coinbase as liquidity continues to be drained.

The chart above indicates a steady decline of the savings rate as we move further in the tightening cycle. As interest rates increase and the FED starts shrinking the balance sheet, we may witness even more drainage of liquidity from markets, and these assets may continue to fall. Additionally, some large investors (1, 2) are formulating strategies to stay away from investments even if they are seeing valuable opportunities because of the current direction of the market.

Conclusion

Coinbase seems to be heavily influenced by the price changes in crypto, particularly bitcoin. As liquidity keeps being drained during the tightening cycle, assets like crypto may experience further declines, which has the potential to keep pressuring the price of Coinbase.

Institutional investors may be reversing their strategy on high-risk assets (including crypto), and the personal savings of retail investors are at multi-year lows, which may encourage cashing-out and prioritizing income for daily needs instead of investing.

Coinbase may see multiple short term rallies, but the declining liquidity landscape is a meaningful risk factor for the company, at least until the uncertainty from inflation subsides.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Coinbase Global going out to 2024, and you can see them free on our platform here.

Plus, you should also learn about the 2 warning signs we've spotted with Coinbase Global .

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives