- United States

- /

- Consumer Services

- /

- NYSE:UTI

Will UTI’s Fast-Tracking of New Programs with Washington Enhance Its Competitive Edge?

Reviewed by Sasha Jovanovic

- In recent days, Barrington Research analyst Alexander Paris reiterated a positive outlook on Universal Technical Institute after management announced active engagement with the US Department of Education and other Trump administration offices to advance skilled trade growth.

- Management disclosed that this government collaboration is expected to speed up new program launches by a year, expanding Universal Technical Institute's offerings in 2026 and signaling operational momentum in workforce education.

- We'll explore how management’s efforts to accelerate program expansion through government collaboration could reshape Universal Technical Institute's investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Universal Technical Institute Investment Narrative Recap

To own shares in Universal Technical Institute, you need to believe in ongoing demand for workforce and skilled trades education as the company expands program offerings and campuses. The recently announced fast-tracking of new programs via government collaboration bolsters the timeline for expansion, reinforcing a key short-term catalyst: accelerating revenue and enrollment growth in 2026. However, the largest risk now centers more on their ability to match enrollment gains to this accelerated expansion, as heavy investments may outpace actual demand if student interest or regulatory approvals do not keep up.

Among recent updates, Universal Technical Institute’s April announcement of the upcoming UTI-San Antonio campus directly aligns with its North Star strategy and the company’s broader goal to expand its skilled trades footprint nationwide. This new campus highlights the importance of execution in new markets and underscores how government support could make bringing additional sites to life both quicker and less risky in the next year.

In contrast, investors should also be aware of the chance that rapid expansion leads to overcapacity and underperformance if the student pipeline does not fill as expected...

Read the full narrative on Universal Technical Institute (it's free!)

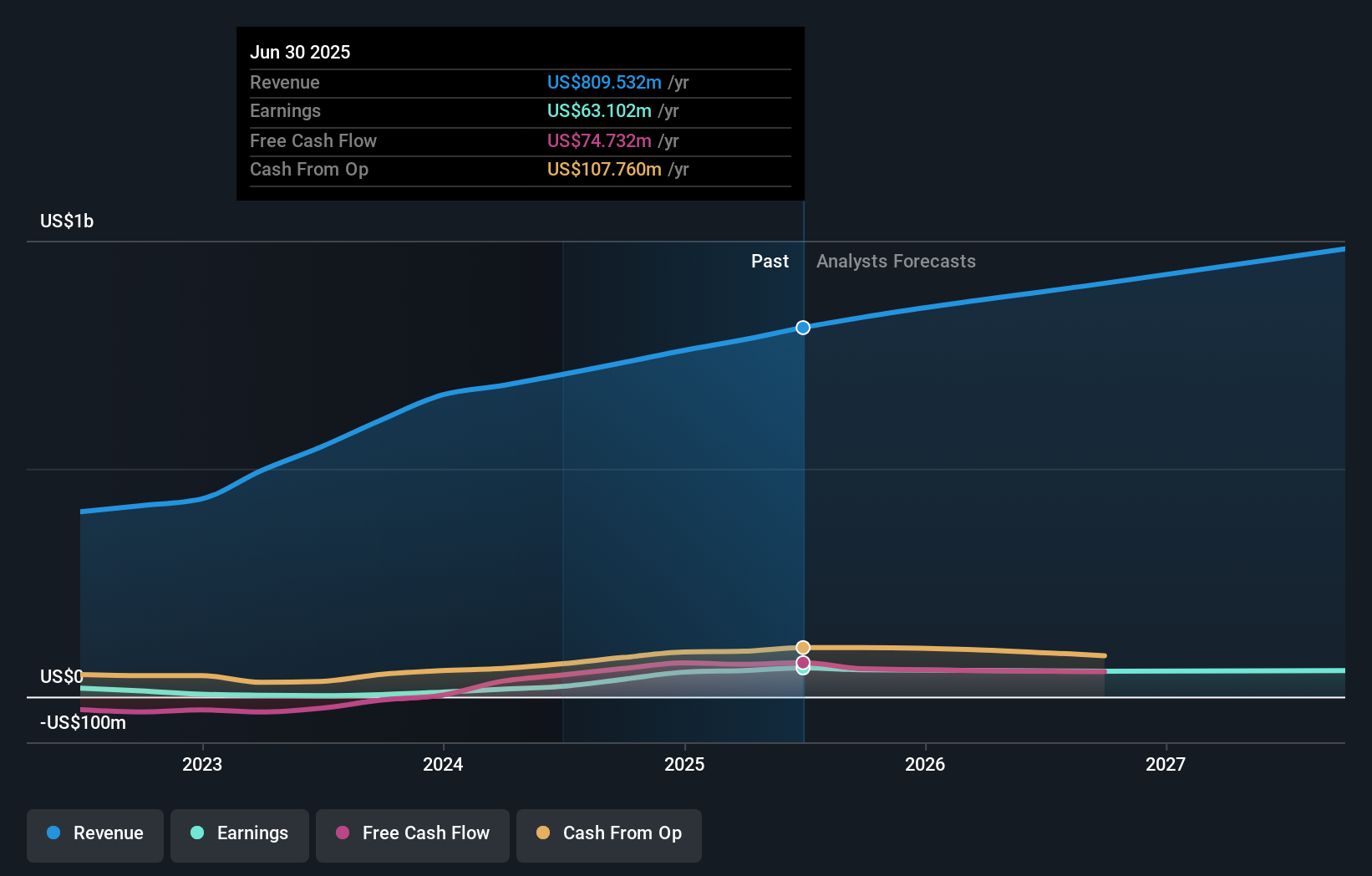

Universal Technical Institute's outlook anticipates $1.0 billion in revenue and $54.0 million in earnings by 2028. This is based on an 8.9% annual revenue growth rate and reflects a $9.1 million decrease in earnings from the current $63.1 million level.

Uncover how Universal Technical Institute's forecasts yield a $37.60 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Community estimates for UTI span from US$17.83 to US$37.60 across just two contributions on Simply Wall St, showing high variation in fair value views. Expansion risk remains top of mind as these differing opinions reflect the uncertainty around whether investment in new programs will deliver strong returns, so see how others are interpreting the growth story.

Explore 2 other fair value estimates on Universal Technical Institute - why the stock might be worth as much as 25% more than the current price!

Build Your Own Universal Technical Institute Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Universal Technical Institute research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Universal Technical Institute research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Universal Technical Institute's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UTI

Universal Technical Institute

Provides transportation, skilled trades, and healthcare education programs in the United States.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives