- United States

- /

- Capital Markets

- /

- NasdaqGS:CG

Market Participants Recognise The Carlyle Group Inc.'s (NASDAQ:CG) Revenues Pushing Shares 31% Higher

The Carlyle Group Inc. (NASDAQ:CG) shareholders have had their patience rewarded with a 31% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 47% in the last year.

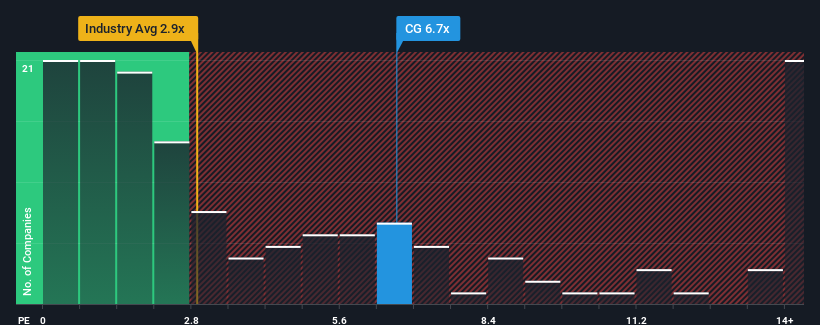

After such a large jump in price, when almost half of the companies in the United States' Capital Markets industry have price-to-sales ratios (or "P/S") below 2.9x, you may consider Carlyle Group as a stock not worth researching with its 6.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Carlyle Group

How Has Carlyle Group Performed Recently?

While the industry has experienced revenue growth lately, Carlyle Group's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Carlyle Group's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Carlyle Group would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 58%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 39% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 31% per year during the coming three years according to the eleven analysts following the company. That's shaping up to be materially higher than the 5.9% per annum growth forecast for the broader industry.

In light of this, it's understandable that Carlyle Group's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The strong share price surge has lead to Carlyle Group's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Carlyle Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Capital Markets industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Carlyle Group (2 don't sit too well with us!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CG

Carlyle Group

An investment firm specializing in direct and fund of fund investments.

Very undervalued low.