- United States

- /

- Hospitality

- /

- NYSE:RSI

Why Are Rush Street Interactive (RSI) Executives Selling Shares as Economic Uncertainty Grows?

Reviewed by Sasha Jovanovic

- Rush Street Interactive recently saw several top executives sell significant shares, as revealed in regulatory filings, amid a period of downbeat economic news and multifaceted concerns about the U.S. economy.

- The combination of internal share sales and warnings from economists about recessionary signals in numerous states has contributed to heightened investor caution surrounding the company.

- We'll explore how executive share sales amid economic uncertainty may influence the investment narrative and future outlook for Rush Street Interactive.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Rush Street Interactive Investment Narrative Recap

To own Rush Street Interactive, you need to believe in the migration to online gaming and the company's ability to expand in new legal markets while efficiently growing its customer base. The recent executive share sales come at a time of broader economic uncertainty, and while this may dampen short-term investor sentiment, the bigger near-term catalyst remains the Q3 earnings release; the key risk is a possible slowdown in user growth as core markets mature, which does not appear materially altered by the share sales.

With Q3 2025 earnings set for release on October 29, investor attention will likely shift to revenue trends and profitability updates. This announcement is particularly relevant as it provides an important check-in on the company’s performance and guidance, placing recent insider activity into the broader context of operational results and ongoing margin risks tied to rising competition and regulatory outcomes.

In contrast, investors should also be mindful of how increased marketing spending and maturing markets could weigh on revenue growth if...

Read the full narrative on Rush Street Interactive (it's free!)

Rush Street Interactive's outlook forecasts $1.5 billion in revenue and $44.7 million in earnings by 2028. This projection is based on annual revenue growth of 13.2% and a $19.5 million increase in earnings from the current $25.2 million.

Uncover how Rush Street Interactive's forecasts yield a $20.75 fair value, a 14% upside to its current price.

Exploring Other Perspectives

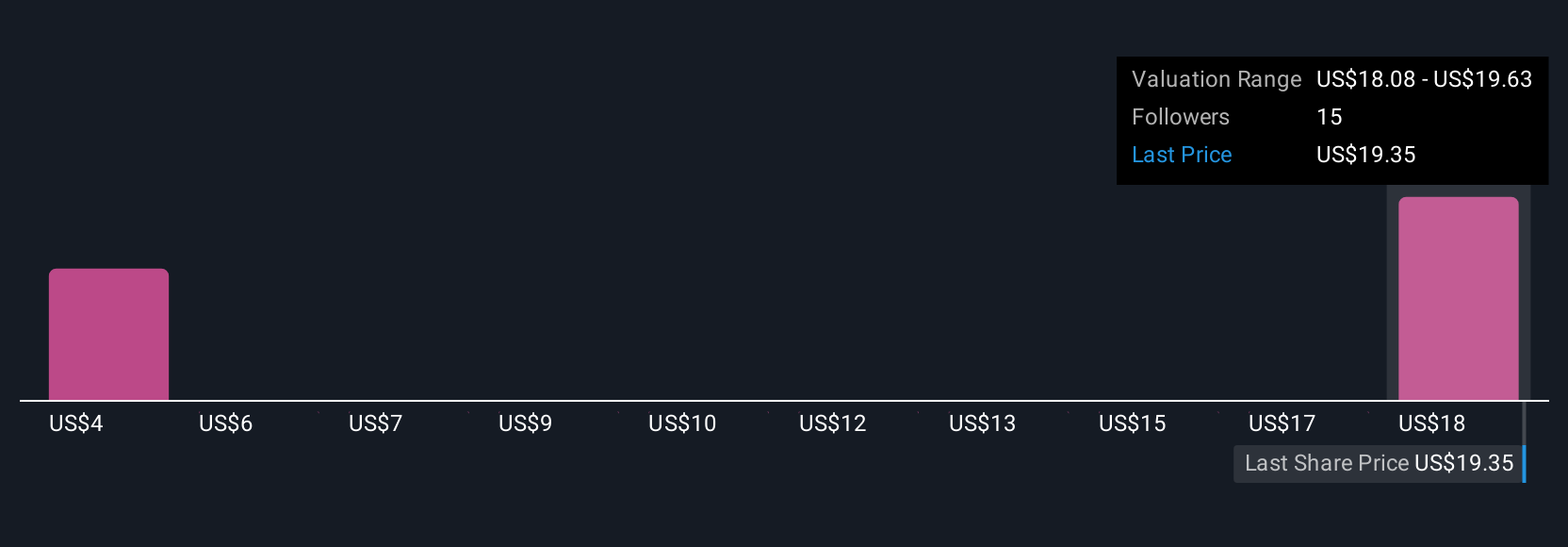

Simply Wall St Community members have posted fair value estimates for RSI between US$20.75 and US$22.61, based on two independent forecasts. While these reflect divergent outlooks, ongoing risks around user growth in key jurisdictions continue to shape the debate over the company’s performance and prospects.

Explore 2 other fair value estimates on Rush Street Interactive - why the stock might be worth as much as 24% more than the current price!

Build Your Own Rush Street Interactive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rush Street Interactive research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Rush Street Interactive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rush Street Interactive's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RSI

Rush Street Interactive

Operates as an online casino and sports betting company in the United States, Canada, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives