- United States

- /

- Consumer Finance

- /

- NasdaqGS:CACC

How Investors Are Reacting To Credit Acceptance (CACC) Securing $500 Million in Lower-Cost Financing

Reviewed by Sasha Jovanovic

- Credit Acceptance Corporation recently completed a US$500.0 million asset-backed non-recourse secured financing, using around US$625.2 million of loans as collateral and issuing three note classes at interest rates between 4.50% and 5.38%.

- This transaction not only reduces higher-cost debt but also leaves Credit Acceptance with approximately US$2.0 billion in unused borrowing capacity and unrestricted cash, significantly enhancing the company’s financial flexibility.

- We’ll now examine how this enhanced balance sheet flexibility could influence Credit Acceptance’s broader investment outlook and risk profile.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Credit Acceptance Investment Narrative Recap

To be a shareholder in Credit Acceptance, you need to believe in its ability to manage credit risk and improve loan performance within the highly competitive subprime auto finance market. The recent US$500.0 million asset-backed financing boosts financial flexibility, which could help address upcoming debt maturities and fund potential growth. However, this move does not materially change the most important near-term catalyst, improvements in loan origination volumes and loan performance, or lessen the primary risk of ongoing credit deterioration in recent loan vintages.

Among recent announcements, the Q3 2025 earnings report stands out, as it highlighted both revenue and net income growth year-over-year. While this reinforces the company’s earnings power, the uplift was not primarily driven by the new financing but rather better operational results; how this momentum interacts with risks around credit quality and future loan volumes remains a key point for investors.

Yet, even with new access to capital, investors should be aware that persistent competition and weaker loan performance in recent vintages could...

Read the full narrative on Credit Acceptance (it's free!)

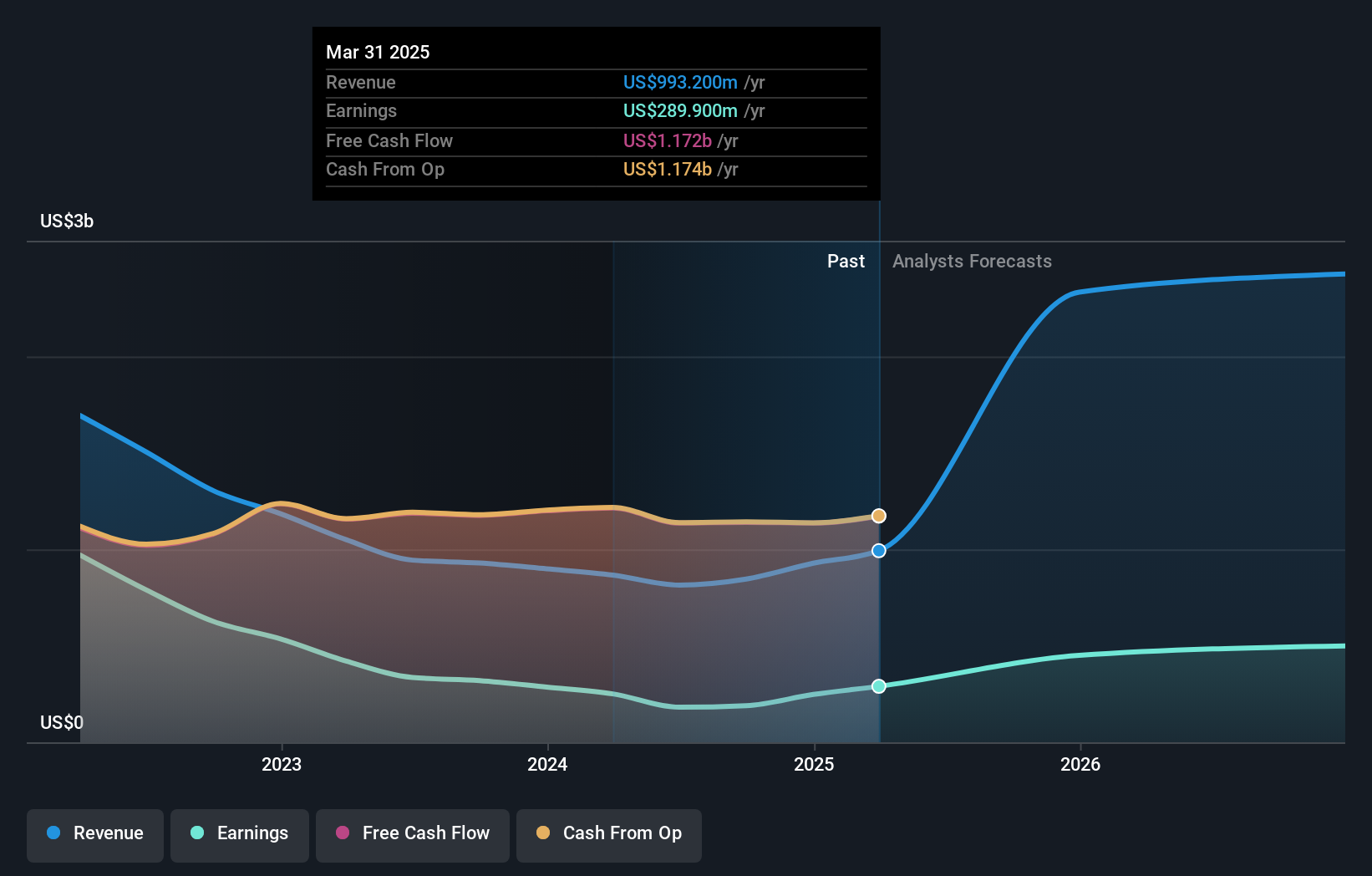

Credit Acceptance's narrative projects $4.5 billion in revenue and $504.0 million in earnings by 2028. This requires 56.2% annual revenue growth and a $79.6 million earnings increase from the current $424.4 million.

Uncover how Credit Acceptance's forecasts yield a $458.00 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Credit Acceptance range widely from US$284.39 to US$458.00 across two viewpoints. As opinions diverge, remember that competition and ongoing credit risk still shape the discussion about future returns.

Explore 2 other fair value estimates on Credit Acceptance - why the stock might be worth 33% less than the current price!

Build Your Own Credit Acceptance Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Credit Acceptance research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Credit Acceptance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Credit Acceptance's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CACC

Credit Acceptance

Engages in the provision of financing programs, and related products and services in the United States.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives