- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Assessing Affirm’s Valuation After Latest Amazon Partnership and Recent Share Price Swings

Reviewed by Bailey Pemberton

Thinking about whether to buy, hold, or sell Affirm Holdings? You're not alone. Over the last few months, Affirm's stock has been riding a rollercoaster, down nearly 5% this past week and over 12% for the month, even as its one-year return stands tall at 52.4%. If you zoom out further, the three-year surge of more than 270% jumps off the page. Clearly, the market's feelings about risk and reward here can shift quickly, especially as investors digest big-picture trends in consumer finance and tech-driven lending.

With recent news highlighting shifts in consumer spending and ongoing innovation in 'buy now, pay later' services, it's no wonder Affirm remains an attention magnet. Still, that wild share price ride makes the question of value even more pressing. How do we know what Affirm is really worth today? It's a fair question, especially when the company's valuation score is just 1 out of 6, suggesting that based on traditional checks, Affirm looks undervalued in only one category.

So, what do those valuation checks entail, and how much should you trust them? To answer that, let's break down each approach. There is also a more holistic perspective on Affirm’s valuation that you won’t want to miss.

Affirm Holdings scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Affirm Holdings Excess Returns Analysis

The Excess Returns valuation model examines how efficiently a company generates profits above the minimum return required by investors, known as the cost of equity. For Affirm Holdings, this approach focuses on return on invested capital, growth expectations, and core fundamentals such as book value and expected earnings per share.

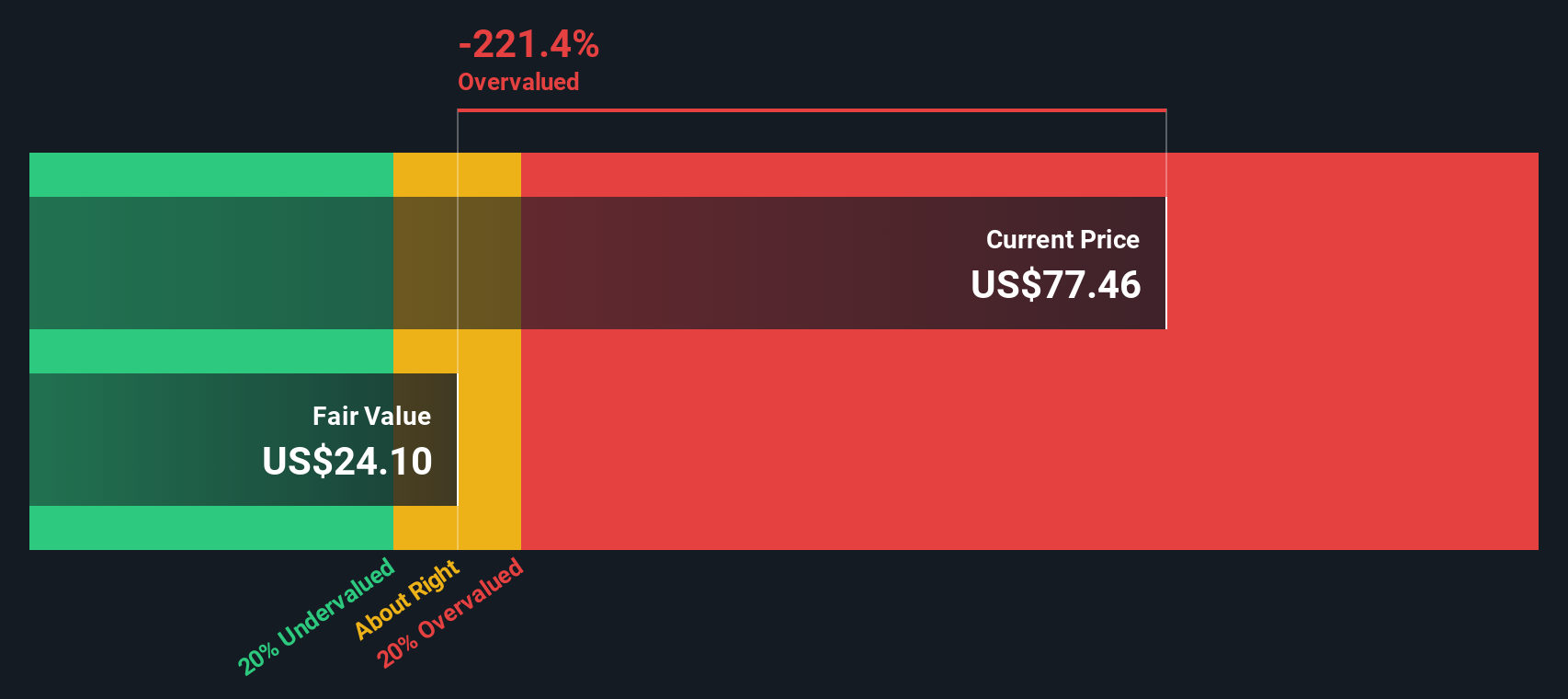

Currently, Affirm has a book value of $9.44 per share and a stable EPS estimate of $1.62 per share, based on consensus from six analysts. The cost of equity stands at $1.11 per share, which means the company’s excess return is calculated at $0.51 per share. Over time, analysts forecast that Affirm's average return on equity will reach 11.77 percent, while the stable book value per share is projected to rise to $13.76, according to estimates from four analysts.

By comparing projected returns to the expected cost, the Excess Returns model estimates Affirm’s intrinsic value at $23.95 per share. With the stock’s recent price significantly higher than this figure, the implied intrinsic discount suggests Affirm is more than 200 percent overvalued according to this specific model. This indicates that investors appear highly optimistic about Affirm’s future beyond what present fundamentals justify.

Result: OVERVALUED

Our Excess Returns analysis suggests Affirm Holdings may be overvalued by 204.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Affirm Holdings Price vs Sales

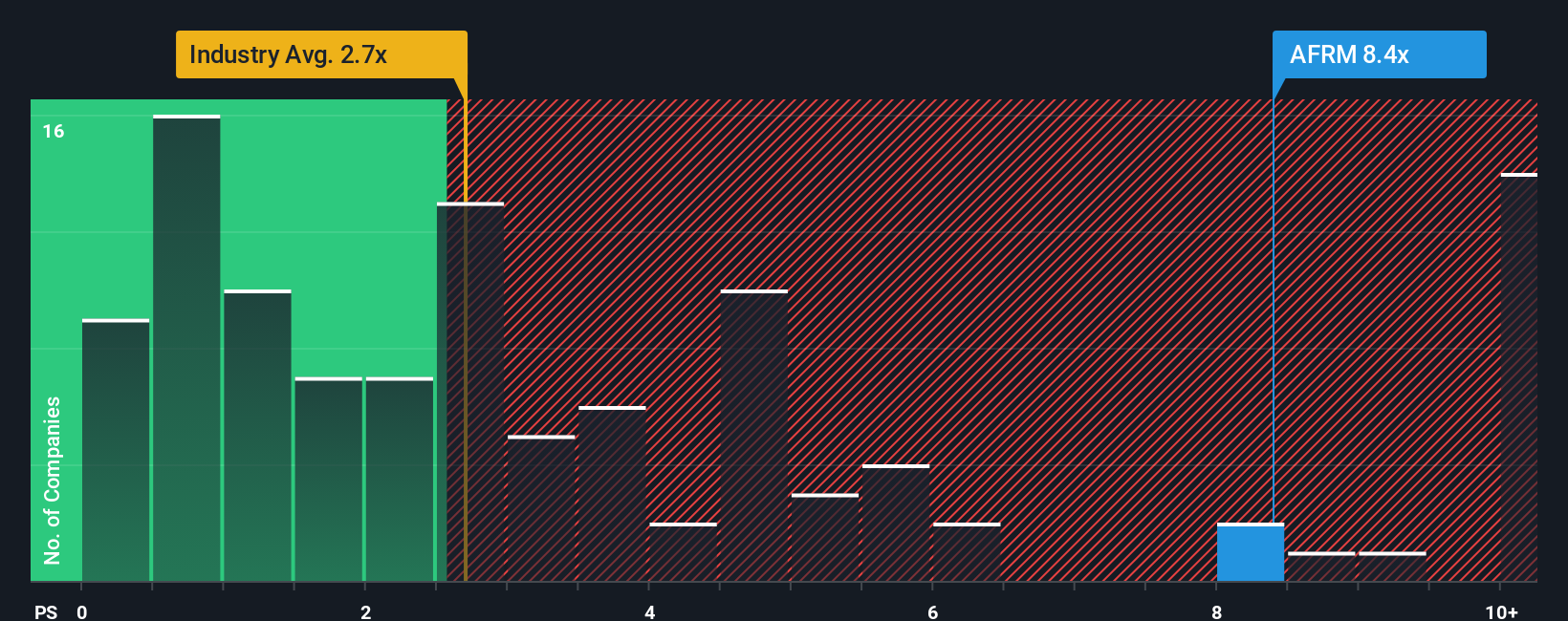

When appraising companies like Affirm Holdings, the Price-to-Sales (P/S) ratio is often the preferred metric. This is particularly suitable for fast-growing tech and fintech firms that may not yet be reliably profitable, but whose top-line momentum holds strong predictive value for future performance. Unlike earnings ratios, Price-to-Sales focuses squarely on revenue generation, which is critical for companies reinvesting heavily for growth or still scaling up their business model.

Affirm’s current P/S ratio stands at 7.36x, notably higher than the industry average of 2.58x and the average of its closest peers at 3.98x. This premium suggests that investors expect substantially higher future growth from Affirm compared to the broader sector. However, not all price multiples are created equal. Factors like growth rates, business risks, and profit margins all influence what constitutes a fair valuation. That is where Simply Wall St’s proprietary “Fair Ratio” comes in. At 4.29x for Affirm, this metric adjusts for the company’s growth outlook, risk profile, profit margin, industry grouping, and even market cap, making it a more nuanced benchmark than peer or industry averages.

Comparing the Fair Ratio of 4.29x to Affirm’s actual P/S multiple of 7.36x reveals that the stock still trades at a significant premium even after accounting for its robust growth and unique risk profile. In other words, while investors are paying up for growth potential, the valuation appears stretched relative to what the fundamentals and sector traits would suggest is reasonable.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Affirm Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story behind the numbers; it is your perspective on where a company like Affirm Holdings is headed, paired with your own assumptions about future revenue, earnings, and profit margins.

Rather than focusing solely on static ratios or yesterday’s fundamentals, Narratives let you actively connect Affirm’s evolving business story to a financial forecast, and then to a Fair Value. This bridges your beliefs with your investment decisions in a structured, easy-to-understand framework.

Available on Simply Wall St's Community page (used by millions of investors globally), this tool empowers anyone to create, follow, or compare investment theses based on the latest facts and assumptions.

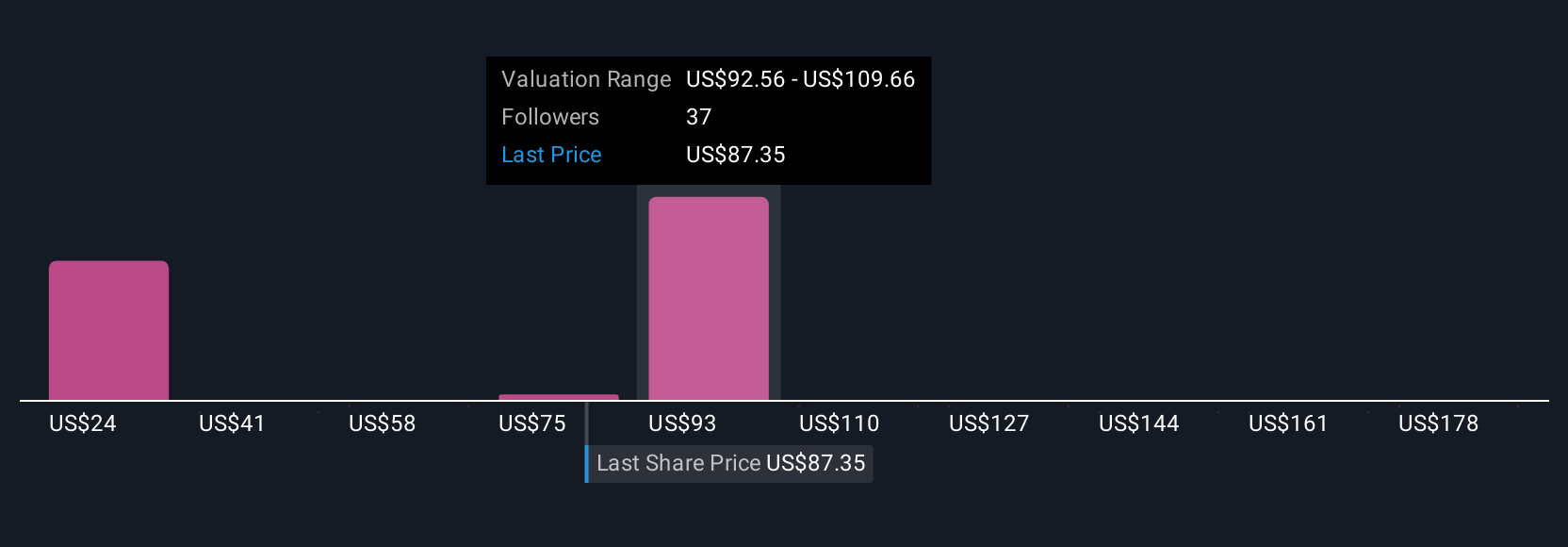

Narratives help you decide whether to buy or sell by showing how your estimated Fair Value stacks up against today’s share price. Because they update automatically when news, earnings, or forecasts change, you are always acting on the freshest information.

For example, with Affirm, some investors may believe that rapid merchant adoption and international expansion could push the company’s Fair Value above $115. Others, more focused on competition or profitability risks, see the stock as fairly valued closer to $64. This range reflects the real disagreements that make markets work.

Do you think there's more to the story for Affirm Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives