- United States

- /

- Hospitality

- /

- NYSE:RCL

Will Royal Caribbean’s US$1.5 Billion Investment-Grade Debt Issuance Reshape the RCL Growth Outlook?

Reviewed by Sasha Jovanovic

- Royal Caribbean Cruises Ltd. recently completed a US$1.5 billion offering of 5.375% senior unsecured notes due 2036, raising net proceeds of about US$1.48 billion to fund the delivery of the Celebrity Xcel ship and to refinance existing debt.

- This transaction marks the company's reentry into the investment-grade market and signals increased financial flexibility to support ongoing fleet expansion.

- We’ll explore how Royal Caribbean’s successful US$1.5 billion note issuance could influence its investment narrative and growth outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Royal Caribbean Cruises Investment Narrative Recap

To be a Royal Caribbean shareholder, you need confidence in the company's ability to attract steady demand for its cruises, execute its expansion with new ships, and manage debt amid changing consumer spending patterns. The successful US$1.5 billion senior note issuance reaffirms Royal Caribbean's financial flexibility and supports its expansion, but is unlikely to immediately alter the company's main near-term catalyst, the launch of new ships to drive revenue, or reduce the biggest risk of a potential slowdown in discretionary spending.

Among recent developments, Royal Caribbean's long-term framework agreement with Meyer Turku, which secures shipbuilding capacity into the next decade, stands out. This agreement aligns with the company’s fleet expansion plans, underpinning its growth catalyst, while also intensifying future capital commitments that will need to be balanced against consumer demand trends and debt management.

However, investors should also be aware that, should economic conditions worsen and consumer confidence decline...

Read the full narrative on Royal Caribbean Cruises (it's free!)

Royal Caribbean Cruises is projected to reach $22.4 billion in revenue and $5.9 billion in earnings by 2028. This outlook relies on a 9.2% annual revenue growth rate and a $2.3 billion increase in earnings from the current $3.6 billion level.

Uncover how Royal Caribbean Cruises' forecasts yield a $355.87 fair value, a 11% upside to its current price.

Exploring Other Perspectives

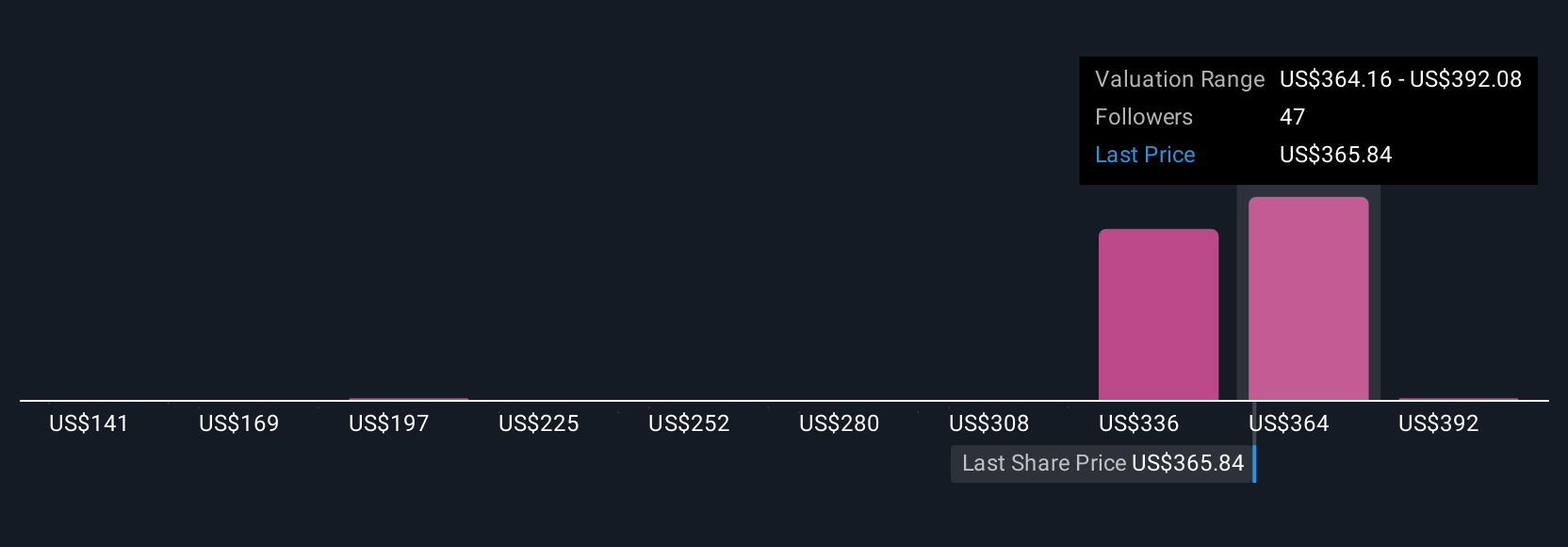

Twelve members of the Simply Wall St Community place Royal Caribbean's fair value between US$140.78 and US$440.34 per share. Amid this broad spectrum of expectations, the company's major upcoming ship launches remain a key driver for future revenue and earnings growth, signaling reasons for optimism among many contributors.

Explore 12 other fair value estimates on Royal Caribbean Cruises - why the stock might be worth as much as 38% more than the current price!

Build Your Own Royal Caribbean Cruises Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royal Caribbean Cruises research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Royal Caribbean Cruises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royal Caribbean Cruises' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RCL

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)