- United States

- /

- Hospitality

- /

- NYSE:YUMC

Yum China (NYSE:YUMC): Evaluating Valuation Following Latest $270 Million Share Buyback Announcement

Reviewed by Simply Wall St

If you’re watching Yum China Holdings (NYSE:YUMC), this latest move is tough to ignore. The company has just unveiled a fresh US$270 million share buyback plan for 2025, part of its much broader, multi-year capital return strategy. Management is sending a clear message here: they still believe in the company’s longer-term growth trajectory, even as they face fierce competition and shifting consumer habits. For investors, a buyback of this magnitude isn’t just about reducing share count. It raises questions about Yum China’s internal outlook, cash flow strength, and sense of opportunity at current prices.

This buyback continues a pattern, with Yum China having repurchased over US$3.46 billion in stock since 2017. Over the past year, shares have climbed 28%, which contrasts with the flat to negative performance seen over the longer term. Still, not all momentum points higher; the past month has been softer, and the stock is actually down year-to-date. Amid these swings, management’s decision to allocate more capital to repurchases puts the company’s valuation and long-term prospects in fresh focus.

So after this year’s jump, is Yum China setting up for another run or just catching up to its fundamentals? Is there still a bargain here, or is the market already pricing in the next stage of growth?

Most Popular Narrative: 24.8% Undervalued

According to the most widely followed narrative, Yum China’s current share price is seen as significantly undervalued, with analysts projecting substantial upside if key growth assumptions materialize.

Continued aggressive expansion into lower-tier Chinese cities and new store formats (including KCOFFEE Cafes and Pizza Hut WOW), combined with healthy new store payback periods, supports ongoing top-line revenue growth and market share gains by tapping into rising urbanization and a broadening middle class.

Want to know what is fueling this bullish outlook? The secret lies in rapid growth projections, bigger margins and a future valuation benchmark that is more ambitious than what you might expect for a consumer company. The underlying roadmap is built on several bold numbers, but you will have to read the full narrative to see which growth estimates and profitability targets drive such a high fair value call.

Result: Fair Value of $58.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising delivery costs and increasing competition from local brands could limit Yum China’s pricing power and create challenges for the bullish case ahead.

Find out about the key risks to this Yum China Holdings narrative.Another View: Discounted Cash Flow Analysis

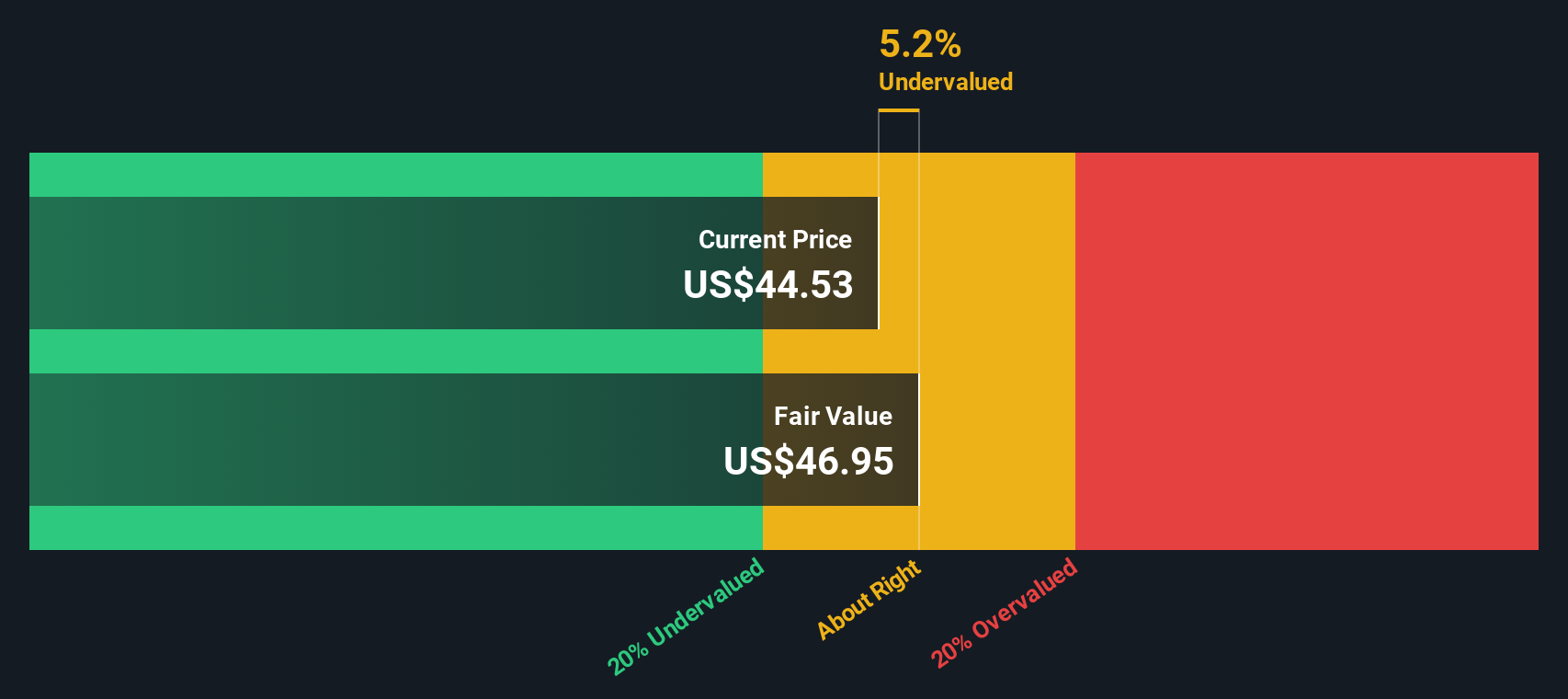

Looking at Yum China from a different angle, our DCF model also suggests the stock trades below its fair value. This offers a perspective rooted in future cash flow projections, rather than analyst assumptions. Does this second approach confirm the story, or is the picture more nuanced?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Yum China Holdings Narrative

If you have a different take or want to build your own story around Yum China, the data is available for you to explore and develop your outlook in just a few minutes. Do it your way

A great starting point for your Yum China Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make your next smart move by tapping into unique stock opportunities tailored to fit your strategy. Miss out and you may leave gains on the table.

- Spot early-stage disruptors showing financial strength by checking out penny stocks with strong financials, which are leading the wave of future market winners.

- Zero in on the rising stars of artificial intelligence as you evaluate AI penny stocks, shaping tomorrow’s economy with next-level innovation.

- Unlock hidden value by targeting undervalued stocks based on cash flows, which are trading at tempting discounts, so you can make smarter investment calls right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YUMC

Yum China Holdings

Owns, operates, and franchises restaurants in the People’s Republic of China.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives