- United States

- /

- Metals and Mining

- /

- NYSE:WS

Spotlighting Undiscovered Gems in the US for December 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has experienced a significant rise of 24% over the past year. In light of expected earnings growth of 15% per annum in the coming years, identifying stocks with strong fundamentals and untapped potential can be key to uncovering undiscovered gems in this dynamic environment.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Power Solutions International (NasdaqCM:PSIX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Power Solutions International, Inc. designs, engineers, manufactures, markets, and sells engines and power systems globally with a market cap of $622.37 million.

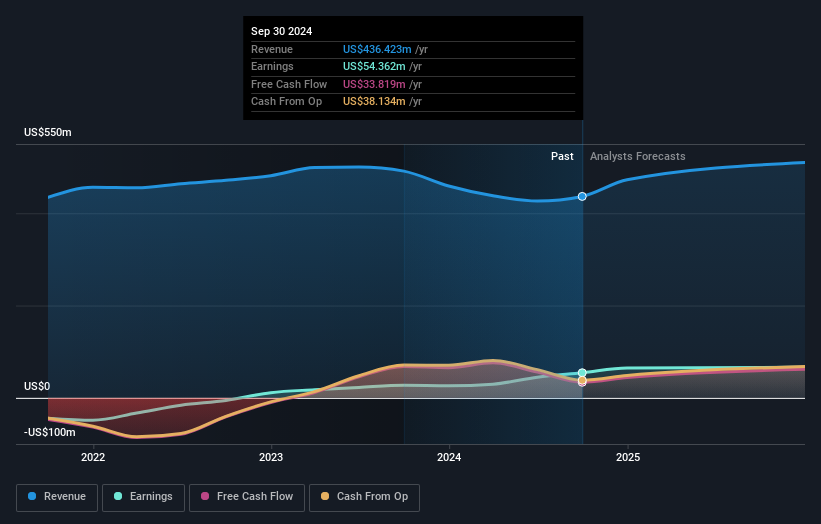

Operations: PSIX generates revenue primarily from its Engineered Integrated Electrical Power Generation Systems segment, which reported $436.42 million. The company's market capitalization stands at approximately $622.37 million.

Power Solutions International, a nimble player in the engine manufacturing sector, has recently transitioned to the NASDAQ Composite Index. Despite its high net debt to equity ratio of 224.8%, which is considered elevated, the company showcases robust earnings growth of 99.5% over the past year, surpassing industry averages. Trading at a significant discount of 41.5% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. Although its share price has been volatile recently and insider selling was noted in recent months, interest payments are well covered by EBIT at 5.1 times coverage, indicating solid operational performance amidst financial challenges.

Coincheck Group (NasdaqGM:CNCK)

Simply Wall St Value Rating: ★★★★★★

Overview: Coincheck Group N.V. operates cryptocurrency exchanges in Japan and has a market capitalization of $1.10 billion.

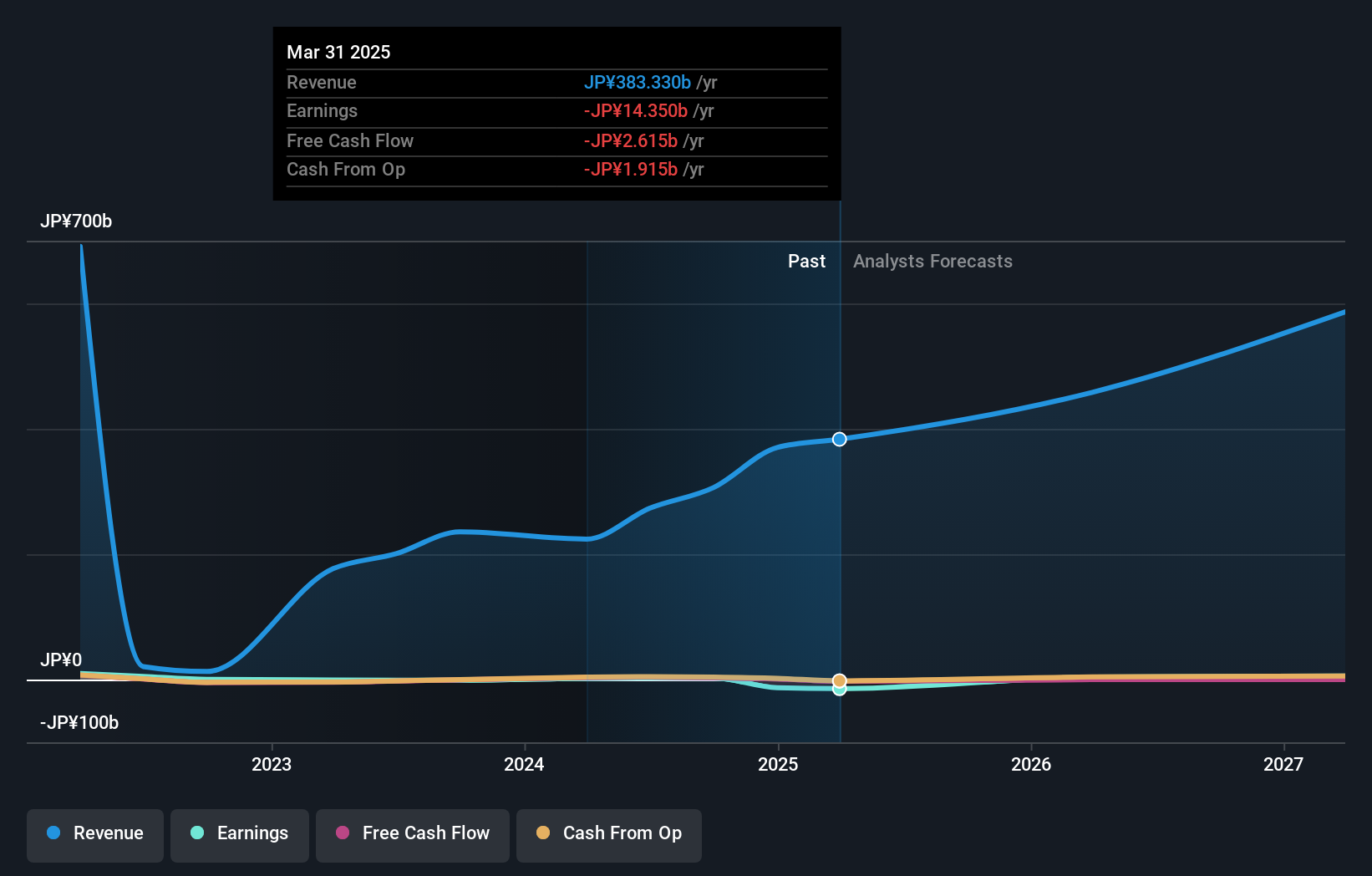

Operations: Coincheck Group generates revenue primarily from its cryptocurrency asset segment, amounting to ¥306.16 million.

Coincheck, Inc. has recently turned a corner by achieving profitability this year, marking a significant shift in its financial landscape. Despite trading at 94% below estimated fair value, the company has faced substantial shareholder dilution over the past year. With no debt on its books for five years and positive free cash flow standing at US$3.13 million as of September 2024, Coincheck appears to be managing its finances prudently. However, earnings have seen a notable decline of 41% annually over the last five years, which could raise concerns about future growth prospects despite being added to the NASDAQ Composite Index recently.

- Get an in-depth perspective on Coincheck Group's performance by reading our health report here.

Gain insights into Coincheck Group's past trends and performance with our Past report.

Worthington Steel (NYSE:WS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Worthington Steel, Inc. operates as a steel processor in North America with a market capitalization of $1.63 billion.

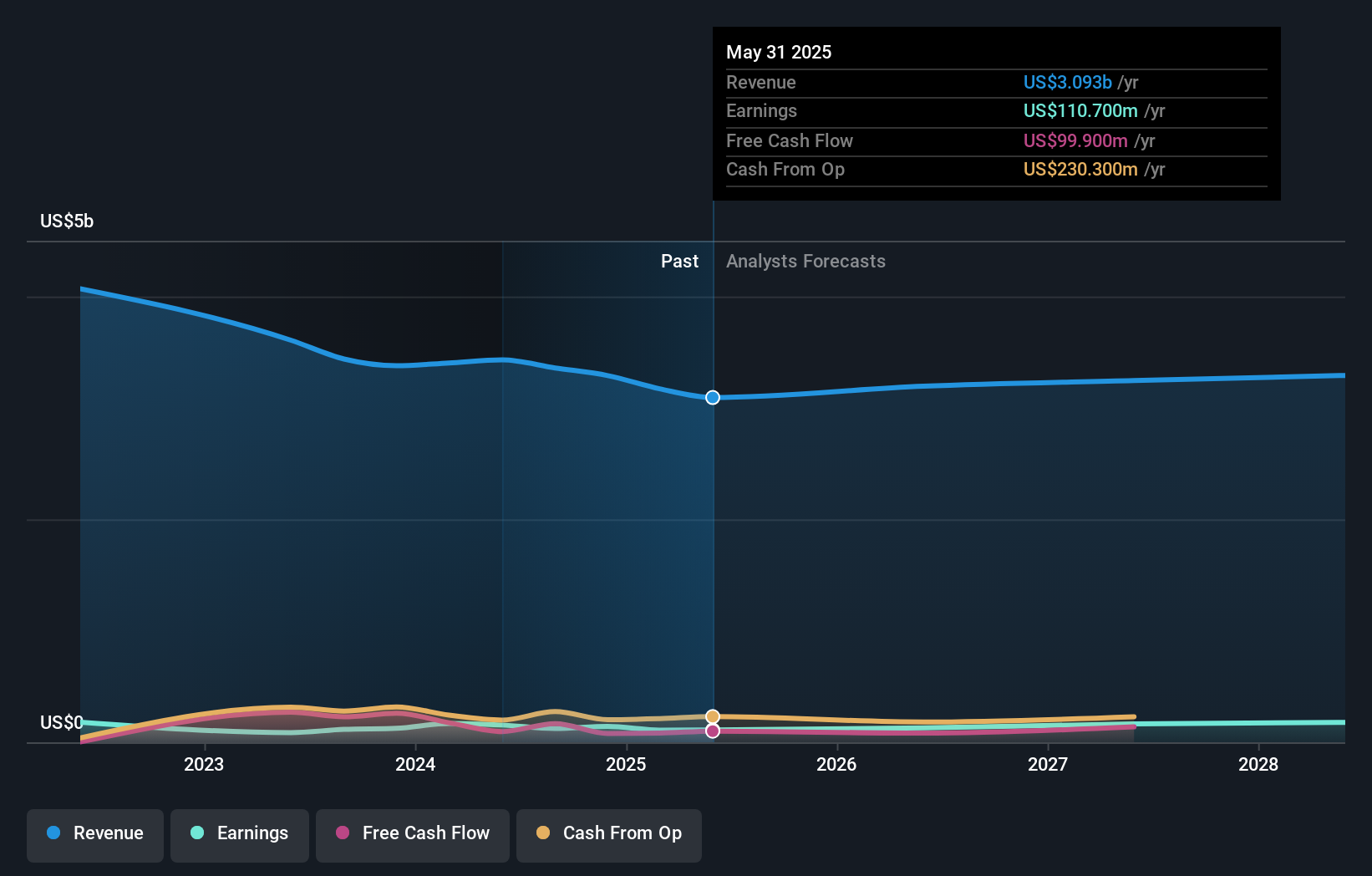

Operations: The company generates revenue primarily from its Metal Processors and Fabrication segment, amounting to $3.29 billion.

Worthington Steel, a promising player in the steel industry, has demonstrated resilience with earnings growth of 14.5% over the past year, outpacing the broader Metals and Mining sector. The company's net debt to equity ratio stands at a satisfactory 5.5%, indicating prudent financial management. Worthington's recent earnings report shows a turnaround with net income of US$12.8 million compared to a loss last year, despite sales dipping from US$808 million to US$739 million for the quarter. The strategic acquisition of Sitem Group aims to bolster its position in Europe and tap into the growing EV market, potentially improving future profit margins and operational efficiencies.

Summing It All Up

- Dive into all 245 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Worthington Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WS

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success