- United States

- /

- Hospitality

- /

- NYSE:RSI

Should You Rethink Rush Street Interactive Stock After Its Recent 17% Weekly Drop?

Reviewed by Bailey Pemberton

Thinking about what to do with Rush Street Interactive stock? You are not alone as investors everywhere are sizing up this high-flyer after its wild ride over the past few years. After all, shares have soared 423.5% over the last three years and delivered an impressive 79.0% jump in just the past twelve months. Even with a steep slip of 16.6% in the most recent week and an 11.8% dip over the last month, the stock remains up 36.0% year-to-date. This hints at strong underlying momentum and perhaps some shifting perceptions of risk in the online betting sector.

Market developments in digital gaming and online casino offerings continue to create both volatility and opportunity for Rush Street Interactive. It is not unusual to see rapid swings as investors react to changes in regulation, new state launches, or evolving competitive dynamics. While some months can test your nerves, the long-term growth story has plenty of believers.

When it comes to valuation, things get a bit more complicated. Using a typical six-point valuation checklist, Rush Street Interactive is only undervalued by one measure, giving the company a modest value score of 1 out of 6. But as any savvy investor knows, numbers rarely tell the entire story. Next, I will break down the valuation approaches that matter most and later, share an even more effective way to judge what this stock is really worth.

Rush Street Interactive scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Rush Street Interactive Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the fair value of a stock by projecting a company’s future cash flows and then discounting them back to their present value. This approach aims to determine what the business is worth today, given all expected future cash it will generate.

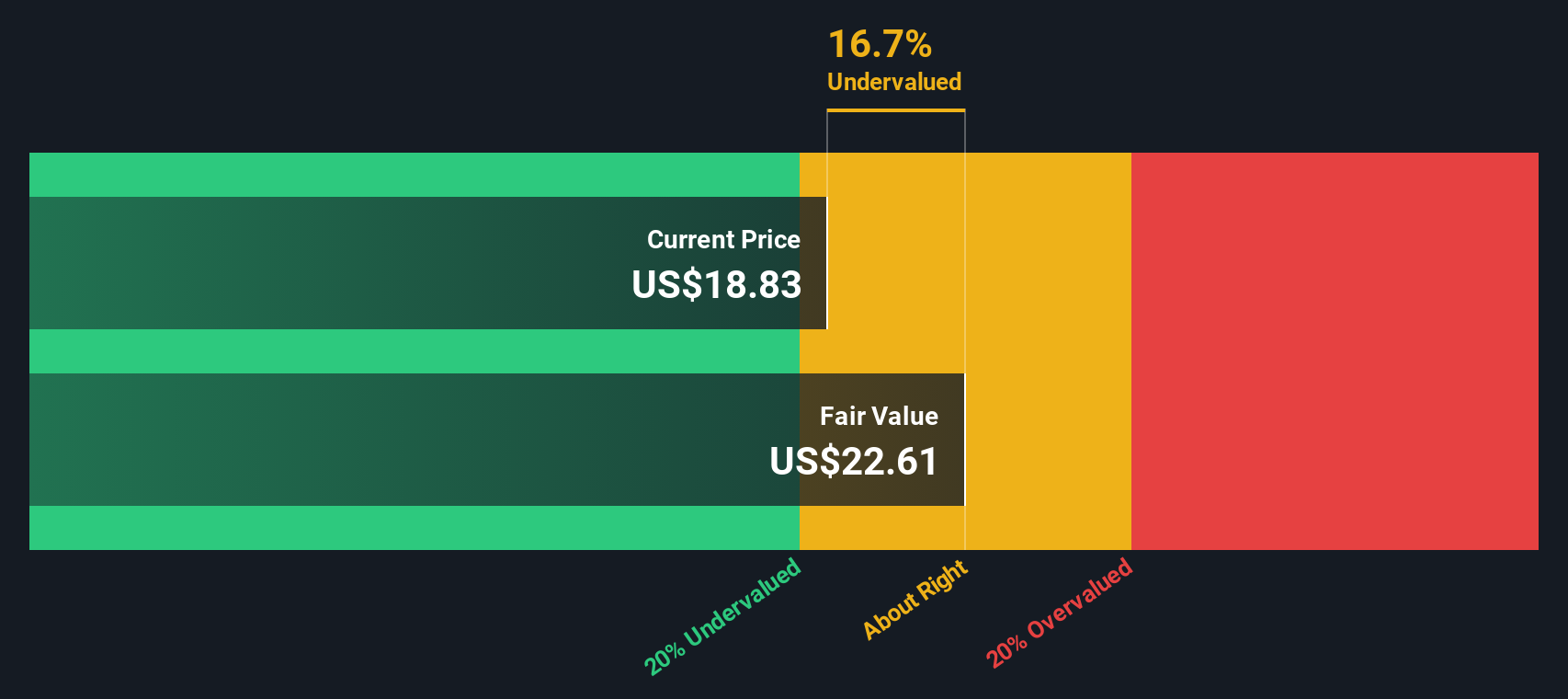

For Rush Street Interactive, the analysis starts with its most recent Free Cash Flow of $68.5 million. Analysts anticipate significant growth, with projections climbing to $107.9 million by 2026 and $162.2 million by 2027. Beyond this, further increases are extrapolated and eventually reach $388.8 million by 2035. All estimates are expressed in US dollars. The DCF model incorporates both analyst estimates for the initial years and Simply Wall St’s extrapolations for longer-term forecasts.

Based on these cash flow projections and discounting them appropriately, the model arrives at an intrinsic fair value estimate of $22.63 per share. Since this is about 17.4% higher than the current share price, the DCF approach suggests the stock is currently undervalued and could offer upside for investors if the optimistic cash flow trajectory materializes.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rush Street Interactive is undervalued by 17.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Rush Street Interactive Price vs Earnings (PE)

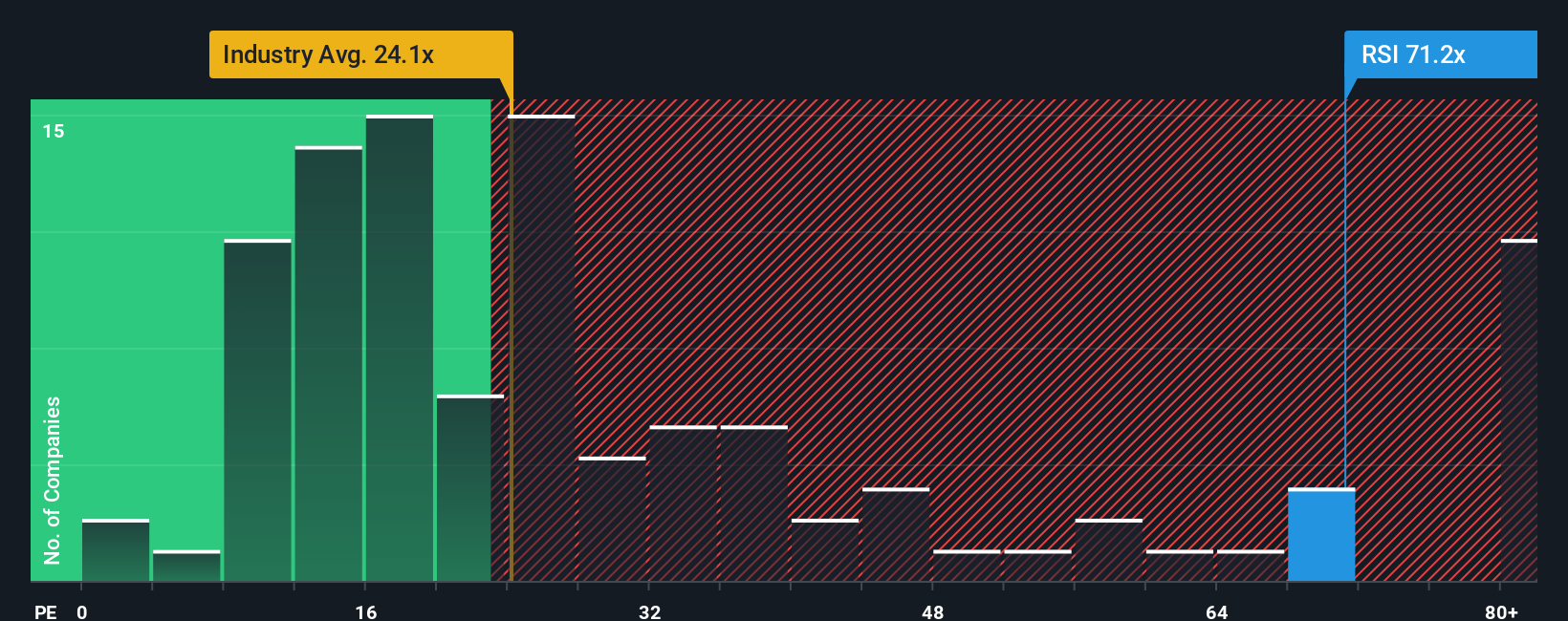

The Price-to-Earnings (PE) ratio is a popular and useful valuation tool for profitable companies like Rush Street Interactive. Since the business has positive earnings, the PE ratio lets investors gauge how the market values each dollar of those earnings. A higher PE often reflects optimistic growth expectations or lower risk, while a lower PE can signal skepticism about future prospects or elevated risks faced by the company.

Rush Street Interactive currently trades at a PE of 70.6x. This is notably higher than the hospitality industry average of 24.9x, and also above the average for its peers at 35.7x. These comparisons might initially suggest the stock is expensive relative to both its sector and its direct competitors. However, it is important to look beyond simple benchmarks.

Simply Wall St's "Fair Ratio" offers a more nuanced comparison by considering several company-specific factors such as earnings growth, industry trends, profit margins, company size, and risk profile. For Rush Street Interactive, the Fair Ratio is calculated to be 24.4x, which is much lower than its current PE. This tailored approach is more powerful than just comparing to industry averages or peers because it adapts to the unique characteristics of the company and its operating environment.

Given the large gap between Rush Street Interactive’s current PE of 70.6x and its Fair Ratio of 24.4x, the stock appears to be overvalued on this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rush Street Interactive Narrative

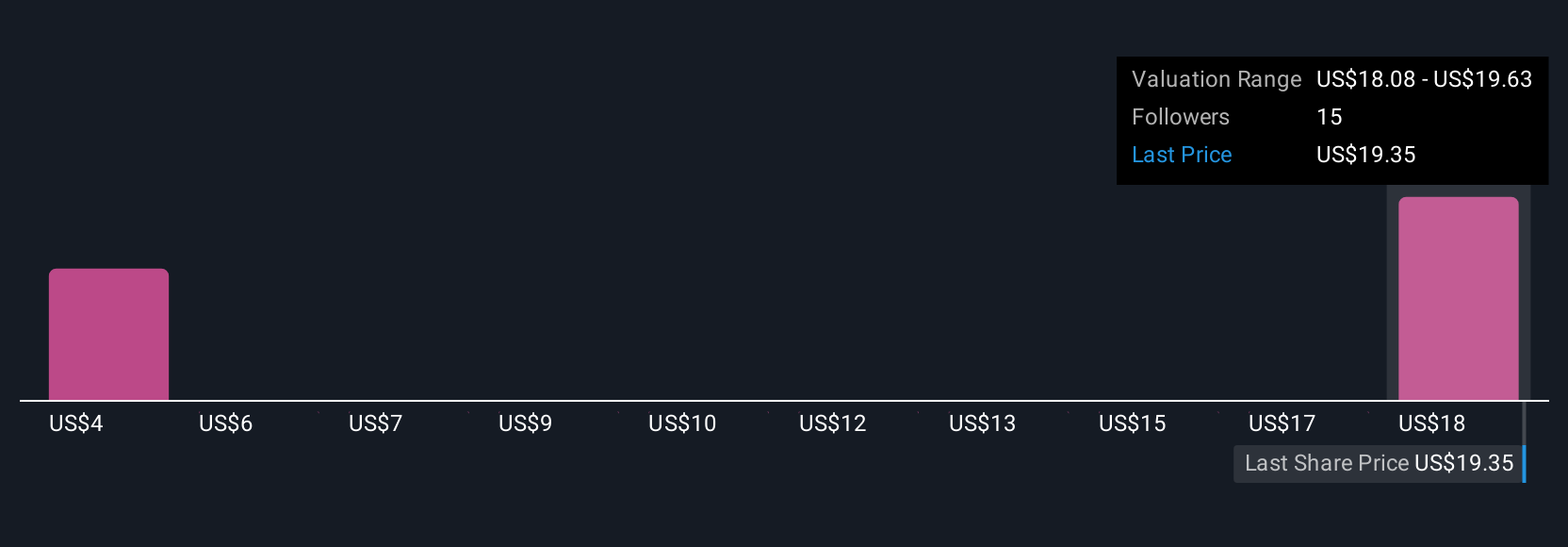

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your perspective on a company; it is the story behind the numbers, where you outline what you believe about Rush Street Interactive’s future (like revenue or profit growth), how those beliefs flow through to a financial forecast, and what you think a fair value should be based on your scenario.

Narratives connect the dots between a company’s unique story, future assumptions, and resulting valuation. This approach makes investing more personal, transparent, and adaptable. On Simply Wall St’s platform, you can easily create, view, and edit Narratives on the Community page, right alongside millions of other investors.

Narratives help you decide when to buy or sell by comparing your estimated Fair Value to the current Price. Because they update dynamically for every major news event or earnings release, you always have an up-to-date view.

For instance, some investors might create a Narrative for Rush Street Interactive that says, “I see record user growth and international expansion driving the stock much higher, with a bullish price target of $23.00,” while others focus on the risks like competition or regulatory setbacks, resulting in a more cautious view with a price target of $16.00. Narratives let you track these diverse perspectives and adjust your own outlook as new information emerges.

Do you think there's more to the story for Rush Street Interactive? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RSI

Rush Street Interactive

Operates as an online casino and sports betting company in the United States, Canada, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives