- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Affirm Holdings (NasdaqGS:AFRM) Partners With World Market To Expand Flexible Payment Options

Reviewed by Simply Wall St

Affirm Holdings (NasdaqGS:AFRM) has experienced a 33% increase in its share price over the past month. This significant movement likely correlates with several key developments. The company's new partnership with World Market, offering flexible payment options, aligns with consumer demand for pay-over-time solutions. Additionally, the collaboration with UATP to provide such options in the travel industry further expanded its market reach. Affirm's Q3 earnings report showed improved financial performance, contributing to investor confidence. These positive developments would have certainly outweighed the broader market's 3.9% rise, highlighting Affirm's momentum amidst favorable trends.

You should learn about the 1 risk we've spotted with Affirm Holdings.

The recent news surrounding Affirm Holdings, including partnerships with World Market and UATP, aligns with its strategy to expand its payment solutions and enhance consumer reach. These developments potentially accelerate Affirm's revenue and earnings forecasts, as the company capitalizes on increased transaction volumes and broadened market access. The integration of AI and optimization of 0% APR loans are expected to further improve operational efficiency and support revenue growth. Such innovations could mitigate some risks associated with international expansion and margin pressure.

Over the past three years culminating on April 30, 2025, Affirm's total shareholder return was substantial at 113.71%. This impressive performance, in a multi-year context, compares favorably to the broader US Diversified Financial industry, which returned 21.8% in the past year. Affirm's shares have therefore outperformed both the market and its industry peers in shorter-term assessments as well.

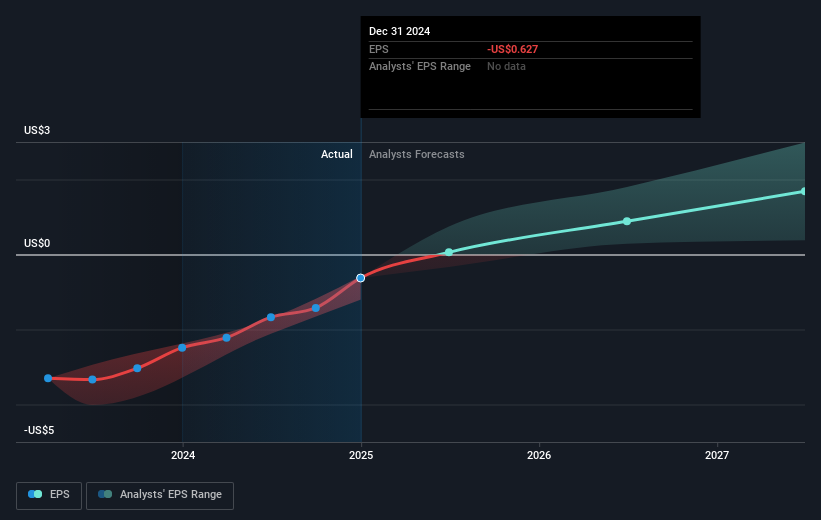

The significant recent share price movement and partnerships might play a role in closing the gap to the analysts' price target of US$67.66, which represents a 25.44% potential upside from the current price of US$50.40. As discussions around future earnings growth include a transition from current losses to US$699.30 million in earnings by May 2028, these partnerships and product enhancements could be fundamental in justifying optimistic analyst expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives