- United States

- /

- Hospitality

- /

- NYSE:PRKS

Will United Parks & Resorts’ (PRKS) Seasonal Shift Reveal Deeper Insights Into Its Guest Loyalty Strategy?

Reviewed by Sasha Jovanovic

- Sesame Place San Diego closed its doors on September 21, 2025, and will shift to a seasonal schedule, reopening in Spring 2026 while the Philadelphia location remains open year-round.

- This move follows United Parks & Resorts' announcement of enhanced 2026 Annual Pass programs for SeaWorld and Busch Gardens, designed to build guest loyalty and drive higher in-park spending.

- Let's explore how the introduction of more valuable annual passes may influence the company’s investment outlook and future growth narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

United Parks & Resorts Investment Narrative Recap

Investors in United Parks & Resorts need to believe in the company’s ability to drive steady attendance and spending, despite near-term headwinds like Sesame Place San Diego’s shift to a seasonal schedule. This operational change, while limiting year-round revenue from one location, is unlikely to significantly move the needle on the short-term catalyst of growing annual pass sales and guest loyalty, but it does reinforce the recurring risk of geographic concentration and weather-related disruptions outside the Orlando core.

Among recent announcements, the launch of more valuable 2026 annual pass programs for SeaWorld and Busch Gardens stands out. These offerings aim to strengthen guest engagement with perks like unlimited visits and extra in-park rewards, supporting the near-term catalyst of boosting both attendance and per capita spending without relying excessively on price promotions or discounts. Of course, investors should still keep an eye on…

Read the full narrative on United Parks & Resorts (it's free!)

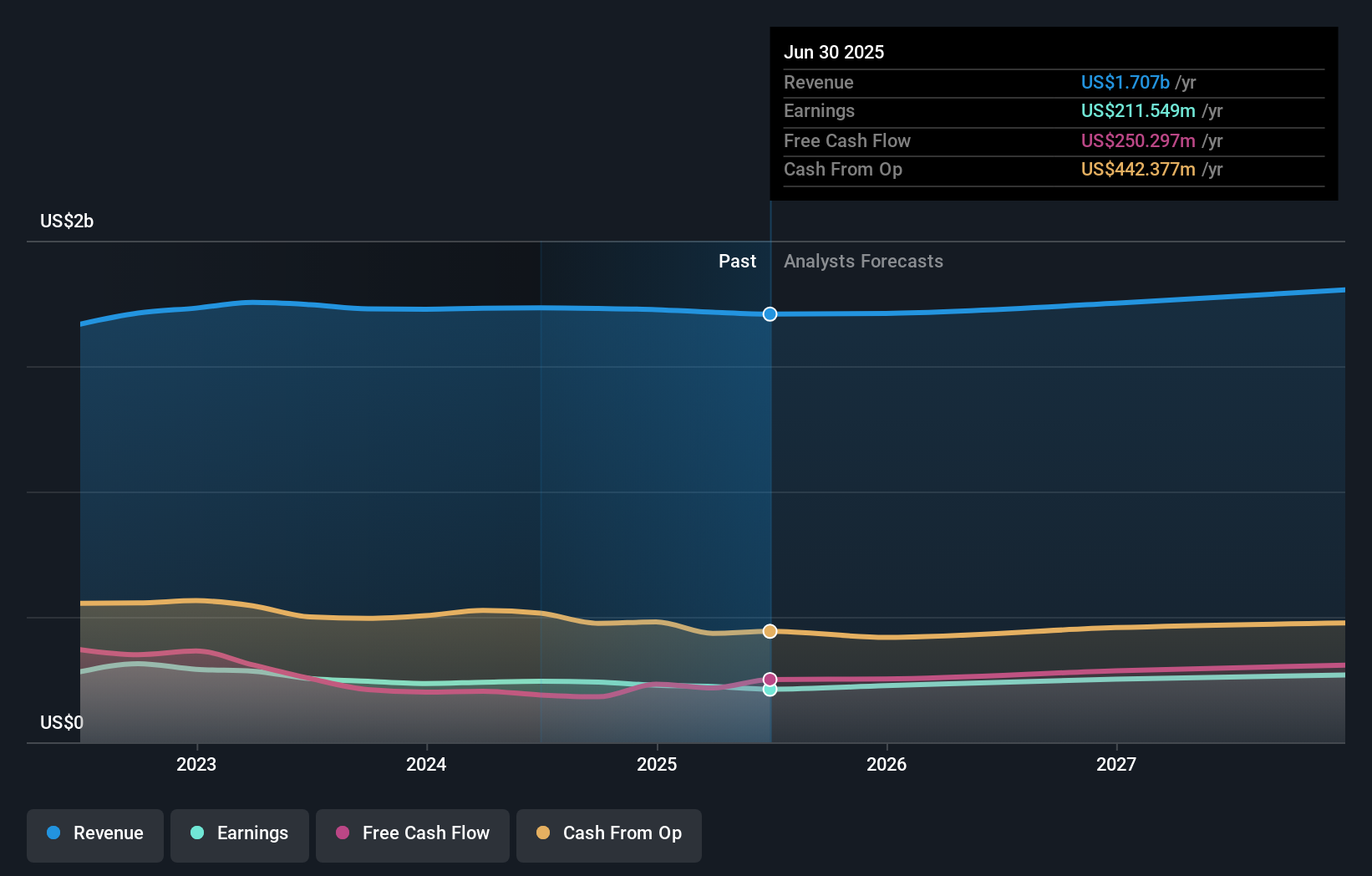

United Parks & Resorts is projected to generate $1.8 billion in revenue and $284.5 million in earnings by 2028. This implies an annual revenue growth rate of 2.1% and a $73 million increase in earnings from the current $211.5 million level.

Uncover how United Parks & Resorts' forecasts yield a $57.45 fair value, a 11% upside to its current price.

Exploring Other Perspectives

All 1 community fair value estimate for United Parks & Resorts from the Simply Wall St Community points to US$57.45 per share. Yet with recurring attendance pressure outside Orlando, you might want to see what other investors think about this company’s risks and future prospects.

Explore another fair value estimate on United Parks & Resorts - why the stock might be worth as much as 11% more than the current price!

Build Your Own United Parks & Resorts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Parks & Resorts research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United Parks & Resorts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Parks & Resorts' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRKS

United Parks & Resorts

Operates as a theme park and entertainment company in the United States.

Undervalued with limited growth.

Similar Companies

Market Insights

Community Narratives