- United States

- /

- Hospitality

- /

- OTCPK:TBTC

US Penny Stocks Spotlight: Enzon Pharmaceuticals And 2 More To Consider

Reviewed by Simply Wall St

As the S&P 500 and Dow Jones Industrial Average face weekly losses, investors are reassessing their strategies amidst fluctuating market conditions. Penny stocks, often associated with smaller or newer companies, remain an intriguing investment option due to their potential for growth at lower price points. In this article, we explore three penny stocks that stand out for their financial strength and potential as promising candidates in the ever-evolving market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.51 | $2.08B | ★★★★☆☆ |

| BAB (OTCPK:BABB) | $0.869 | $6.03M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $141.58M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.91 | $87.36M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2444 | $8.83M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.52 | $49.5M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.7645 | $14.19M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8899 | $80.95M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.76 | $413.23M | ★★★★☆☆ |

Click here to see the full list of 712 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Enzon Pharmaceuticals (OTCPK:ENZN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Enzon Pharmaceuticals, Inc., along with its subsidiaries, currently does not have significant operations and has a market cap of $6.71 million.

Operations: Enzon Pharmaceuticals does not report any revenue segments, reflecting its lack of significant operations.

Market Cap: $6.71M

Enzon Pharmaceuticals, with a market cap of US$6.71 million, is pre-revenue, generating less than US$1 million annually. Despite having no significant operations or revenue streams, the company has recently turned profitable. It reported a net income of US$0.85 million for the first nine months of 2024, up from US$0.701 million in the previous year. Enzon has maintained stability by being debt-free and having short-term assets significantly exceeding liabilities (US$47 million vs. US$438K). However, its share price remains highly volatile and it trades at a substantial discount to estimated fair value.

- Navigate through the intricacies of Enzon Pharmaceuticals with our comprehensive balance sheet health report here.

- Explore historical data to track Enzon Pharmaceuticals' performance over time in our past results report.

Inhibitor Therapeutics (OTCPK:INTI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Inhibitor Therapeutics, Inc. is a pharmaceutical development company focused on creating and commercializing treatments for certain cancers and non-cancerous proliferation disorders in the United States, with a market cap of $12.92 million.

Operations: No revenue segments have been reported for the company.

Market Cap: $12.92M

Inhibitor Therapeutics, Inc., with a market cap of US$12.92 million, is pre-revenue and unprofitable, reporting no significant revenue streams. Despite this, the company has managed to reduce its losses by 31.2% annually over the past five years and maintains a debt-free status. Its short-term assets of US$6.5 million comfortably exceed both short-term liabilities (US$44.6K) and long-term liabilities (US$3 million). While its share price remains highly volatile with decreased weekly volatility from 39% to 23%, it still surpasses most US stocks in volatility terms. The board's average tenure is only 1.2 years, indicating inexperience amidst ongoing financial challenges.

- Take a closer look at Inhibitor Therapeutics' potential here in our financial health report.

- Understand Inhibitor Therapeutics' track record by examining our performance history report.

Table Trac (OTCPK:TBTC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Table Trac, Inc. designs, develops, and sells casino information and management systems across various international markets with a market cap of $19.82 million.

Operations: The company generates revenue of $10.94 million from its gaming equipment and services provided to casinos.

Market Cap: $19.82M

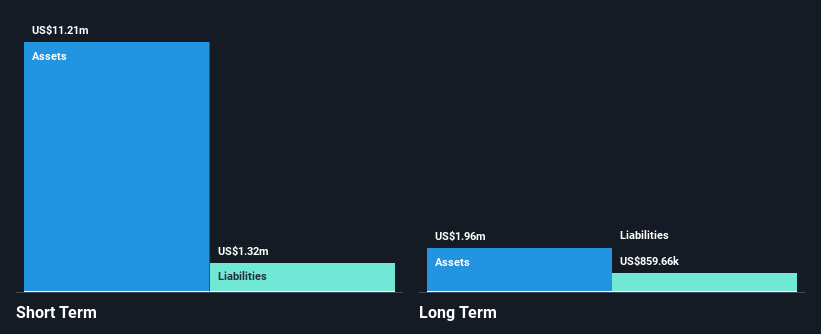

Table Trac, Inc., with a market cap of US$19.82 million, has shown strong financial performance in the gaming sector, reporting third-quarter sales of US$2.55 million and net income growth to US$0.29 million from the previous year. The company is debt-free and maintains high-quality earnings with stable weekly volatility at 7%. Its short-term assets of US$11.2 million exceed both short-term (US$1.3M) and long-term liabilities (US$859.7K). Recent developments include securing a contract with Jackpot Crossing Casino for its CasinoTrac system, highlighting potential for further revenue growth despite an inexperienced management team averaging 1.5 years tenure.

- Dive into the specifics of Table Trac here with our thorough balance sheet health report.

- Examine Table Trac's past performance report to understand how it has performed in prior years.

Where To Now?

- Gain an insight into the universe of 712 US Penny Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Table Trac might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:TBTC

Table Trac

Designs, develops, and sells casino information and management systems in the United States, Australia, Japan, the Caribbean, and Central and South America.

Flawless balance sheet and good value.