- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Affirm (AFRM): Evaluating Valuation as Google Partnership Deepens Digital Payments Push

Reviewed by Kshitija Bhandaru

Affirm Holdings (AFRM) has just expanded its collaboration with Google, announcing support for the Agent Payments Protocol (AP2) to help enable secure, agent-led transactions on emerging platforms like chatbots and digital wallets.

This move deepens Affirm's integration within the digital payments landscape and fits right in with the company's recent push to make buy now, pay later available wherever consumers shop, whether that’s in-store or through AI-driven commerce tools.

See our latest analysis for Affirm Holdings.

Affirm’s latest moves, including the new Google integration, follow on the heels of its in-store expansion with Ace Hardware and a national 0% APR promotion. These developments are keeping the stock firmly on investors’ radar. While the share price has come down in the past month, the one-year total shareholder return is an impressive 51.1%, and the three-year total return sits at a staggering 311.9%. This is a clear sign that momentum over the long term remains strong, even with recent volatility reflecting shifting market risk perceptions and debate around valuation.

If Affirm’s combination of fintech innovation and rapid growth interests you, now is a great moment to see what else could be out there. Broaden your search and discover fast growing stocks with high insider ownership

With the stock trading well below analyst price targets, but riding a wave of innovation and recent partnerships, should investors see the current dip as an undervalued entry point, or has the market already priced in Affirm's future growth?

Most Popular Narrative: 26.3% Undervalued

Affirm’s most widely followed narrative points to a fair value much higher than its recent close. This suggests analysts see significant upside if the company meets ambitious growth and expansion goals. The narrative centers its valuation on fast-rising revenues, expanding margins, and international catalysts that challenge the market’s current pricing.

Adoption by a growing base of merchants and consumers, combined with expansion into new geographies (notably the imminent U.K. entry via Shopify), positions Affirm to capture larger volumes as e-commerce and embedded finance become increasingly central to global retail. This is likely to drive top-line revenue growth.

Curious what assumptions could justify such a bold valuation gap? The most popular narrative is banking on breakneck growth, margin expansion, and a range of catalysts just on the horizon. Want to see which key figures are driving this high conviction price? Dive in for the full breakdown behind these projections.

Result: Fair Value of $96.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a key merchant loss or a sudden drop in consumer demand could quickly undermine projections and challenge the bullish thesis on Affirm.

Find out about the key risks to this Affirm Holdings narrative.

Another View: Multiples Paint a Cautious Picture

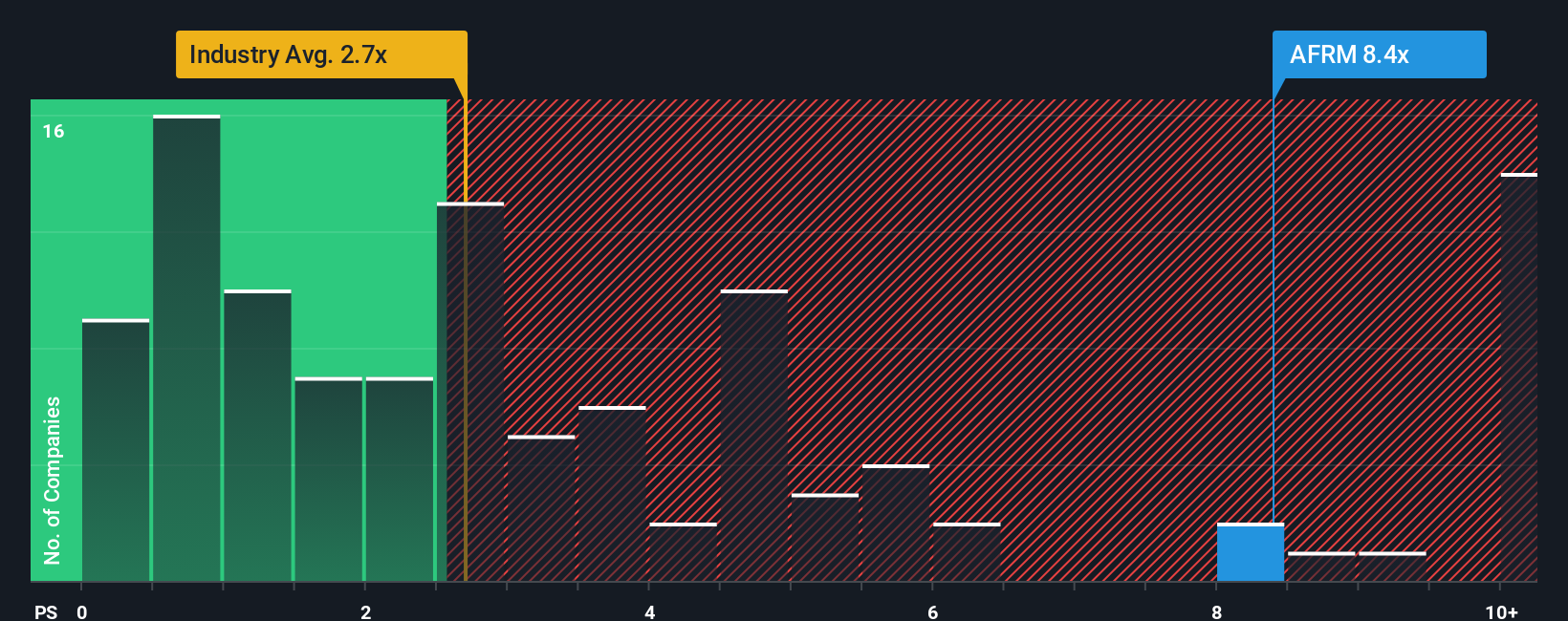

While the dominant narrative sees Affirm as undervalued, there is a different story told by its price-to-sales ratio. At 7.2x, Affirm is priced significantly above both the US Diversified Financial industry average of 2.6x and the peer group average of 3.8x. Even compared to its fair ratio of 4.3x, the gap suggests investors are paying a premium. This raises the risk that expectations are running ahead of fundamentals. Is the premium justified by Affirm’s growth prospects, or could the stock be vulnerable if results do not measure up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Affirm Holdings Narrative

If you want to dig deeper and shape your own view, you can analyze the numbers and build a narrative in just a few minutes, Do it your way

A great starting point for your Affirm Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop seeking opportunity. Make your next move with unique ideas waiting just beyond Affirm. These screens spotlight fresh angles and genuine growth stories most are missing.

- Tap into rapid market shifts by starting with these 79 cryptocurrency and blockchain stocks, where digital currency trends shape an entirely new investing landscape.

- Catch high-potential payouts and strengthen your portfolio with consistent income by scanning these 19 dividend stocks with yields > 3% boasting robust yields above 3%.

- Capitalize on transformative breakthroughs in health and artificial intelligence with these 33 healthcare AI stocks emerging at the intersection of technology and medical innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives