- United States

- /

- Hospitality

- /

- NYSE:YUM

Yum! Brands (NYSE:YUM) affirms $0.67 dividend, highlights robust earnings growth and shareholder value

Reviewed by Simply Wall St

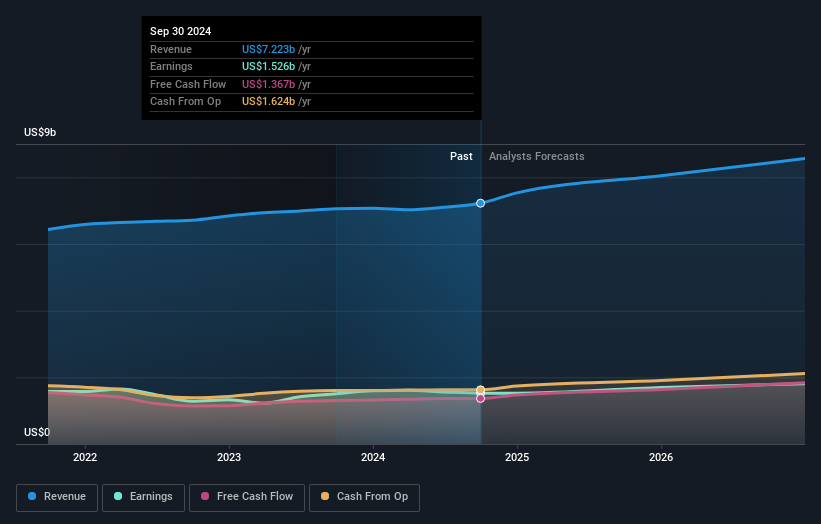

Yum! Brands (NYSE:YUM) continues to solidify its market position with a declared dividend of $0.67 per share, set for distribution on September 6, 2024, reflecting its commitment to shareholder value. Despite reporting a slight dip in net income for the second quarter, the company shows resilience through strategic product innovations and a share buyback program. However, challenges such as slower growth forecasts compared to market averages and debt coverage issues highlight areas needing strategic focus.

Click here and access our complete analysis report to understand the dynamics of Yum! Brands.

Unique Capabilities Enhancing Yum! Brands's Market Position

Yum! Brands has demonstrated financial health with a 9.9% earnings growth over the past year, surpassing its 5-year average of 6.7%. This growth is complemented by improved profit margins, currently at 22% compared to 20.3% last year. The company's strategic focus on product innovation, particularly through Taco Bell's new menu items, has driven customer engagement and sales. This proactive approach is supported by a seasoned management team, whose experience contributes significantly to strategic goals. Additionally, Yum! Brands has declared a dividend of $0.67 per share, reflecting its commitment to returning value to shareholders. The company's valuation, with a Price-To-Earnings Ratio of 23.9x, suggests a strong market position compared to peers, despite trading above the SWS fair ratio.

To dive deeper into how Yum! Brands's valuation metrics are shaping its market position, check out our detailed analysis of Yum! Brands's Valuation.Critical Issues Affecting the Performance of Yum! Brands and Areas for Growth

While Yum! Brands is on a growth trajectory, its earnings and revenue growth forecasts of 7.8% and 7.1% respectively lag behind the US market averages of 15.4% and 8.9%. This slower growth is compounded by negative shareholder equity, posing a significant financial concern. The company's dividend history has been volatile, which could affect investor confidence. Furthermore, debt coverage remains a challenge, as operating cash flow is insufficient to cover existing debt levels. These issues highlight the need for strategic cost management, particularly in supply chain logistics, to protect margins from rising costs.

Learn about Yum! Brands's dividend strategy and how it impacts shareholder returns and financial stability.Future Prospects for Yum! Brands in the Market

Opportunities abound for Yum! Brands, with earnings forecasted to grow at 7.79% annually, indicating potential for future expansion. The company's strategic focus on international markets, especially in Asia and Latin America, presents significant growth prospects. By capitalizing on these opportunities, Yum! Brands can enhance its market position and diversify its revenue streams. The recent share buyback program, which saw the repurchase of 366,000 shares, underscores the company's commitment to shareholder value and confidence in its growth strategy.

See what the latest analyst reports say about Yum! Brands's future prospects and potential market movements.Key Risks and Challenges That Could Impact Yum! Brands's Success

Yum! Brands faces intense competition within the hospitality industry, with its earnings growth not outperforming the industry's 13.9%. This competitive pressure necessitates continuous innovation and differentiation of offerings. Additionally, the company's unstable dividend track record poses a risk to investor confidence. Recent insider selling could indicate concerns about the company's future prospects. Regulatory changes and supply chain disruptions further threaten operational stability, requiring proactive measures to mitigate these risks and ensure sustained growth.

To gain deeper insights into Yum! Brands's historical performance, explore our detailed analysis of past performance.Conclusion

Yum! Brands has shown commendable financial progress with a significant earnings growth of 9.9% over the past year and improved profit margins, indicating effective management and strategic product innovation, particularly at Taco Bell. However, the company faces challenges such as slower growth forecasts and negative shareholder equity, which necessitate improved cost management and debt coverage strategies. The focus on international markets offers promising growth avenues, but intense industry competition and an unstable dividend history require Yum! Brands to continuously innovate and stabilize investor confidence to sustain future performance. The company's commitment to shareholder value through dividends and share buybacks, while trading above estimated fair value, underscores a need for balanced growth and risk management strategies.

Where To Now?

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:YUM

Yum! Brands

Develops, operates, and franchises quick service restaurants worldwide.

Average dividend payer low.