- United States

- /

- Hospitality

- /

- OTCPK:LKNC.Y

Luckin Coffee (OTCPK:LKNC.Y): Assessing Valuation After New York Flagship Store Signals Bold US Expansion

Reviewed by Simply Wall St

Luckin Coffee (OTCPK:LKNC.Y) is making headlines after opening its flagship store in New York City, a major milestone that places the Chinese coffee giant right in the hometown of global rivals. For investors, this is more than just another international launch. It signals a bold play to capture US market share and compete directly with established American brands. With the buzz around this move, everyone is asking what it means for the stock.

The excitement from expanding stateside appears to be spilling over into Luckin’s share price, which has delivered an eye-catching 95.8% return over the past year. Thanks to this growth streak and rapid rollout strategy, momentum has clearly built up. This draws investors' attention to whether the company’s aggressive approach can keep fueling gains or if risks might increase as it takes on dominant players in the world's largest coffee market.

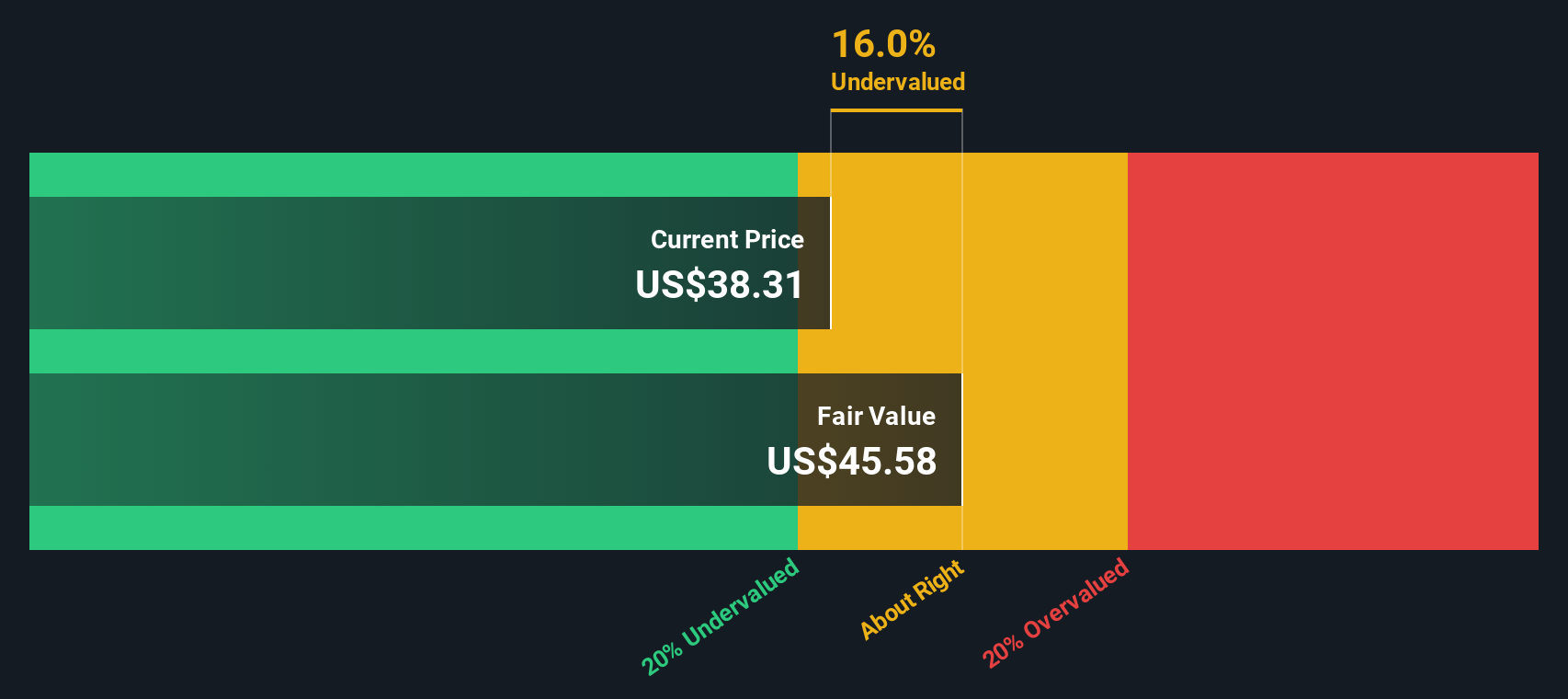

So, with shares already riding such strong momentum and optimism swirling around future prospects, is this a window to buy into undervalued growth or has the market already priced in most of the upside?

Most Popular Narrative: 17.4% Undervalued

The most widely followed valuation narrative signals that Luckin Coffee is trading well below its assessed fair value, suggesting overlooked upside potential for investors based on latest analyst assumptions.

Sustained product innovation and menu diversification, including newly launched health-focused and low-calorie beverage offerings, better align Luckin with shifting consumer preferences around wellness. This enables the company to extend its reach and tap into rising demand for healthier specialty drinks, supporting increased average ticket size and incremental sales.

Want to know what’s driving this undervalued call? The secret sauce behind this price target combines big expectations for growth, profit evolution, and a future valuation multiple you might not expect from a coffee chain. Curious about the numbers and strategies analysts are betting on to back up this bullish stance? Dive deeper to discover the high-impact forecasts that shape this narrative’s calculation.

Result: Fair Value of $46.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shrinking profit margins or aggressive expansion could challenge Luckin Coffee’s growth story. This could potentially cause investors to revisit the optimistic valuation case.

Find out about the key risks to this Luckin Coffee narrative.Another View: Discounted Cash Flow Reality Check

Taking a fresh look, our DCF model also points to Luckin Coffee trading below its estimated fair value, which suggests that both valuation methods agree on current undervaluation. But could this consensus hide any blind spots?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Luckin Coffee Narrative

If you think there’s more to the story or want to see how your personal insights stack up, you can build your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Luckin Coffee.

Looking for more investment ideas?

Don't let big opportunities slip by. Use the Simply Wall Street Screener to target stocks handpicked for growth, innovation, or solid income. Your next winning move could be just one click away.

- Spot resilient dividend payers and secure your portfolio’s income stream by jumping straight to dividend stocks with yields > 3%.

- Pounce on overlooked opportunities with strong financials among up-and-coming companies featured in penny stocks with strong financials.

- Ride the artificial intelligence wave and catch tomorrow’s leaders early by heading over to AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:LKNC.Y

Luckin Coffee

Offers retail services of freshly brewed drinks, and pre-made food and beverage items in the People's Republic of China.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives