- United States

- /

- Consumer Services

- /

- NYSE:TAL

Assessing TAL Education Group (NYSE:TAL) Valuation After Recent 4% Share Price Move

Reviewed by Kshitija Bhandaru

TAL Education Group (NYSE:TAL) shares moved just over 4% today, drawing attention to how the stock has performed over the past month. Investors are beginning to weigh how these recent shifts might influence future opportunities or risks for TAL Education Group.

See our latest analysis for TAL Education Group.

After a strong pop today, TAL’s share price is still up a solid 7.1% year-to-date, despite a dip over the past week, while its longer-term picture is more mixed. The three-year total shareholder return is enormously positive at nearly 150%, but the one-year total return is slightly negative. The action hints at shifting risk perceptions and fresh optimism about the company’s growth potential, even as momentum fluctuates in the short term.

If you’re curious about other fast-changing opportunities, now’s a great moment to broaden your research and discover fast growing stocks with high insider ownership

With shares still trading below many analyst price targets and recent growth in both revenue and net income, the question now is whether TAL Education Group remains undervalued or if the market has already priced in its next wave of growth potential.

Most Popular Narrative: 19.1% Undervalued

With TAL Education Group’s fair value pegged at $12.99 and the latest close at $10.51, the most followed narrative sees upside still on the table. The consensus points to improvements in profitability and efficiency despite ongoing sector headwinds, setting the stage for a deeper examination of what is driving this positive outlook.

Diversification into online enrichment, STEAM, and AI-driven learning devices, along with disciplined expansion of offline centers, lessens regulatory risk concentration and creates multiple growth engines. This approach underpins more resilient and broad-based revenue streams.

How is the narrative justifying ambitious upside from here? It centers on expectations for a step-change in earnings growth, greater profit margins, and a future multiple that rivals high-flying sectors. Which bold financial leaps do analysts see as achievable? Tap into the full narrative for the surprising projections that could power the next breakout.

Result: Fair Value of $12.99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower K-12 revenue growth and ongoing losses in the learning device segment could challenge the bullish outlook if profitability does not improve.

Find out about the key risks to this TAL Education Group narrative.

Another View: Are Shares Priced Too High?

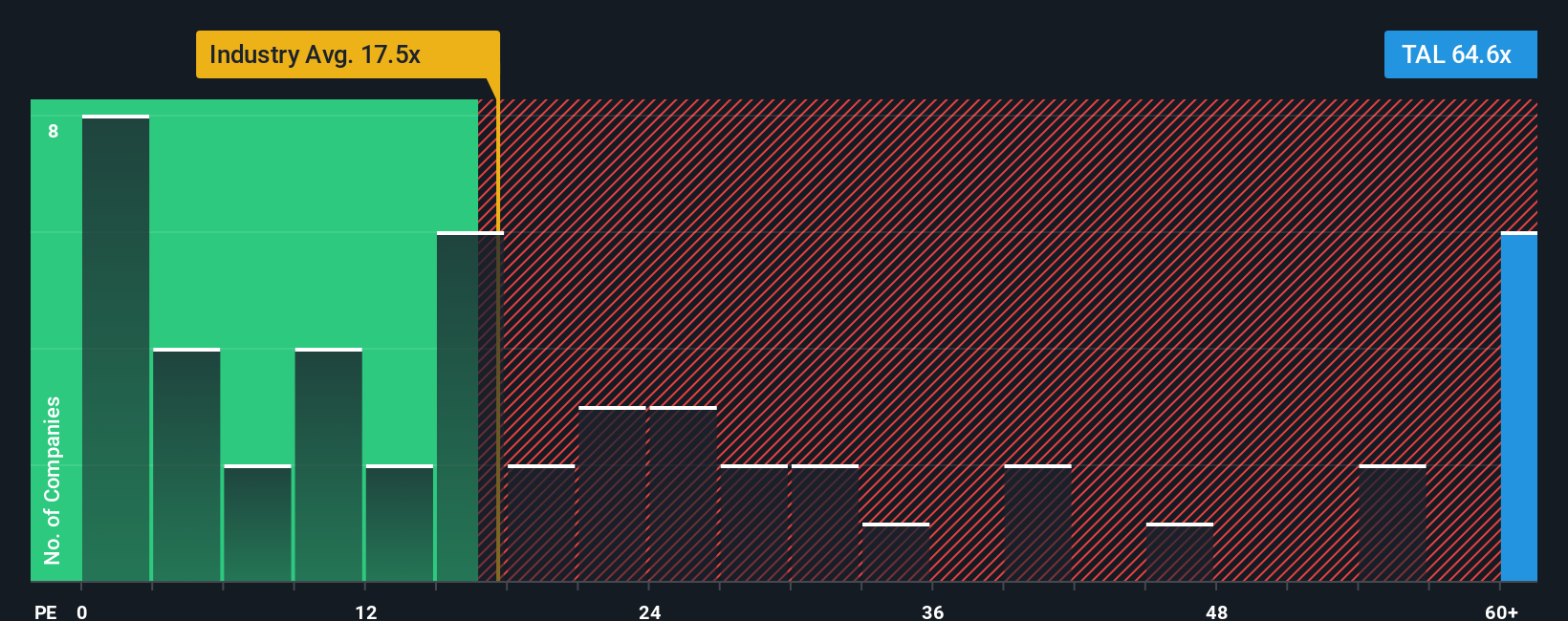

Looking through the lens of price-to-earnings ratios, TAL Education Group stands out as expensive. The company's ratio of 61.2x is far above the US Consumer Services industry average of 17x and the peer average of 25x. Even compared to the fair ratio of 34.8x, TAL trades at a significant premium. Does this raise red flags about valuation risk, or is something big getting priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TAL Education Group Narrative

If you see things differently or value independent research, take a few minutes to dig into the numbers and shape your own perspective. Do it your way

A great starting point for your TAL Education Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Broaden your search and secure your place ahead of the crowd by tapping into these standout investment themes:

- Spot income potential and ramp up your yield by reviewing these 18 dividend stocks with yields > 3% that consistently offer returns over 3%.

- Fuel your portfolio’s growth prospects and shape your future in tech by checking out these 25 AI penny stocks with game-changing innovation.

- Stay ahead of market trends and catch undervalued opportunities early by acting now on these 891 undervalued stocks based on cash flows based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TAL Education Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TAL

TAL Education Group

Provides K-12 after-school tutoring services in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives