- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

Coinbase Global (NasdaqGS:COIN) Declines 17% As Q4 2025 Earnings Rise

Reviewed by Simply Wall St

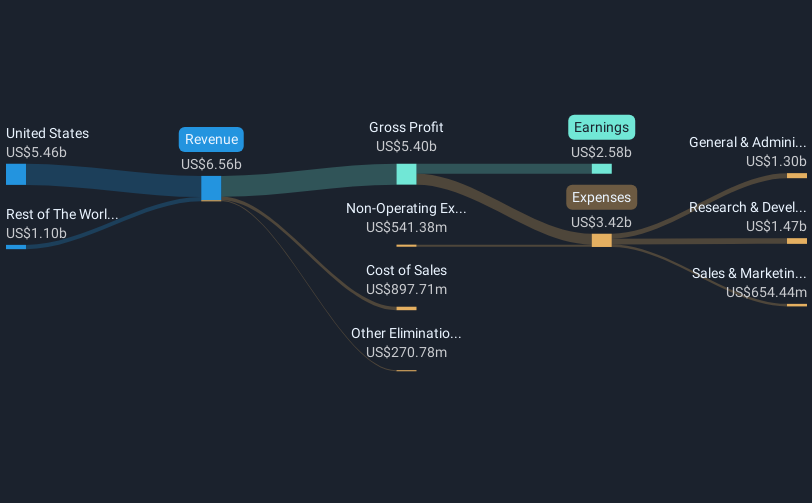

Coinbase Global (NasdaqGS:COIN) experienced a 17% decline in its share price over the past week, despite robust financial performance for the fourth quarter of 2025. The company reported a notable year-on-year increase in sales and net income, yet the absence of any share buybacks during this period may reflect strategic decisions that dampened investor sentiment. The ongoing commitment to acquisitions, underscored by statements from CEO Brian Armstrong, highlights an ambitious growth strategy, particularly in enhancing their product offerings and international reach. Meanwhile, the broader market saw a 4% decline, influenced by persistent economic concerns, such as tariffs and inflation expectations, with tech stocks rallying towards the week's end. Though the tech-heavy Nasdaq Composite surged by over 2%, Coinbase's decline suggests that sector-wide gains had limited impact on the company's stock, possibly overshadowed by broader financial market volatility and its strategic focus on cash preservation.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the longer-term period of three years, Coinbase Global, Inc. (NasdaqGS:COIN) delivered a total shareholder return of 0.15%. During this time, the company's earnings saw massive growth over the past year, and its profit margins improved significantly, culminating in a net profit margin of 41%. However, the broader market experienced challenges, and Coinbase's 1-year total return underperformed compared to the US market and the Capital Markets industry.

Among noteworthy developments, Coinbase initiated a US$1 billion share repurchase program in October 2024. The addition of the company to major indices like the Russell and FTSE on July 1, 2024, enhanced its market presence. Despite these positive actions, legal challenges, including class action lawsuits announced in May and September 2024, may have contributed to investor caution. Strategic focus on acquisitions, as emphasized in 2025, underscores an ongoing commitment to growth, though the slower forecasted revenue growth than the overall market may impact investor sentiment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Coinbase Global, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives