- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Will Affirm’s Pacsun Holiday BNPL Push Reveal the Durability of Its Retail Strategy (AFRM)?

Reviewed by Sasha Jovanovic

- Affirm recently announced a partnership with fashion retailer Pacsun, allowing shoppers to use its buy-now-pay-later plans and access a 10% “AFFIRM” promo on Holiday Gift Guide purchases through December 18, 2025.

- This collaboration adds another recognizable retail brand to Affirm’s nearly 420,000-merchant network, underscoring how installment payments are becoming embedded in mainstream seasonal shopping.

- We’ll now look at how this Pacsun tie-up, especially its holiday-focused BNPL offer, could influence Affirm’s broader investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Affirm Holdings Investment Narrative Recap

To own Affirm, you need to believe its BNPL platform can keep adding merchants and users faster than credit risk and competition catch up. The Pacsun partnership fits that thesis but is unlikely to meaningfully affect near term results or change the key swing factors, which remain the holiday impact from losing a major enterprise partner and the profitability of its growing mix of 0% APR products.

Among recent announcements, the expanded Worldpay for Platforms integration is most connected to the Pacsun news, because both deepen Affirm’s presence at checkout in third party retail ecosystems. Together, these relationships speak directly to the core catalyst for the stock: broadening acceptance across online and offline merchants as BNPL becomes a standard payment option rather than a niche add on.

But while these partnerships can help offset some merchant concentration, investors also need to be aware that...

Read the full narrative on Affirm Holdings (it's free!)

Affirm Holdings’ narrative projects $6.0 billion revenue and $756.6 million earnings by 2028. This requires 22.9% yearly revenue growth and about a $704 million earnings increase from $52.2 million today.

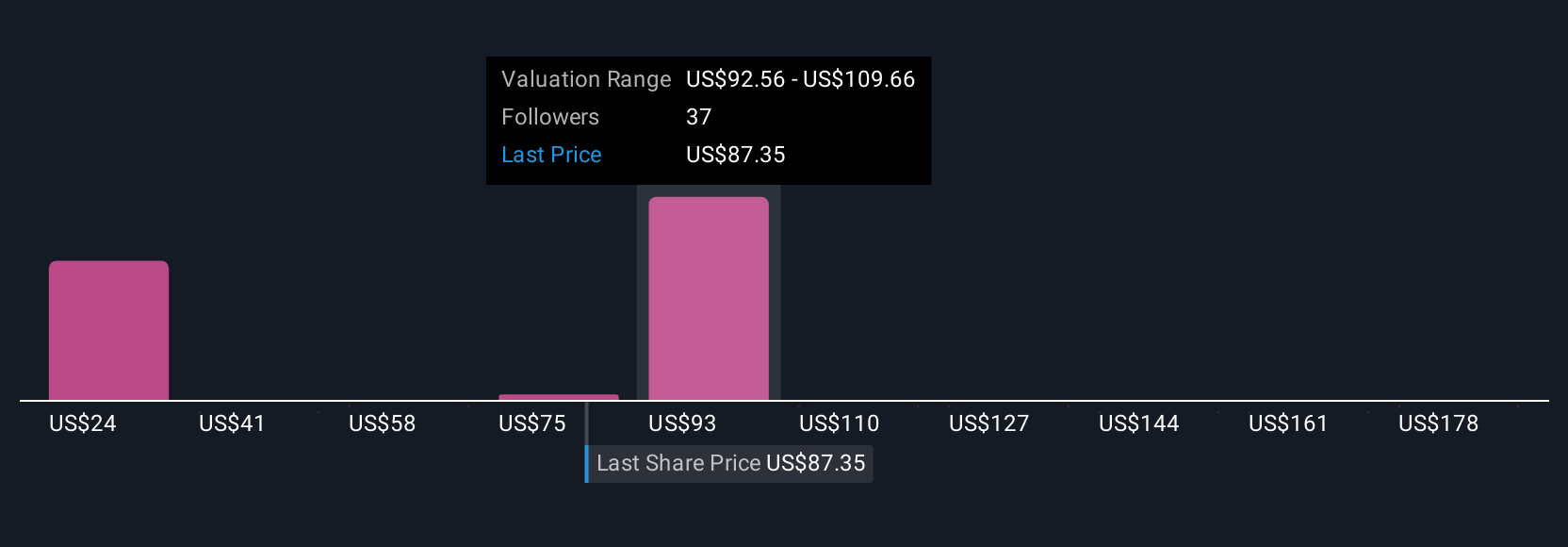

Uncover how Affirm Holdings' forecasts yield a $92.83 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Nineteen members of the Simply Wall St Community value Affirm between US$25.09 and US$140 per share, reflecting very different views on its future. Against that backdrop, the reliance on a widening merchant base as a key growth driver, highlighted by the Pacsun and Worldpay deals, becomes a central question for how Affirm’s performance evolves from here.

Explore 19 other fair value estimates on Affirm Holdings - why the stock might be worth less than half the current price!

Build Your Own Affirm Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Affirm Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Affirm Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Affirm Holdings' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026