- United States

- /

- Capital Markets

- /

- BATS:CBOE

How Cboe's Entry Into the Australian Listings Market Could Shape Global Growth for CBOE Investors

Reviewed by Sasha Jovanovic

- In the past week, Cboe Global Markets secured regulatory approval from the Australian Securities & Investments Commission to operate a stock listings market in Australia, enabling new competition for IPO listings in the region.

- This move marks a major step in Cboe’s global expansion, allowing the company to directly challenge the Australian Securities Exchange and broaden its presence in Asia Pacific financial markets.

- We'll explore how gaining access to Australia’s listings market could reshape Cboe Global Markets’ international growth narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Cboe Global Markets Investment Narrative Recap

To be a shareholder in Cboe Global Markets, you need to believe in the company’s ability to unlock long-term growth by expanding its exchange, data, and derivatives platforms globally, despite increasing competition and rapid fintech innovation. The recent regulatory approval in Australia directly ties to the most important short-term catalyst, international expansion, while the biggest risk remains Cboe’s reliance on key index partnerships; this week's news improves growth prospects but does not change the concentration risk in its core US options business.

Among recent updates, the launch of new Cboe Continuous bitcoin and ether futures in the US stands out. This product development builds on Cboe’s push for global diversification and addresses the same catalysts as its Australia market entry: broadening product offerings, attracting new trading volumes, and tapping into emerging markets for digital assets and derivatives.

However, in contrast, investors should also be aware that ongoing reliance on proprietary index partnerships may expose Cboe to...

Read the full narrative on Cboe Global Markets (it's free!)

Cboe Global Markets' outlook anticipates $2.6 billion in revenue and $1.1 billion in earnings by 2028. This reflects a 16.9% annual revenue decline, but an earnings increase of approximately $204 million from current earnings of $896.3 million.

Uncover how Cboe Global Markets' forecasts yield a $247.47 fair value, a 4% upside to its current price.

Exploring Other Perspectives

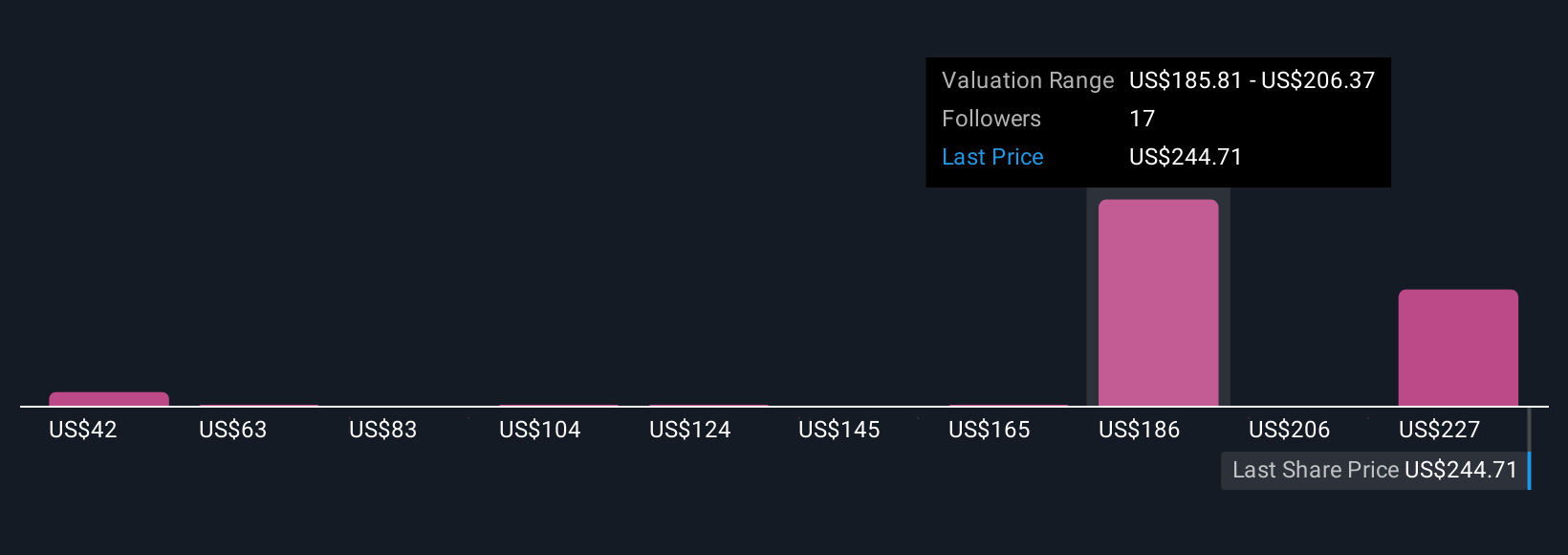

The Simply Wall St Community has published 10 fair value estimates for Cboe, ranging from US$41.96 to US$247.47 per share. While several participants see strong upside, keep in mind that dependence on a few core index products could have outsized effects on future earnings, explore these different viewpoints to understand the range of possibilities.

Explore 10 other fair value estimates on Cboe Global Markets - why the stock might be worth as much as $247.47!

Build Your Own Cboe Global Markets Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cboe Global Markets research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cboe Global Markets research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cboe Global Markets' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BATS:CBOE

Cboe Global Markets

Through its subsidiaries, operates as an options exchange in the United States and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives