- United States

- /

- Hospitality

- /

- NYSE:RCL

Royal Caribbean Cruises (NYSE:RCL) Dropped From Multiple Russell Value Indexes

Reviewed by Simply Wall St

Royal Caribbean Cruises (NYSE:RCL) experienced a notable shift in its market positioning when it was removed from several key indices, such as the Russell 1000 Value Index, which may have impacted investor perception. Over the last quarter, the company's share price surged 51%, against a backdrop of broader market rallies with the S&P 500 and Nasdaq reaching record highs. While the index removal may have reduced visibility among some investors, strong earnings and a share buyback completion likely bolstered investor confidence, supporting its price surge, aligning broadly with favorable market trends and enhancing its appeal during positive economic sentiment.

Find companies with promising cash flow potential yet trading below their fair value.

Royal Caribbean Cruises' removal from key indices, as mentioned earlier, could recalibrate investor perceptions, potentially affecting short-term visibility. However, the company has shown resilience with a significant 51% share price increase in the last quarter amidst broader market uptrends. Over a longer three-year period, the company achieved a total shareholder return of 786.71%, a very large growth reflecting its robust performance and strategic initiatives. In contrast, its one-year return surpassed the U.S. Hospitality industry's 21.5% performance.

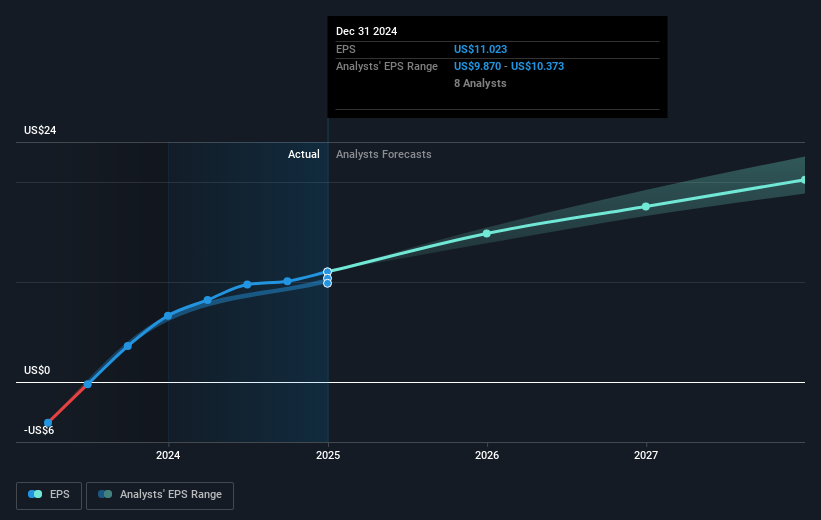

Despite potential challenges, such as macroeconomic uncertainty impacting consumer behavior, the company's strong revenue drivers—new ships and exclusive destinations—could support revenue and earnings growth forecasts. Analysts have projected an annual revenue increase of 9.3% over the next three years, with earnings growing from US$3.25 billion to US$5.7 billion by mid-2028. Current share price movements must be seen regarding the US$265.43 price target, showing a 15% discount, indicating room for potential appreciation. The removal's impact on revenue and earnings forecasts could be limited if Royal Caribbean continues its current trajectory of operational successes.

Assess Royal Caribbean Cruises' previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RCL

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives