- United States

- /

- Mortgage REITs

- /

- NasdaqGS:AGNC

AGNC Investment (NasdaqGS:AGNC) Announces US$1.5 Billion Follow-On Equity Offering

Reviewed by Simply Wall St

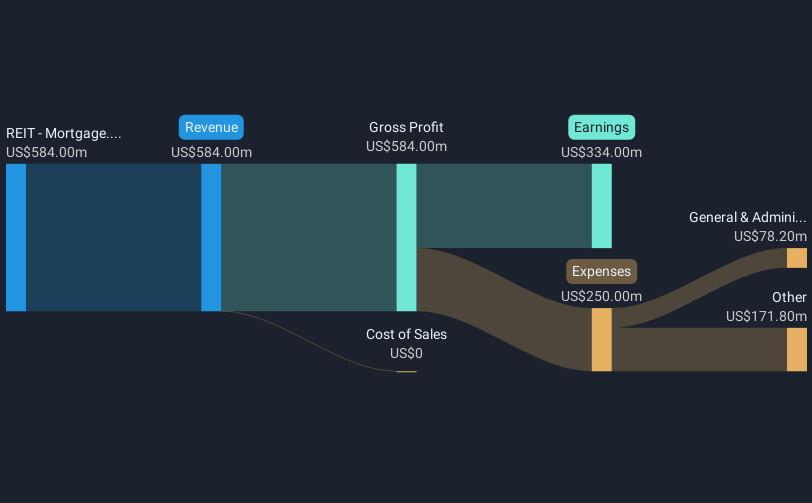

AGNC Investment (NasdaqGS:AGNC) has recently been in the spotlight due to its filing for a $1.5 billion follow-on equity offering. Over the past week, the company's stock has moved 4.6%, coinciding with significant market activity. Despite the announcement of a substantial decrease in its quarterly earnings, AGNC’s stock movement aligned with broader market trends, reflecting a 4.1% rise in the market over the same period. These dynamics suggest that while the equity offering and earnings results were pertinent, the overall market movements likely had a comparable influence on AGNC's stock performance.

AGNC Investment has 3 weaknesses we think you should know about.

The recent filing for a $1.5 billion equity offering by AGNC Investment may influence its revenue and earnings forecasts as it potentially allows the company to leverage its premium to tangible net book value for accretive opportunities. This could enhance book value per share, improve future earnings, and bolster shareholder returns. However, the company's quarterly earnings decline signals ongoing pressure, and interest rate volatility remains a challenge. Revenues could benefit from a stable interest rate environment, but uncertainties in U.S. fiscal policy could introduce risks.

Over the past five years, AGNC's total return, including share price and dividends, reached 30.49%. While this demonstrates a robust longer-term performance, the company's recent annual returns fell short of the broader US Market, which achieved a 7.9% return compared to AGNC's decline in the same period. This underperformance highlights the importance of the current strategic adjustments.

The current share price of US$8.3 indicates a 15.6% discount to the consensus price target of US$9.83. This gap underscores analysts' expectation of growth, contingent on revenue climbing to $2.3 billion and earnings reaching $1.7 billion by 2028. Should the equity offering be accretive, it may assist AGNC in narrowing this gap, although execution risks and macroeconomic factors will be influential.

Evaluate AGNC Investment's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade AGNC Investment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AGNC

AGNC Investment

Provides private capital to housing market in the United States.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives