- United States

- /

- Hospitality

- /

- NYSE:SGHC

A Fresh Look at Super Group (NYSE:SGHC)'s Valuation After Its Recent Share Price Pause

Reviewed by Kshitija Bhandaru

Super Group (SGHC) (NYSE:SGHC) saw its share price move slightly lower over recent days, even as longer-term performance looks positive. Investors seem to be weighing the current valuation following a steady run this year.

See our latest analysis for Super Group (SGHC).

Super Group’s share price has been on a tear this year, with momentum only pausing recently as investors assess whether its rally, driven by solid fundamentals and a 1-year total shareholder return of 237%, has further to run or if risk is starting to outweigh reward.

If strong rallies like this have you eyeing what else could take off next, broaden your investing horizons and discover fast growing stocks with high insider ownership.

With impressive returns and strong financial results, the question now is whether Super Group is still undervalued at current levels or if the market has already priced in all future growth and opportunities for investors.

Most Popular Narrative: 26% Undervalued

With Super Group (SGHC) closing at $13.00, the most closely followed narrative sees fair value around $17.63, a notable premium to the market price. This narrative sets bold expectations and hints at the company's capacity for outsized returns despite market caution.

"Accelerated investment in technology, including the addition of a Group CTO and scaling AI/data-driven initiatives, is enhancing product offerings, automating processes, and driving cost and marketing efficiencies. This is likely leading to structurally higher EBITDA margins and improved free cash flow. The shift of resources away from the unprofitable U.S. iGaming business toward high-return/core markets is expected to improve overall profitability and enable higher incremental margin capture as revenue grows, strengthening future net income and margin profile."

Want to know what’s fueling this eye-catching valuation? The narrative’s secret sauce mixes rising profitability forecasts, more aggressive margin targets, and a major strategic pivot. Which financial leap inspires this 26% upside, and just how much further could these operational changes push earnings? Get the full story and decipher the forecasts behind the optimism.

Result: Fair Value of $17.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tightening regulations across key markets and Super Group’s exit from the U.S. iGaming segment could quickly challenge current growth expectations.

Find out about the key risks to this Super Group (SGHC) narrative.

Another View: What Do Market Ratios Say?

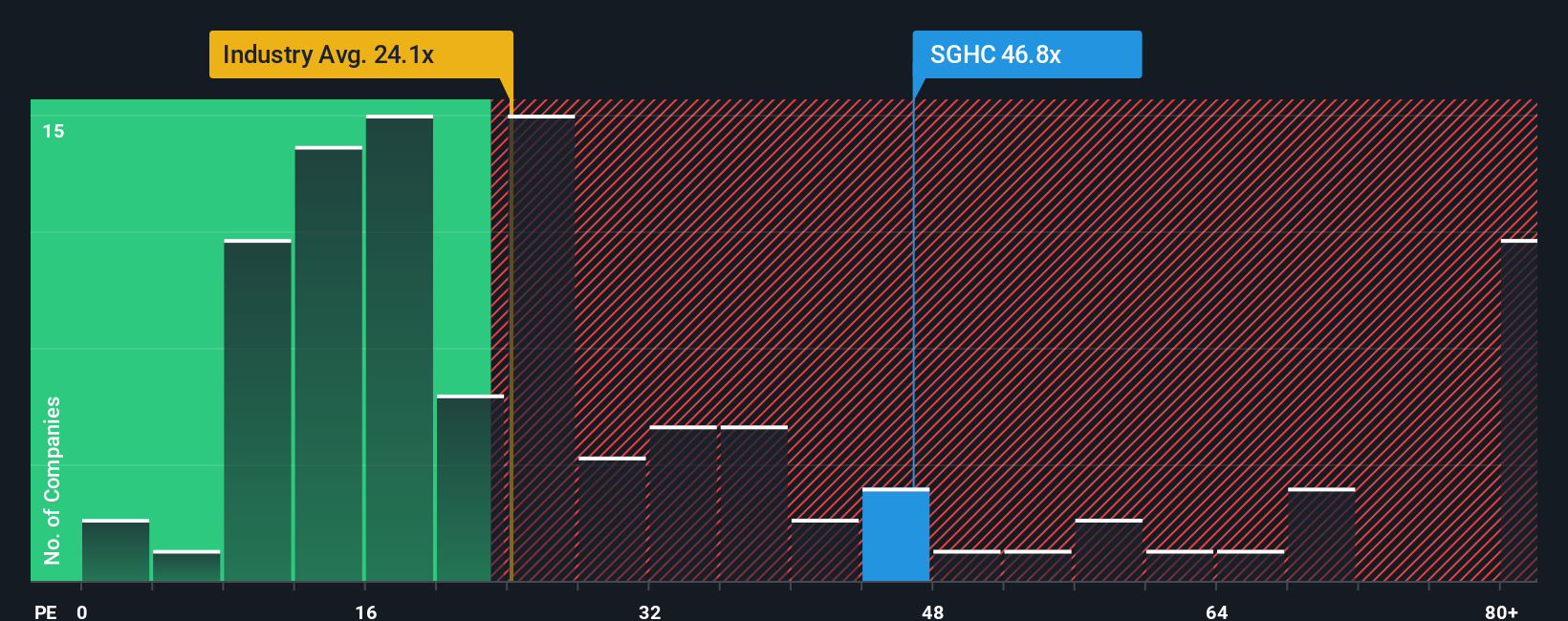

While our previous valuation sees Super Group as undervalued, a look at market ratios tells a more cautious story. Its price-to-earnings ratio is 45.5x, which is far above peers at 26.8x and the US Hospitality industry at 23.1x. Even compared to its fair ratio of 37.6x, the shares look pricey. Could this disconnect signal real risk, or is the long-term opportunity still intact?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Super Group (SGHC) Narrative

If you want to understand the numbers for yourself or dig deeper than the consensus, you can craft your own perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Super Group (SGHC).

Looking for More Investment Ideas?

If you’re hungry for the next breakout opportunity, step up your investing game now and seek the edge that most investors miss by using smarter stock screens:

- Target reliable cash flow and income potential by checking out these 18 dividend stocks with yields > 3% with yields above 3% and a track record of strong returns.

- Get ahead of the curve on medical innovation and growth by reviewing these 33 healthcare AI stocks shaping tomorrow’s healthcare landscape with artificial intelligence breakthroughs.

- Capitalize on the momentum in cryptocurrencies and blockchain technology. Scan these 79 cryptocurrency and blockchain stocks for companies riding the digital finance wave with robust strategies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SGHC

Super Group (SGHC)

Operates as an online sports betting and gaming operator.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives