- United States

- /

- Hospitality

- /

- NYSE:PRKS

How Investors Are Reacting To United Parks & Resorts (PRKS) Analyst Upgrade and $500M Buyback Approval

Reviewed by Sasha Jovanovic

- Texas Capital Securities recently initiated coverage on United Parks & Resorts with a positive outlook, highlighting operational improvements and growth opportunities linked to guest monetization, new park development, and a newly approved US$500 million share repurchase program.

- Shareholders also approved the significant buyback authorization, while the company appointed Kevin Connelly as chief accounting officer, underlining ongoing leadership and capital management changes during a period of enhanced growth focus.

- We'll explore how the focus on guest monetization, highlighted by analyst coverage, could influence United Parks & Resorts' investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

United Parks & Resorts Investment Narrative Recap

To invest in United Parks & Resorts, you need confidence in the company's ability to boost guest monetization, capitalize on new park development, and sustain demand-driven attendance growth. The positive analyst coverage and leadership changes underscore management’s efforts to drive profitability, but ongoing weather volatility and regional attendance trends remain the most important risk for the business right now. Overall, these latest developments do not materially shift the key short-term catalyst, which continues to be execution on attendance and per-guest spending.

The newly announced US$500 million share repurchase program, approved by shareholders, stands out as the most pertinent announcement. By returning capital and signaling confidence, this move could provide incremental support for earnings per share if operational progress follows through, yet its impact will depend on broader demand and cost trends, which remain a focus for investors.

By contrast, as investors look for upside, United Parks’ exposure to persistent weather disruptions is a risk you should be aware of…

Read the full narrative on United Parks & Resorts (it's free!)

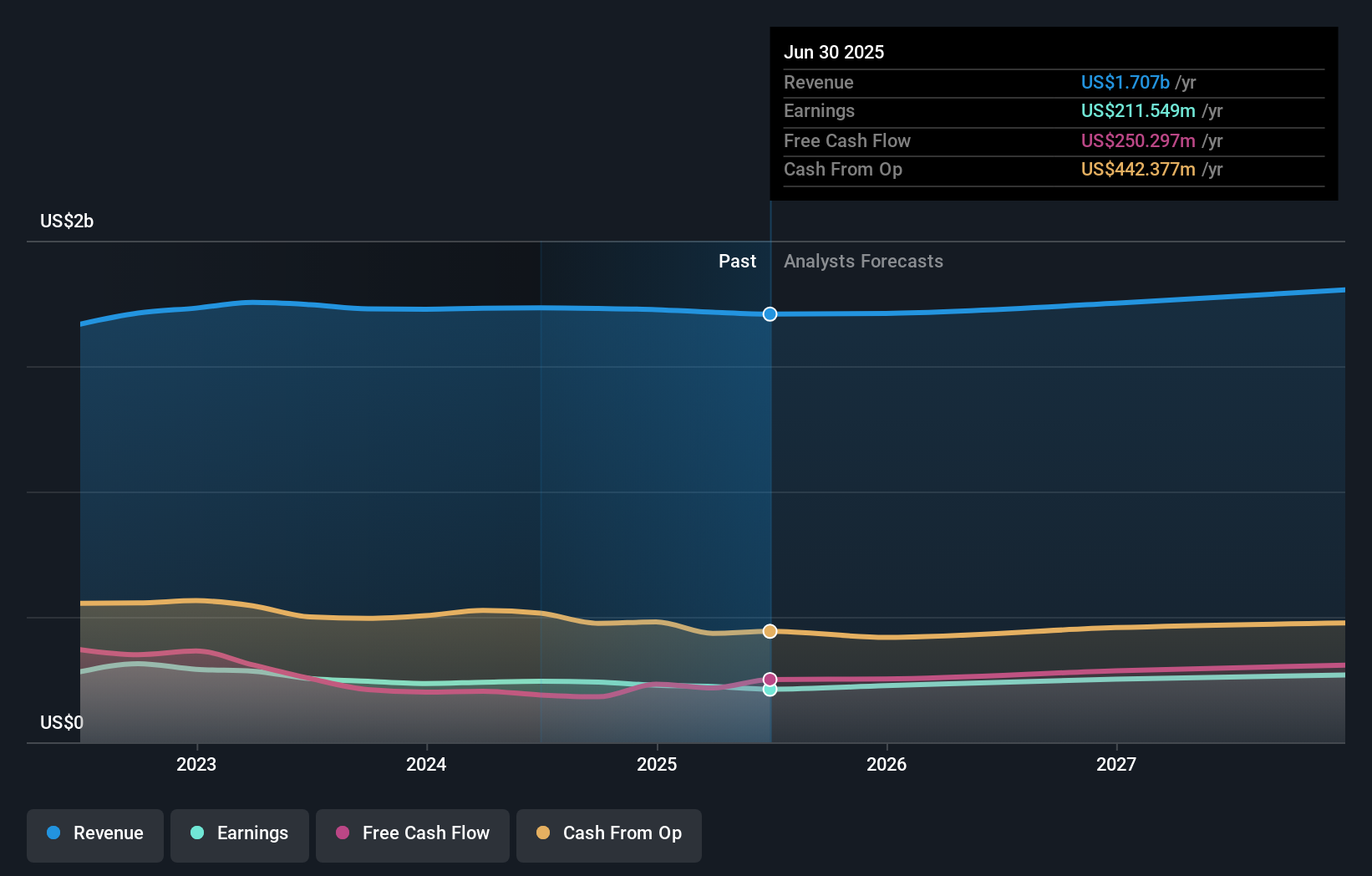

United Parks & Resorts' projections indicate revenues of $1.8 billion and earnings of $284.5 million by 2028. This outlook assumes a 2.1% annual revenue growth rate and a $73 million increase in earnings from the current $211.5 million.

Uncover how United Parks & Resorts' forecasts yield a $57.45 fair value, a 8% upside to its current price.

Exploring Other Perspectives

One fair value estimate of US$57.45 from the Simply Wall St Community reflects a narrow range of retail investor views. While guest monetization initiatives have gained attention, opinions on the company's future path can vary, so it pays to review a variety of analysis angles.

Explore another fair value estimate on United Parks & Resorts - why the stock might be worth as much as 8% more than the current price!

Build Your Own United Parks & Resorts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Parks & Resorts research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United Parks & Resorts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Parks & Resorts' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRKS

United Parks & Resorts

Operates as a theme park and entertainment company in the United States.

Undervalued with limited growth.

Similar Companies

Market Insights

Community Narratives