- United States

- /

- Capital Markets

- /

- BATS:CBOE

A Look at Cboe Global Markets’s Valuation Following Australian Regulatory Approval for New Listings Venture

Reviewed by Kshitija Bhandaru

Cboe Global Markets (BATS:CBOE) just secured a green light from the Australian Securities & Investments Commission to launch its own listings market in Australia. This move puts it in direct competition with incumbent ASX Ltd. The development opens new doors for Cboe abroad and marks a pivotal point in its international growth strategy.

See our latest analysis for Cboe Global Markets.

Cboe’s international ambitions are grabbing investor attention, and the momentum is showing up in the numbers. The stock’s 1-day and 30-day share price returns of 1.6% and 4.5% suggest growing optimism as Cboe takes aim at Australia’s IPO market. Its total shareholder return of 20% over the past year underscores both short-term and long-term strength.

If bold expansion moves like this inspire your investing, it’s a great moment to see what else is on the rise. Discover fast growing stocks with high insider ownership

The question for investors now is whether Cboe’s latest surge of international expansion is fully reflected in its share price, or if the market is still underestimating the company’s growth potential in light of these headline wins.

Most Popular Narrative: Fairly Valued

The narrative's fair value for Cboe Global Markets lands right next to the last close, signaling a rare consensus between analyst models and trading price. However, beneath this equilibrium is a story of digital acceleration and market reinvention.

Cboe is experiencing broad-based growth across derivatives, data, and global spot markets. This positions it to benefit from ongoing increases in electronic trading volume and automation. These trends are likely to drive higher transaction-based revenue and support further top-line growth.

Curious why the numbers match up so closely? One piece of the puzzle is a bold call on future profit margins and a recalibration of expected earnings. The narrative places its focus on high-stakes growth projections and shifting industry benchmarks. Want to see which assumptions move the needle in this valuation?

Result: Fair Value of $247.47 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Cboe’s reliance on S&P index partnerships and rising global competition could challenge its growth story if diversification efforts do not gain traction.

Find out about the key risks to this Cboe Global Markets narrative.

Another View: What About Discounted Cash Flow?

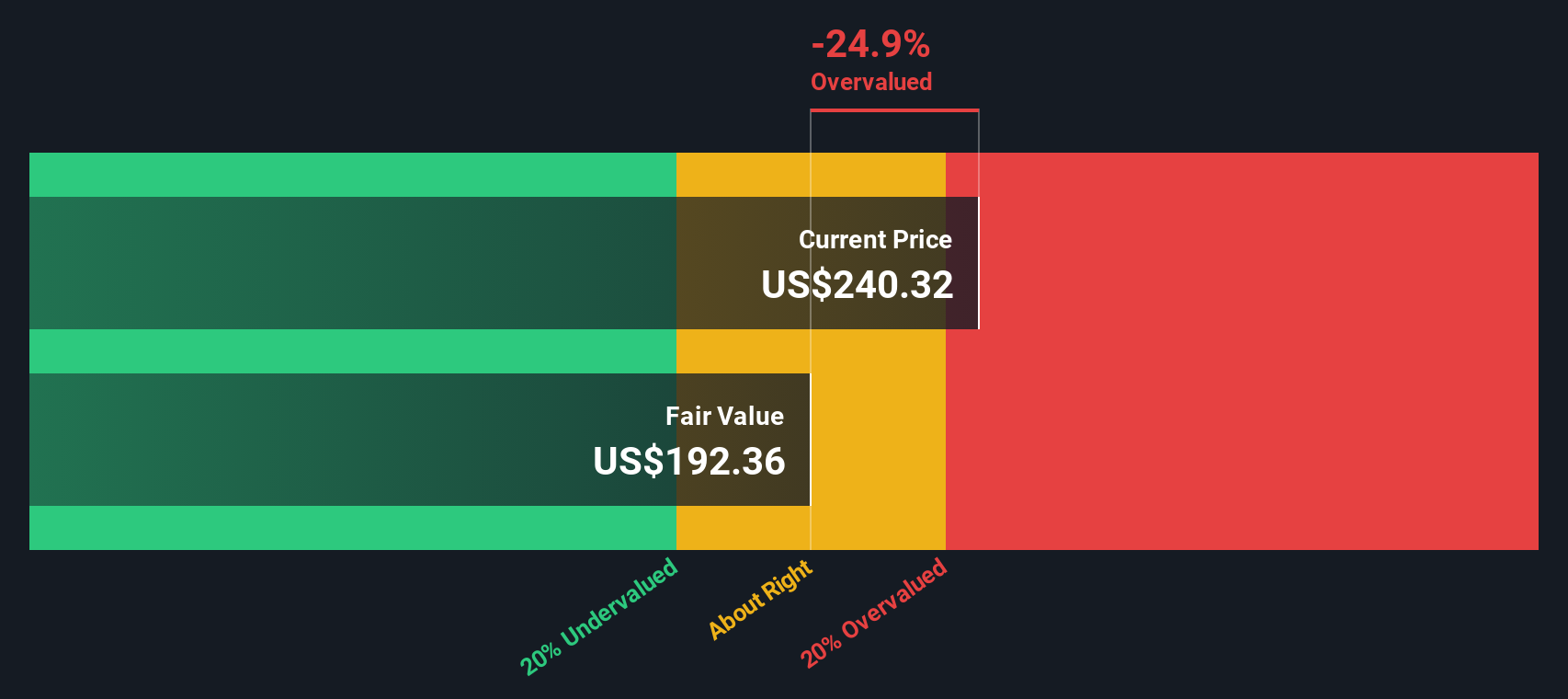

While analysts see Cboe’s trading price as fair, our SWS DCF model presents a contrasting outlook. By weighing future cash flows, it values Cboe at $192.16, which is well below the current share price. Does the market factor in too much optimism, or is the DCF model overlooking key growth drivers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cboe Global Markets for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cboe Global Markets Narrative

If you have your own perspective or want to dig into the data directly, crafting a custom view is quick, clear, and completely up to you. Do it your way

A great starting point for your Cboe Global Markets research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investing means you never limit your options. Seize the chance to uncover tomorrow’s growth stories and stay ahead. These powerful market trends should not be missed.

- Start building wealth with market-tested payouts by seeking out steady returns from these 19 dividend stocks with yields > 3% offering yields above 3% and a history of financial strength.

- Ride the momentum of tech breakthroughs by tapping into innovation through these 24 AI penny stocks focused on artificial intelligence breakthroughs poised to transform entire industries.

- Capitalize on opportunities others overlook by targeting profitable entry points with these 893 undervalued stocks based on cash flows that have compelling fundamentals and strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BATS:CBOE

Cboe Global Markets

Through its subsidiaries, operates as an options exchange in the United States and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives