- United States

- /

- Medical Equipment

- /

- NYSE:INSP

US Stocks That May Be Priced Below Intrinsic Value In January 2025

Reviewed by Simply Wall St

As the United States stock market enters 2025, major indices like the Dow Jones and S&P 500 are attempting to recover from a sluggish start, following a challenging end to 2024. In such conditions, identifying stocks that may be priced below their intrinsic value can offer potential opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $27.04 | $53.41 | 49.4% |

| Argan (NYSE:AGX) | $143.32 | $279.51 | 48.7% |

| Burke & Herbert Financial Services (NasdaqCM:BHRB) | $60.50 | $118.65 | 49% |

| German American Bancorp (NasdaqGS:GABC) | $38.85 | $77.34 | 49.8% |

| Camden National (NasdaqGS:CAC) | $42.25 | $84.44 | 50% |

| Cadence Bank (NYSE:CADE) | $33.70 | $65.46 | 48.5% |

| Kanzhun (NasdaqGS:BZ) | $13.64 | $26.99 | 49.5% |

| HealthEquity (NasdaqGS:HQY) | $96.81 | $189.22 | 48.8% |

| Repligen (NasdaqGS:RGEN) | $143.05 | $281.09 | 49.1% |

| Zillow Group (NasdaqGS:ZG) | $70.08 | $137.46 | 49% |

We'll examine a selection from our screener results.

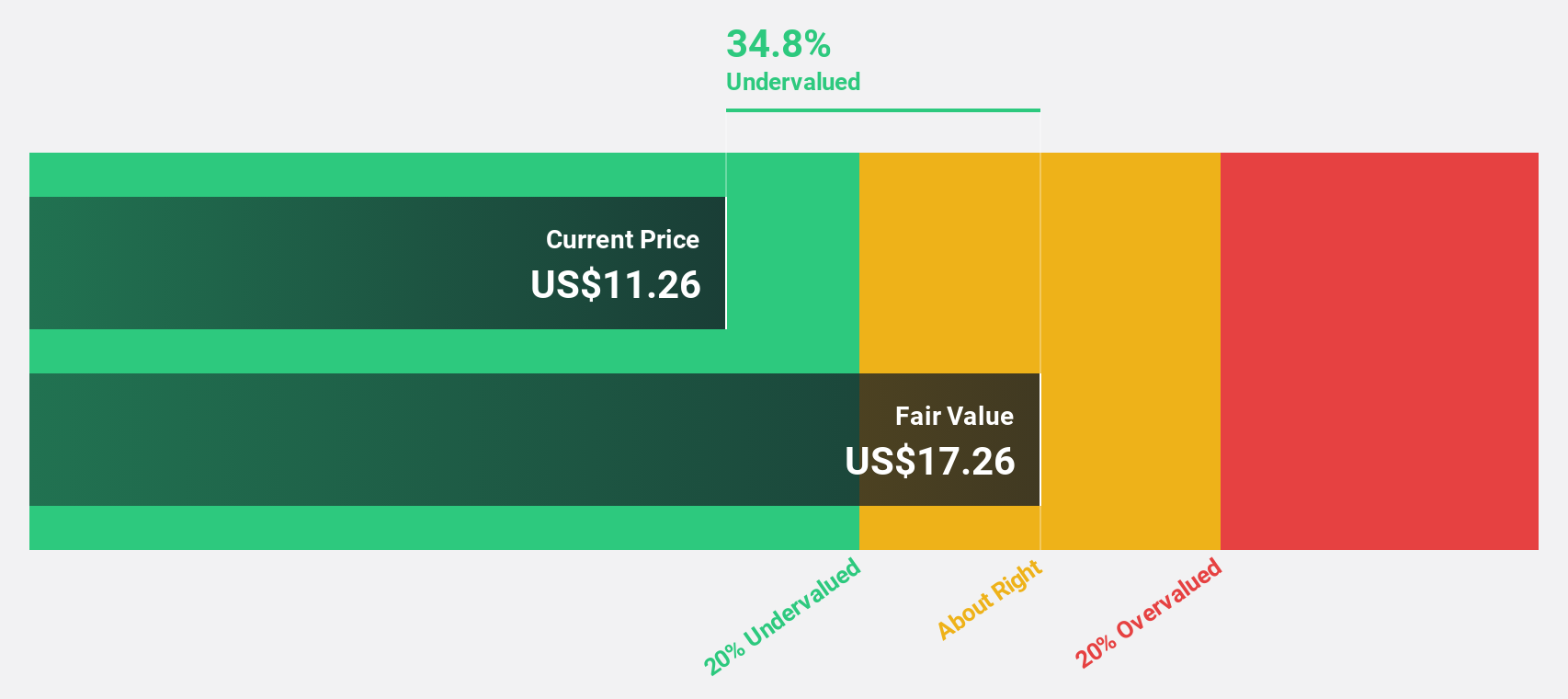

ChromaDex (NasdaqCM:CDXC)

Overview: ChromaDex Corporation is a bioscience company that develops healthy aging products and has a market cap of approximately $406.10 million.

Operations: The company's revenue is derived from three primary segments: Ingredients ($16.95 million), Consumer Products ($71.72 million), and Analytical Reference Standards and Services ($3.00 million).

Estimated Discount To Fair Value: 35.1%

ChromaDex is trading at US$5.48, below its estimated fair value of US$8.44, suggesting it may be undervalued based on cash flows. The company recently reported a profitable quarter with net income of US$1.88 million, a turnaround from the previous year's loss. Its earnings are forecasted to grow significantly at 81.8% annually, outpacing the broader U.S. market growth rate of 14.9%. Recent product rollouts and partnerships further bolster revenue prospects.

- Insights from our recent growth report point to a promising forecast for ChromaDex's business outlook.

- Get an in-depth perspective on ChromaDex's balance sheet by reading our health report here.

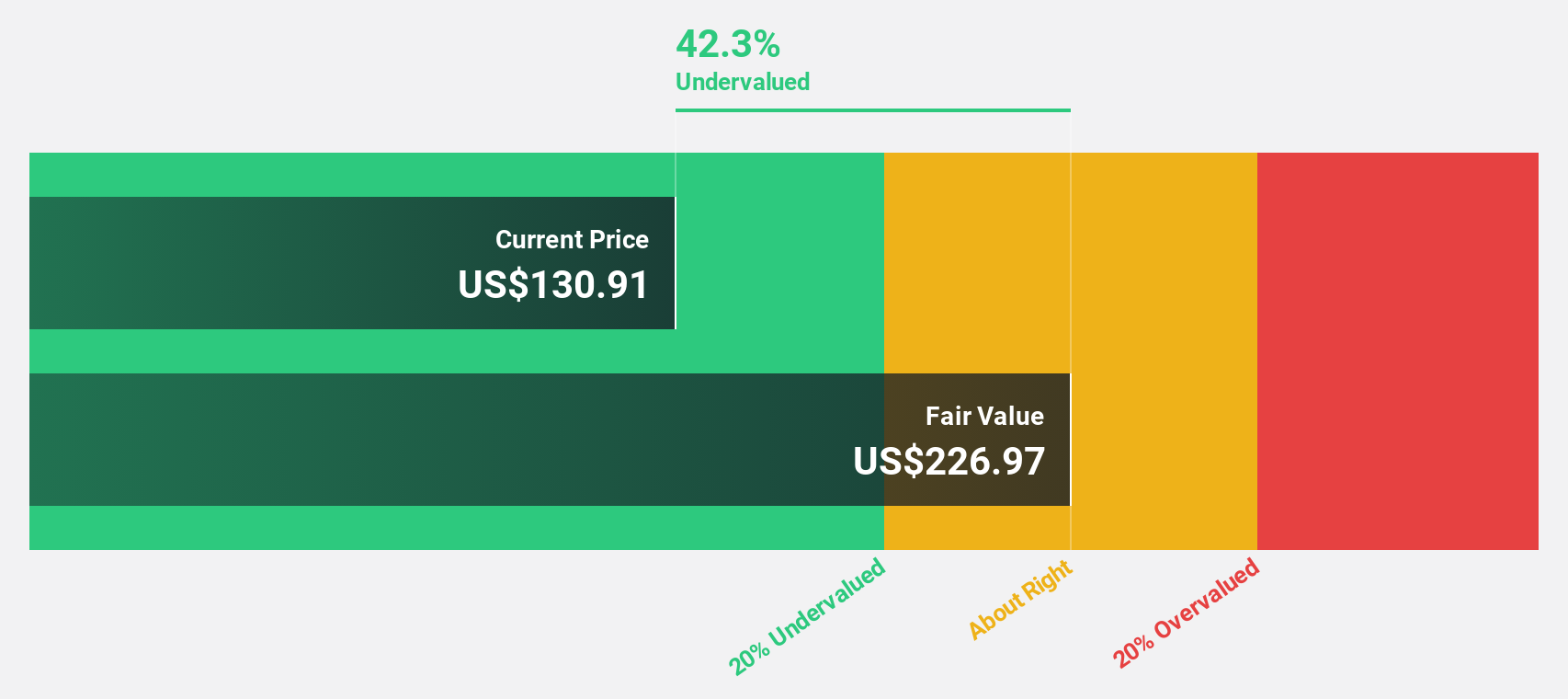

Inspire Medical Systems (NYSE:INSP)

Overview: Inspire Medical Systems, Inc. is a medical technology company that develops and commercializes minimally invasive solutions for obstructive sleep apnea, with a market cap of approximately $5.56 billion.

Operations: The company generates revenue primarily from its Patient Monitoring Equipment segment, totaling $755.59 million.

Estimated Discount To Fair Value: 16.8%

Inspire Medical Systems, trading at US$189.19, is undervalued with a fair value estimate of US$227.52. The company reported significant financial turnaround with Q3 net income of US$18.5 million against a prior loss and raised its 2024 revenue guidance to US$793-798 million, reflecting growth over the previous year. Revenue is forecasted to grow faster than the U.S. market at 15.2% annually, while earnings are expected to increase significantly by 31.3% per year.

- In light of our recent growth report, it seems possible that Inspire Medical Systems' financial performance will exceed current levels.

- Take a closer look at Inspire Medical Systems' balance sheet health here in our report.

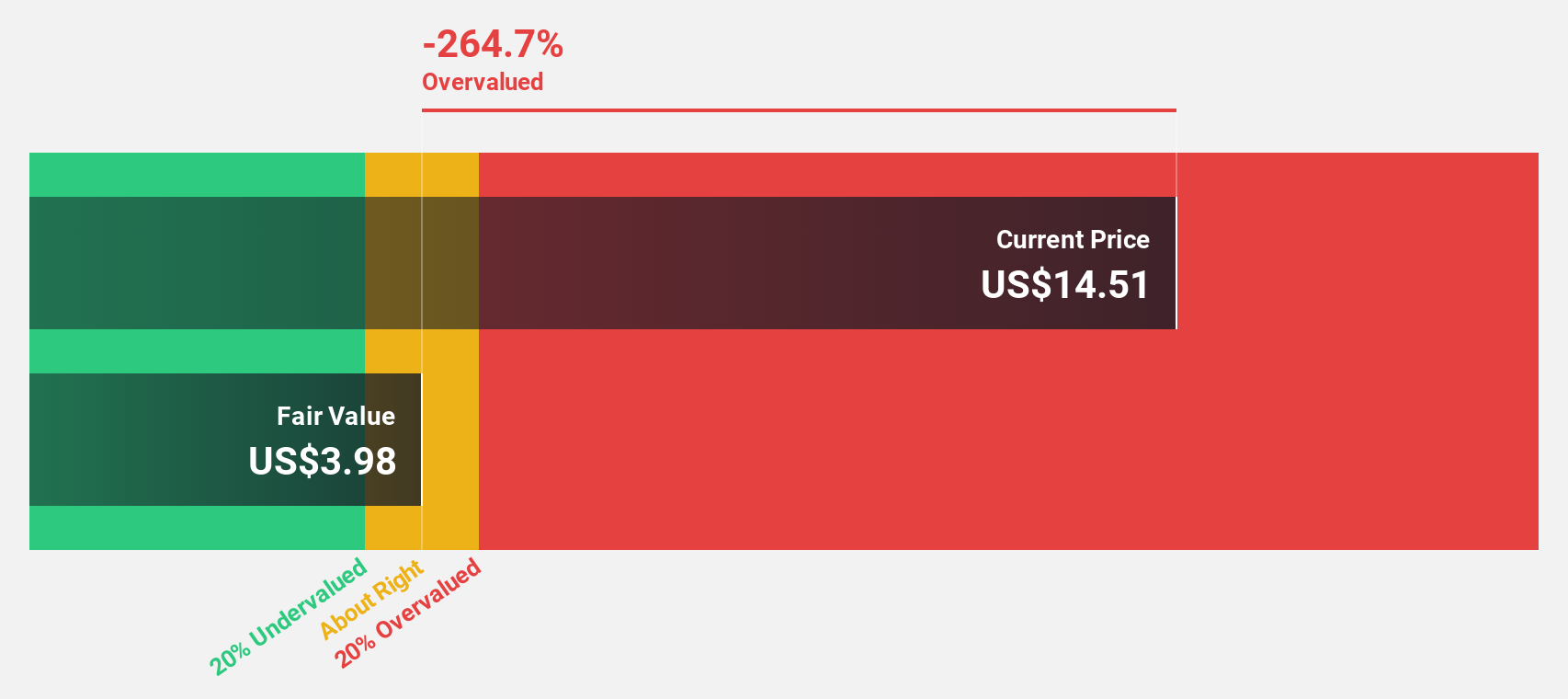

Rush Street Interactive (NYSE:RSI)

Overview: Rush Street Interactive, Inc. operates as an online casino and sports betting company across the United States, Canada, Mexico, and Latin America with a market cap of approximately $3.10 billion.

Operations: The company's revenue is primarily generated from its Casinos & Resorts segment, which amounts to $863.77 million.

Estimated Discount To Fair Value: 28.3%

Rush Street Interactive is trading at US$13.74, below its estimated fair value of US$19.16, indicating it may be undervalued based on cash flows. The company reported Q3 sales of US$232.11 million and achieved a net income turnaround to US$1.19 million from a loss last year. With revenue expected to grow 32% year-over-year in 2024, RSI's strategic moves, including launching BetRivers Poker and board expansion with Thomas Winter, bolster its growth potential.

- According our earnings growth report, there's an indication that Rush Street Interactive might be ready to expand.

- Navigate through the intricacies of Rush Street Interactive with our comprehensive financial health report here.

Make It Happen

- Reveal the 175 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INSP

Inspire Medical Systems

A medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives