- United States

- /

- Biotech

- /

- NasdaqCM:XFOR

Spotlight On 3 US Penny Stocks With At Least $60M Market Cap

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations ahead of major earnings reports, investors are keenly observing opportunities across various sectors. Penny stocks, a term that may seem outdated, still represent an intriguing segment for those interested in smaller or newer companies. By focusing on penny stocks with solid financial foundations and growth potential, investors can find opportunities that offer both value and stability amidst current market conditions.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.827 | $6.01M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $144.65M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.56 | $133.43M | ★★★★★☆ |

| So-Young International (NasdaqGM:SY) | $1.25 | $90.8M | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.27 | $9.77M | ★★★★★★ |

| Puma Biotechnology (NasdaqGS:PBYI) | $2.74 | $134.5M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $1.63 | $2.97M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8799 | $79.14M | ★★★★★☆ |

Click here to see the full list of 738 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

X4 Pharmaceuticals (NasdaqCM:XFOR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: X4 Pharmaceuticals, Inc. is a late-stage clinical biopharmaceutical company dedicated to the research, development, and commercialization of novel therapeutics for rare diseases, with a market cap of $62.76 million.

Operations: X4 Pharmaceuticals, Inc. has not reported any revenue segments.

Market Cap: $62.76M

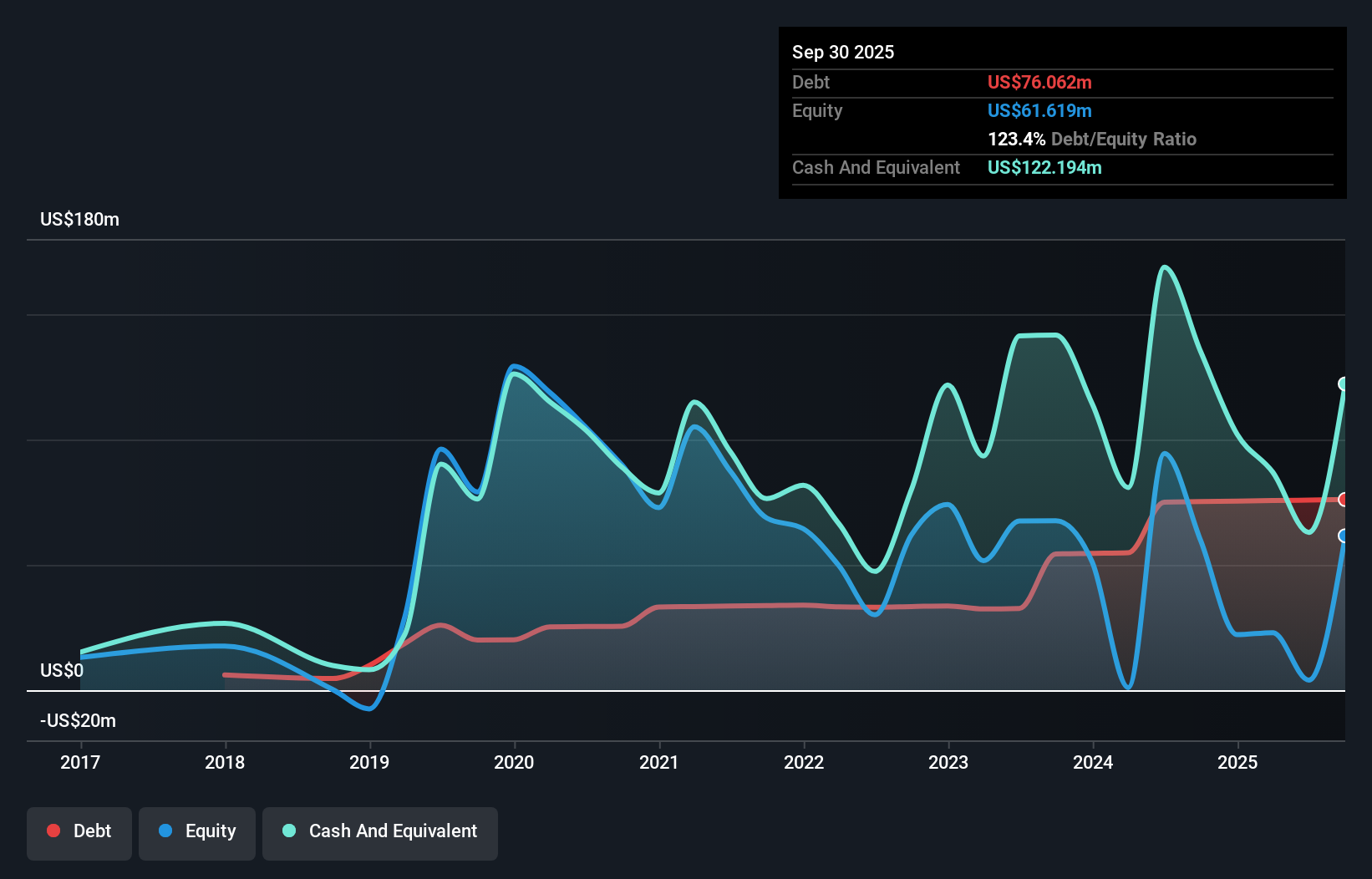

X4 Pharmaceuticals, Inc., with a market cap of US$62.76 million, is pre-revenue and has faced increasing losses over the past five years. Recently, the company reported a net loss of US$36.7 million for Q3 2024 but showed positive clinical trial results for mavorixafor in treating chronic neutropenia. Despite its unprofitability and high debt-to-equity ratio of 126.2%, X4's short-term assets exceed both its short- and long-term liabilities, providing some financial stability. However, its cash runway is less than a year if free cash flow continues to decline at historical rates.

- Take a closer look at X4 Pharmaceuticals' potential here in our financial health report.

- Assess X4 Pharmaceuticals' future earnings estimates with our detailed growth reports.

Acacia Research (NasdaqGS:ACTG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Acacia Research Corporation specializes in acquiring and managing companies within the technology, energy, and industrial sectors, with a market cap of $430.37 million.

Operations: The company's revenue is derived from Industrial Operations, contributing $30.82 million, and Intellectual Property Operations, generating $102.27 million.

Market Cap: $430.37M

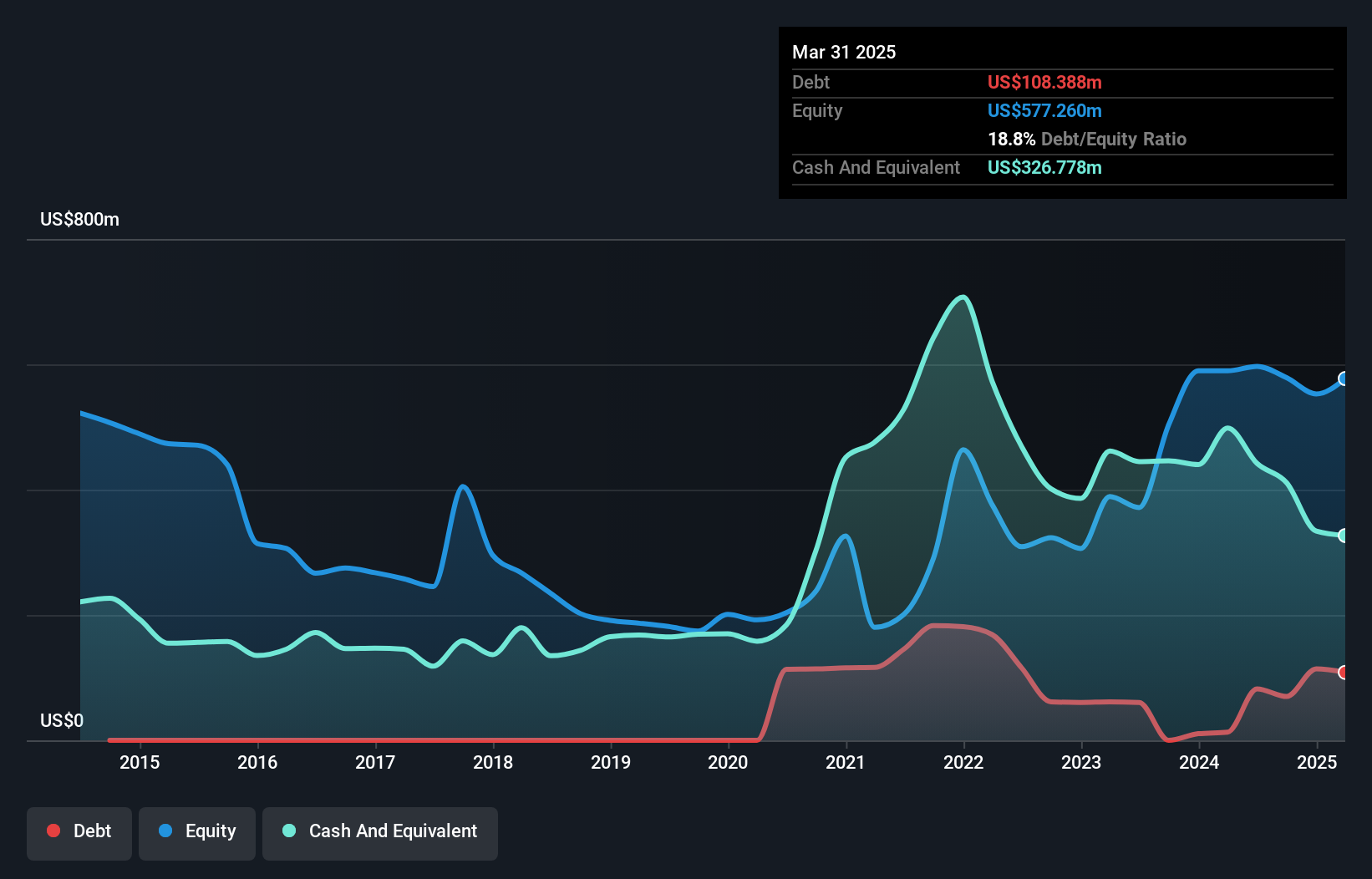

Acacia Research Corporation, with a market cap of US$430.37 million, has shown significant revenue growth, reporting US$73.47 million for the first nine months of 2024 compared to US$32.79 million a year ago. Despite this increase, the company posted a net loss of US$22.63 million over the same period, indicating profitability challenges. Acacia's short-term assets significantly exceed both its long-term liabilities and debt levels are well-covered by operating cash flow, suggesting strong liquidity management. However, earnings are forecast to decline sharply in the coming years despite being valued below estimated fair value and having become profitable recently.

- Jump into the full analysis health report here for a deeper understanding of Acacia Research.

- Examine Acacia Research's earnings growth report to understand how analysts expect it to perform.

SES AI (NYSE:SES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SES AI Corporation focuses on developing and producing high-performance Lithium-metal rechargeable batteries for electric vehicles and other applications, with a market cap of approximately $118.88 million.

Operations: SES AI Corporation has not reported any revenue segments.

Market Cap: $118.88M

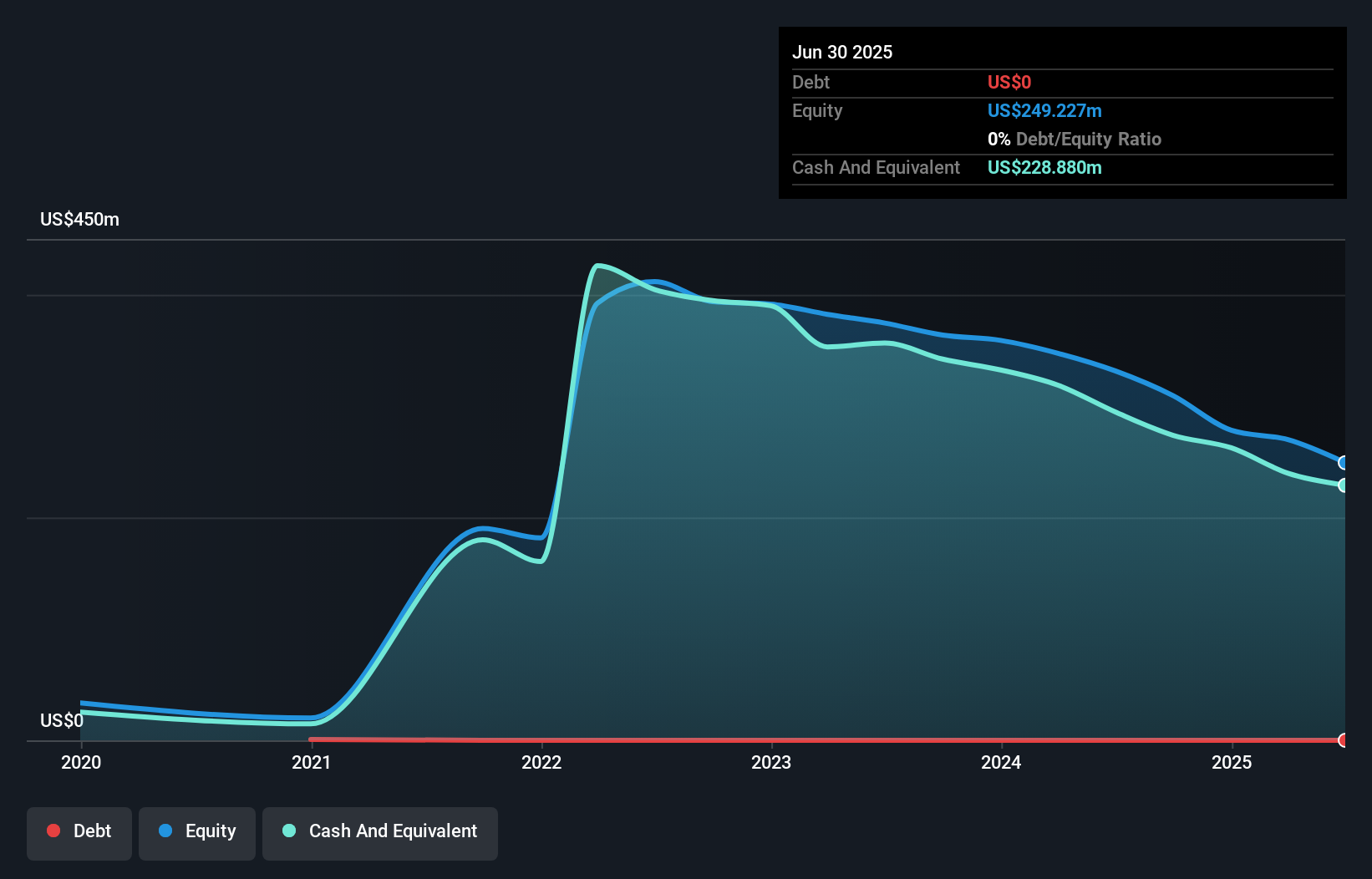

SES AI Corporation, with a market cap of US$118.88 million, is pre-revenue and faces challenges typical of penny stocks. The company reported significant net losses for Q3 2024, increasing from the previous year. Despite having sufficient cash runway for over three years based on current free cash flow and no debt obligations, SES AI's share price remains highly volatile. Recent board changes and non-compliance with NYSE listing requirements add to its instability. However, SES AI is advancing its lithium-metal battery technology through strategic partnerships and AI-driven initiatives aimed at revolutionizing battery chemistry and enhancing energy storage solutions.

- Navigate through the intricacies of SES AI with our comprehensive balance sheet health report here.

- Gain insights into SES AI's future direction by reviewing our growth report.

Seize The Opportunity

- Dive into all 738 of the US Penny Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:XFOR

X4 Pharmaceuticals

A late-stage clinical biopharmaceutical company, focuses on the research, development, and commercialization of novel therapeutics for the treatment of rare diseases.

Adequate balance sheet slight.

Market Insights

Community Narratives