- United States

- /

- Hospitality

- /

- NYSE:XPOF

The Market Doesn't Like What It Sees From Xponential Fitness, Inc.'s (NYSE:XPOF) Revenues Yet As Shares Tumble 35%

Xponential Fitness, Inc. (NYSE:XPOF) shareholders won't be pleased to see that the share price has had a very rough month, dropping 35% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 69% share price decline.

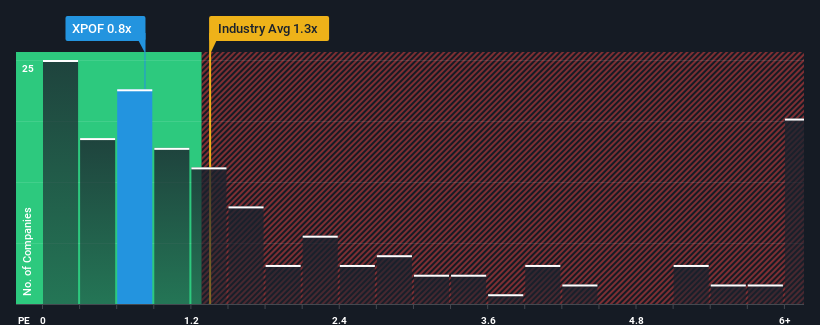

After such a large drop in price, considering around half the companies operating in the United States' Hospitality industry have price-to-sales ratios (or "P/S") above 1.3x, you may consider Xponential Fitness as an solid investment opportunity with its 0.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Xponential Fitness

How Has Xponential Fitness Performed Recently?

Recent times haven't been great for Xponential Fitness as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Xponential Fitness will help you uncover what's on the horizon.How Is Xponential Fitness' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Xponential Fitness' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 23% last year. The strong recent performance means it was also able to grow revenue by 215% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 8.2% as estimated by the eleven analysts watching the company. With the industry predicted to deliver 13% growth, the company is positioned for a weaker revenue result.

With this information, we can see why Xponential Fitness is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Xponential Fitness' recently weak share price has pulled its P/S back below other Hospitality companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Xponential Fitness' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Xponential Fitness (at least 4 which are a bit concerning), and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:XPOF

Xponential Fitness

Through its subsidiaries, operates as a boutique fitness brands franchisor in North America.

Good value with moderate growth potential.

Market Insights

Community Narratives