- United States

- /

- Capital Markets

- /

- NasdaqGS:BGC

BGC Group (BGC): Assessing Valuation After Record Q2 Revenues and Upbeat Guidance

Reviewed by Kshitija Bhandaru

BGC Group (BGC) reported record revenues for Q2 2025, with strong growth across its business segments and regions. The company introduced a cost reduction initiative and shared upbeat Q3 guidance, which suggests further momentum ahead.

See our latest analysis for BGC Group.

Building on its robust quarterly results, BGC Group’s recent news has sparked renewed investor attention despite a challenging run for the share price. After a dip of nearly 10% over the past month, momentum appears mixed. It is worth keeping in mind the stock’s impressive longer-term performance, with a three-year total shareholder return of 153%, which suggests staying power beyond the latest swings.

If you’re curious about what other fast-moving companies with strong insider backing are doing, now’s the perfect moment to discover fast growing stocks with high insider ownership

With such robust growth and upbeat guidance, is BGC Group’s current share price leaving value on the table for investors, or is the market already reflecting the company’s promising outlook and future gains?

Most Popular Narrative: 36.8% Undervalued

With BGC Group’s last close at $9.17 and the most popular narrative suggesting fair value at $14.50, the stock price sharply trails behind consensus expectations. The story fueling this valuation hinges on rapid digital platform growth, strategic expansion, and technology-driven transformation.

Continued expansion and strong revenue growth from BGC's electronic trading platforms (notably Fenics and FMX), supported by substantial increases in electronic volumes and market share across asset classes, suggest that BGC is positioned to capitalize on the accelerating shift toward technology-driven trading. This is likely to boost top-line revenue and expand margins due to the higher scalability and profitability of electronic versus voice-driven trading.

Want to know the growth blueprint driving this bullish narrative? It pivots on lightning-fast digital adoption and ambitious profit margin leaps. What assumptions fuel this upward target? See which pivotal forecasts are setting the stage for BGC’s next act.

Result: Fair Value of $14.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this positive outlook could change if trading volumes drop or if anticipated cost synergies from acquisitions do not materialize as expected.

Find out about the key risks to this BGC Group narrative.

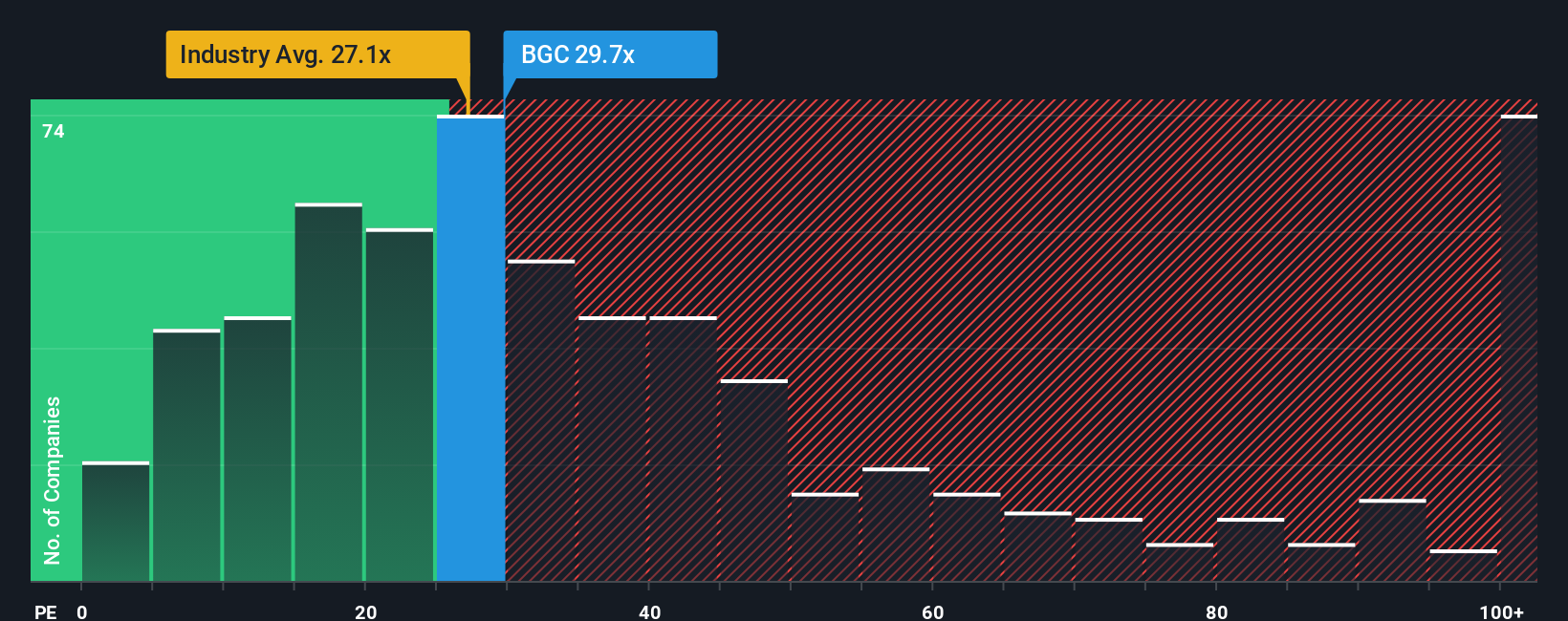

Another View: Peer and Industry Ratios Paint a Different Picture

While the narrative suggests BGC Group is undervalued, comparing its price-to-earnings ratio of 29.6x to the industry average of 25.8x and peer average of 6.9x hints at a much richer valuation. This sizable gap raises questions about whether the market is already pricing in a lot of optimism or if there is room for disappointment if growth stalls.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BGC Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BGC Group Narrative

If you see things differently or want to dig into the numbers firsthand, you can craft your own view in just a few minutes. Do it your way

A great starting point for your BGC Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Seize More Smart Investment Opportunities

Expand your investing edge with top ideas uncovered by the Simply Wall Street Screener. Don’t let a winning stock slip past you. See what others overlook!

- Uncover tomorrow’s winners with these 877 undervalued stocks based on cash flows that highlight hidden gems primed for upside based on in-depth cash flow analysis.

- Boost your portfolio’s potential by tapping into these 18 dividend stocks with yields > 3% offering consistent payouts and robust yields for reliable income.

- Spot early trends in breakthrough technologies and innovation by checking out these 24 AI penny stocks poised to lead in the fast-evolving AI space.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BGC Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BGC

BGC Group

Operates as a financial brokerage and technology company in the United States, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives