- United States

- /

- Consumer Services

- /

- NYSE:UTI

Is It Too Late to Consider Universal Technical Institute After 97% One Year Surge?

Reviewed by Bailey Pemberton

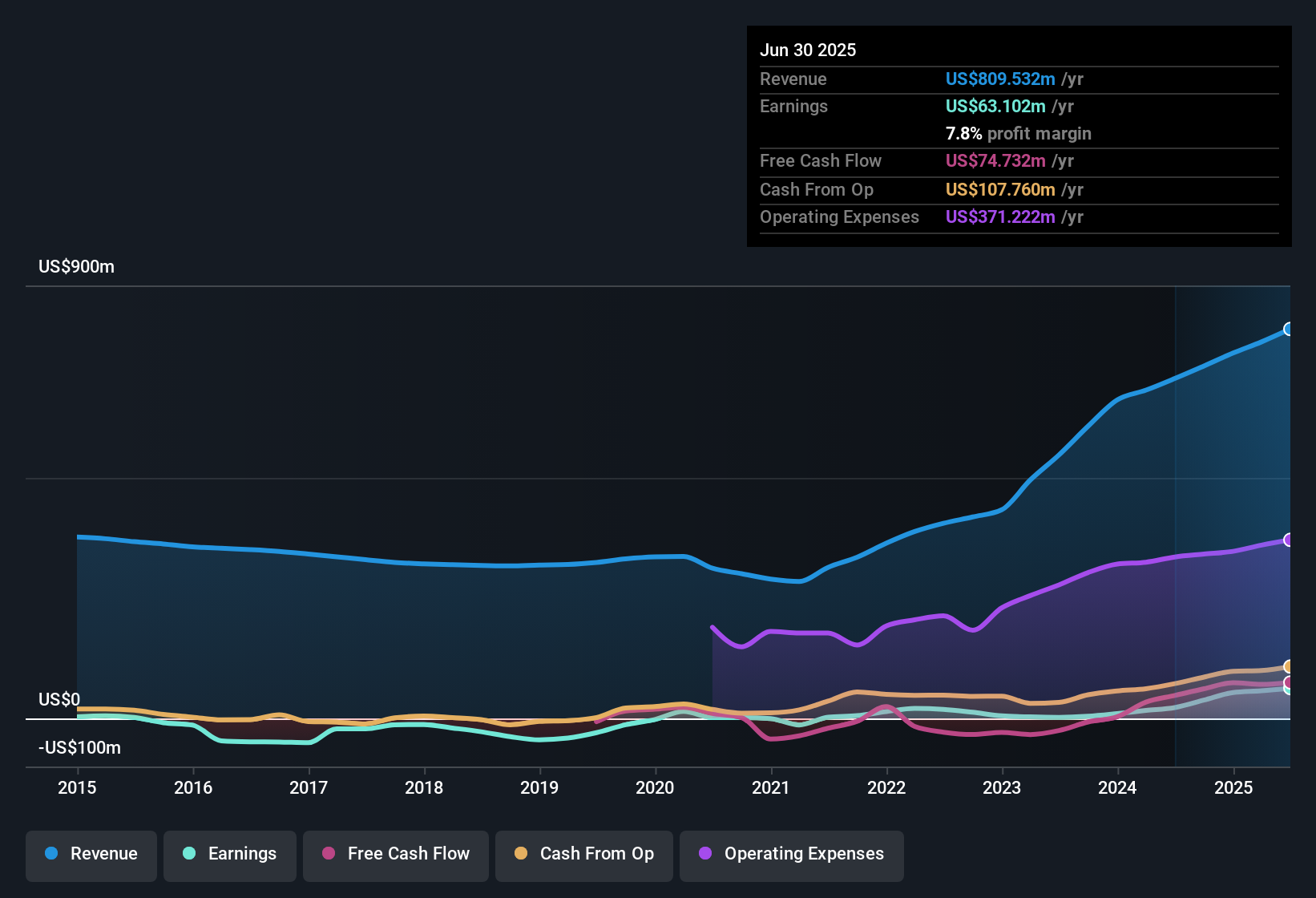

If you are weighing what to do with Universal Technical Institute stock right now, you are not alone. Investors have been buzzing as the stock has not just outperformed in the short term, but also logged massive gains over the past few years. Just take a look at the numbers: up nearly 20% year-to-date, and up an eye-popping 97% over the last year. Stretch out to three or five years and those returns soar past 450%. Even a brief dip of 3.8% in the past week does little to overshadow the longer-term momentum that continues to impress market watchers.

What is fueling the run? For a stock in the sometimes overlooked education sector, Universal Technical Institute has found ways to deliver results that grab attention. Industry shifts and increased demand for skilled technical labor play a part, but the bigger story may be changing perceptions about the company’s growth potential and business model resilience. Of course, with that rise comes the inevitable question: is the stock still a good deal, or has all the upside already been priced in?

That is where valuation comes into play. Looking at six different checks commonly used to identify undervalued stocks, Universal Technical Institute currently comes out ahead in only one out of six, giving it a numerical value score of 1. But numbers only scratch the surface. Let’s dig into those valuation approaches and, more importantly, hint at a way to get an even deeper understanding of what the company is really worth.

Universal Technical Institute scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Universal Technical Institute Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to their value today. This approach aims to determine the present worth of what Universal Technical Institute is expected to generate in cash, giving a sense of the stock’s true value based on fundamentals rather than market hype.

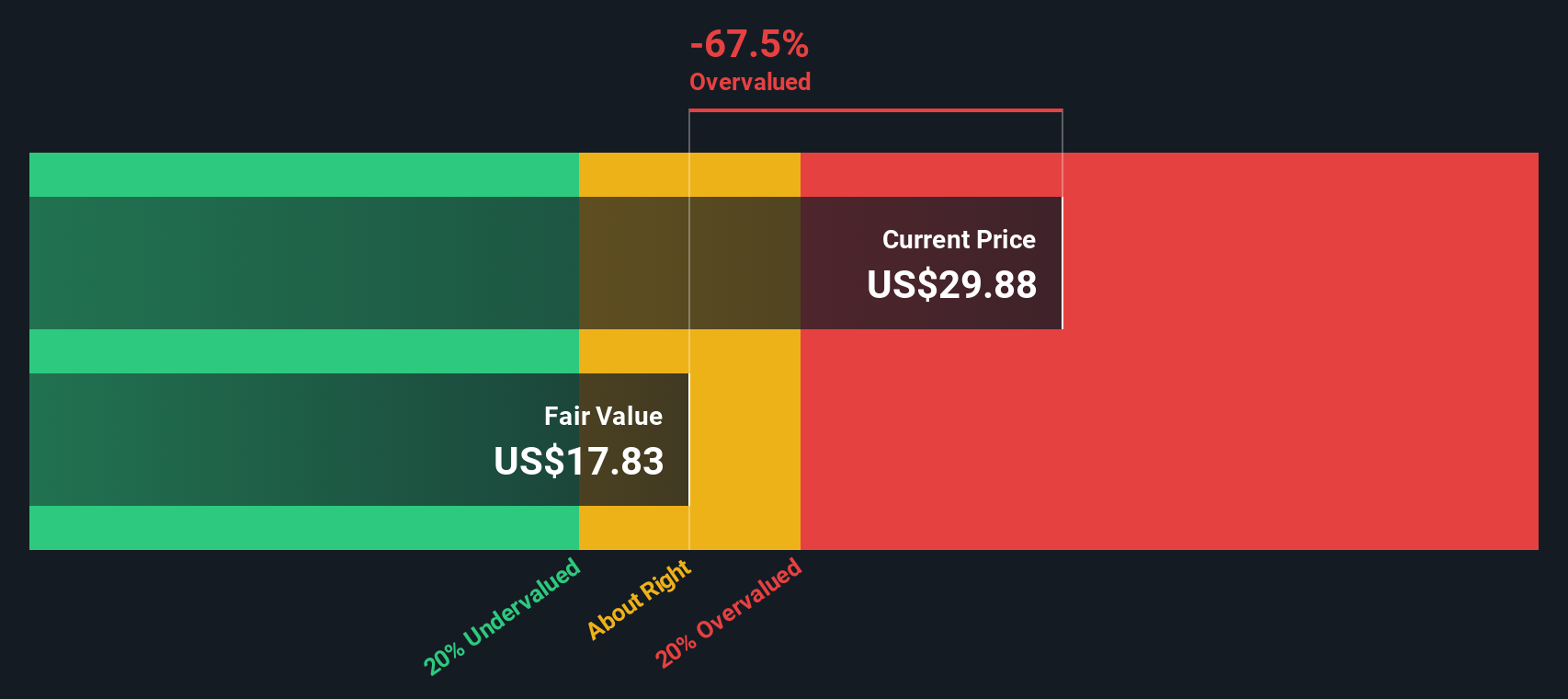

According to the latest available data, Universal Technical Institute reported free cash flow of $62.13 million over the last 12 months. Analysts project that in 2027, annual free cash flow will be around $53.0 million, with further estimates (extrapolated by Simply Wall St) suggesting relatively stable figures just below or around $50 million annually through the next decade.

Using a two-stage Free Cash Flow to Equity approach, the discounted projections lead to an intrinsic value per share of $17.81. When compared to the current share price, this suggests the stock is trading at a 71.1% premium to its intrinsic worth. This indicates the market is valuing the company well above what the DCF model considers fair.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Universal Technical Institute may be overvalued by 71.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Universal Technical Institute Price vs Earnings

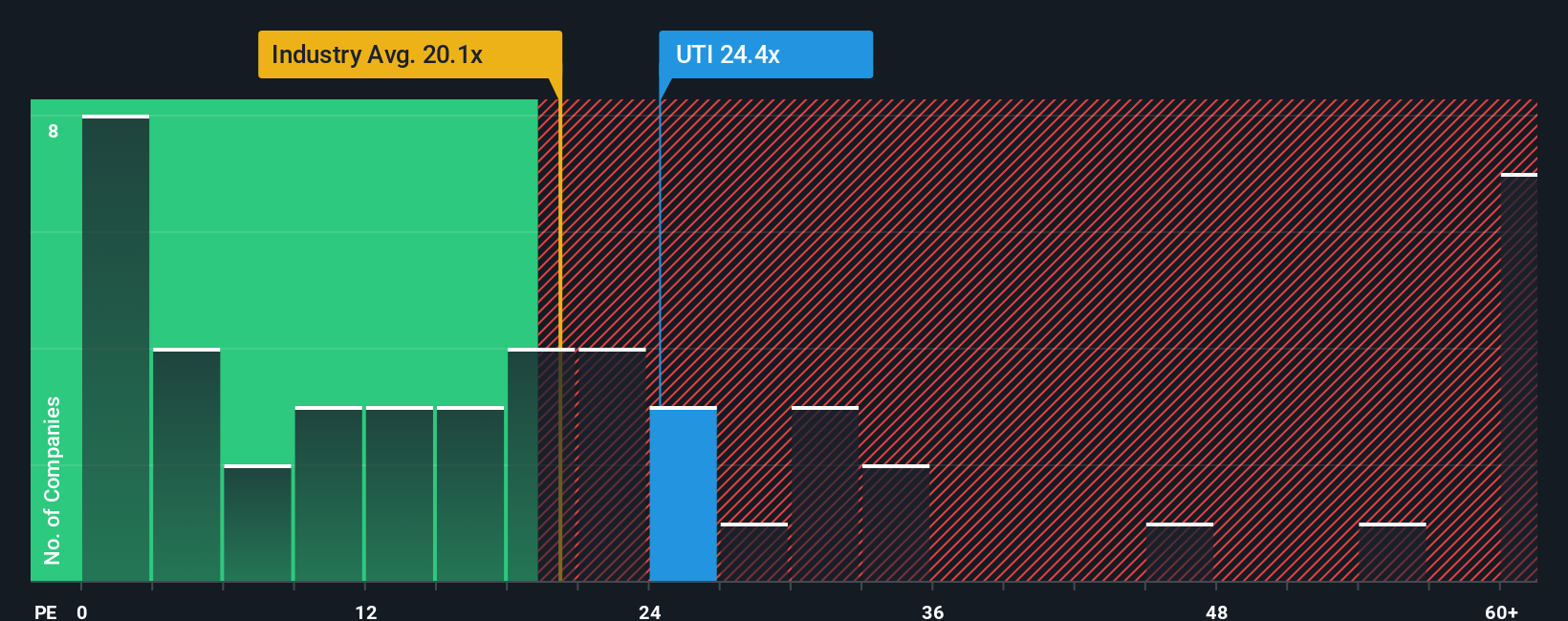

The Price-to-Earnings (PE) ratio is a widely used valuation metric, especially for companies like Universal Technical Institute that are generating solid profits. It helps investors assess how much they are paying for each dollar of earnings and is generally more meaningful for companies with steady earnings streams.

Expectations for future growth and the risks a business faces have a big impact on what can be considered a fair or normal PE ratio. Companies with rapid earnings growth or lower risk profiles often justify higher PE ratios, while slower-growing or riskier businesses tend to trade at lower multiples.

Currently, Universal Technical Institute trades on a PE ratio of 26.3x. To put this in perspective, the Consumer Services industry average is 17.0x and the peer group sits at 20.7x. This means the company trades at a noticeable premium to both. However, Simply Wall St’s Fair Ratio, which tailors the PE to Universal Technical Institute’s specific growth, profitability, industry, and risk profile, comes in at 14.0x. This Fair Ratio is a step above simple peer comparisons as it blends all the company’s relevant fundamentals with broader industry trends.

Comparing Universal Technical Institute’s current PE ratio of 26.3x to its Fair Ratio of 14.0x suggests the stock may be valued much higher than what its key fundamentals warrant.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Universal Technical Institute Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company, connecting what you think will happen in its business to a forecast for its future revenue, earnings, and ultimately, your own fair value estimate.

Unlike traditional metrics that focus solely on current or past numbers, Narratives let you tie a company’s unique story, such as expansion plans, industry trends, risks, and opportunities, directly into a transparent, customizable financial forecast and valuation. They are easy to create on Simply Wall St’s platform, where millions of investors share different Narratives for thousands of companies within the Community page.

Narratives empower you to make buy or sell decisions by showing your version of Fair Value alongside the current Price, clearly signaling when your story says a stock is attractive or expensive. As soon as important news or earnings are released, Narratives update automatically, so your view is always fresh.

For example, one optimistic Narrative sees Universal Technical Institute worth $37.6 per share based on aggressive expansion and continued demand. A more cautious view might value it much lower due to regulatory risks and margin pressures, helping you see how different perspectives can lead to very different conclusions, all from the same set of facts.

Do you think there's more to the story for Universal Technical Institute? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UTI

Universal Technical Institute

Provides transportation, skilled trades, and healthcare education programs in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion