- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

41% Down in the Last Week - Coinbase Global (NASDAQ:COIN) is Facing More Trouble Ahead

Key takeaways:

- Coinbase missed revenue estimates by 22%

- Down 15% pre-market, and -76% in the last 12 months

- Some funds are holding, but retail investors bare most of the risk

Coinbase Global, Inc. ( NASDAQ:COIN ) is dependent on the liquidity of the crypto market, and if traders see gains, then the company gets a slice when they withdraw funds. Unfortunately, the market has been in turmoil in the last year and investors are pulling away. Today, we will put the overall performance of the company in context of the last earnings report .

View our latest analysis for Coinbase Global

Testing Coinbase's Business

Coinbase's investors had a bad start over the last year, as the stock price plummeted 76% . However, some investors and funds are holding on to the stock. Funds like ARK Investment management added 28% to their stake by the end of March, so there may be some reasoning for managers to be involved with Coinbase.

Who holds the stock matters, and you can find the ownership breakdown for Coinbase in our report.

The attractive aspect of the business for investors is that Coinbase is a platform for most crypto assets, and is independent of the rise or downfall of one particular currency - as long as there are other currencies to offset the decline. Unfortunately, Coinbase is not immune to a general slump in the crypto market, which will get tested on its proposed "recession immunity" qualities in the coming months.

We can remind ourselves that Bitcoin - the leading asset in Coinbase, was created during the financial crisis precisely for the reason of attaining independence from centralized currencies. Given that financial tightening is affecting the economy, we may find ourselves in a similar situation to 2007 when the crisis started causing unemployment and people's purchasing power declined . Should something of the sort occur, Coinbase investors will be able to test their thesis on the resilience of cryptocurrencies and may emerge on top.

Earnings Performance

Despite the longer term possibilities, investors are also concerned about the current performance. After Coinbase released the earnings report, we see that the stock has dropped around 15% before Wednesday's market open.

The highlights of the Q1 release are:

- Q1 loss of $1.98 per share

- Q1 sales at $1.165 billion, 22% below the $1.5 estimate

- Sales were 35% lower than last year's Q1 result of $1.8 billion

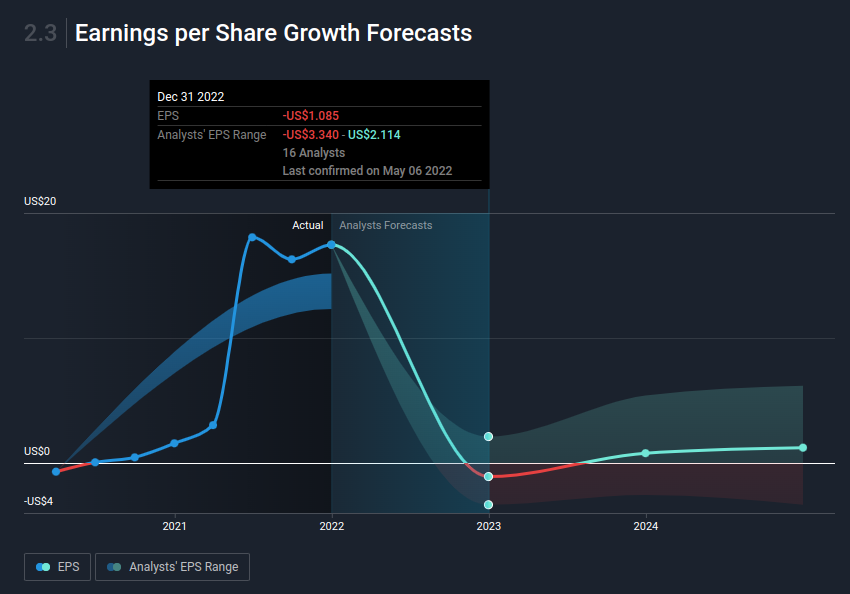

We can see what analysts were expecting prior to the results, and we may experience an adjustment in their estimates for 2023 in the next few days.

Investors can put Coinbase in their Watchlist and get notified of changes in estimates.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

While cryptocurrency markets are hard to forecast, we can see that analysts have been expecting Coinbase to finish 2023 in the red, and the current result indicates that that may happen sooner.

Conclusion

Coinbase Global shareholders are down 76% for the year, even worse than the market loss of 9.8%. The latest earnings suggest more downside, and institutions have already made the first moves pre-market open.

The cryptocurrency markets are high-risk, and investors should be aware that while the company has already made money, the 34%+ of retail investors that own the stock are carrying most of that risk.

To that end, you should learn about the 3 warning signs we've spotted with Coinbase Global (including 1 which is concerning) .

It may also be good to get this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you're looking to trade Coinbase Global, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives