- United States

- /

- Hospitality

- /

- NYSE:PLNT

Is Planet Fitness Share Price Justified After Recent Stock Dip in 2025?

Reviewed by Bailey Pemberton

If you have been eyeing Planet Fitness stock and wondering whether now is the right time to get in or increase your position, you are definitely not alone. This is one of those stocks that can make even experienced investors pause, especially after the rollercoaster the broader fitness industry has seen in recent years. With the share price closing at $97.96, it reflects a minor dip of 6.9% over the past week and 6.3% in the last month. Yet, take a step back and you will notice a stronger backdrop. Planet Fitness is still up 20.6% over the past year and an impressive 62.7% in the last three years.

Behind these numbers, changes in market sentiment are in play. Investors are weighing ongoing industry trends such as shifting consumer habits, renewed expansion plans from major gym operators, and how economic conditions might affect discretionary spending. While Planet Fitness has demonstrated resilience and strong brand loyalty, some recent choppiness in the stock price could be reflecting heightened market caution instead of company-specific weakness.

For those tuning in to valuation, the company scores 1 out of 6 on our value checklist. In other words, Planet Fitness appears to be undervalued in just one of the key six areas typically used to find bargains. This sets the perfect stage to dig deeper into how Planet Fitness stacks up on traditional valuation measures. Considering why thinking beyond these approaches might unlock a clearer picture for investors is something we will explore toward the end of the article.

Planet Fitness scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Planet Fitness Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model helps estimate a company's intrinsic value by forecasting its future cash flows and then discounting them back to their present value. For Planet Fitness, the model uses the latest reported Free Cash Flow of $203.6 million as a starting point, reflecting the cash available after expenses and investments.

According to analyst estimates and projections, Planet Fitness's Free Cash Flow is expected to reach $405 million by 2029, with figures for subsequent years extrapolated by Simply Wall St. The first five years of these forecasts are based on analyst input, while years six through ten are estimates using moderate growth rates.

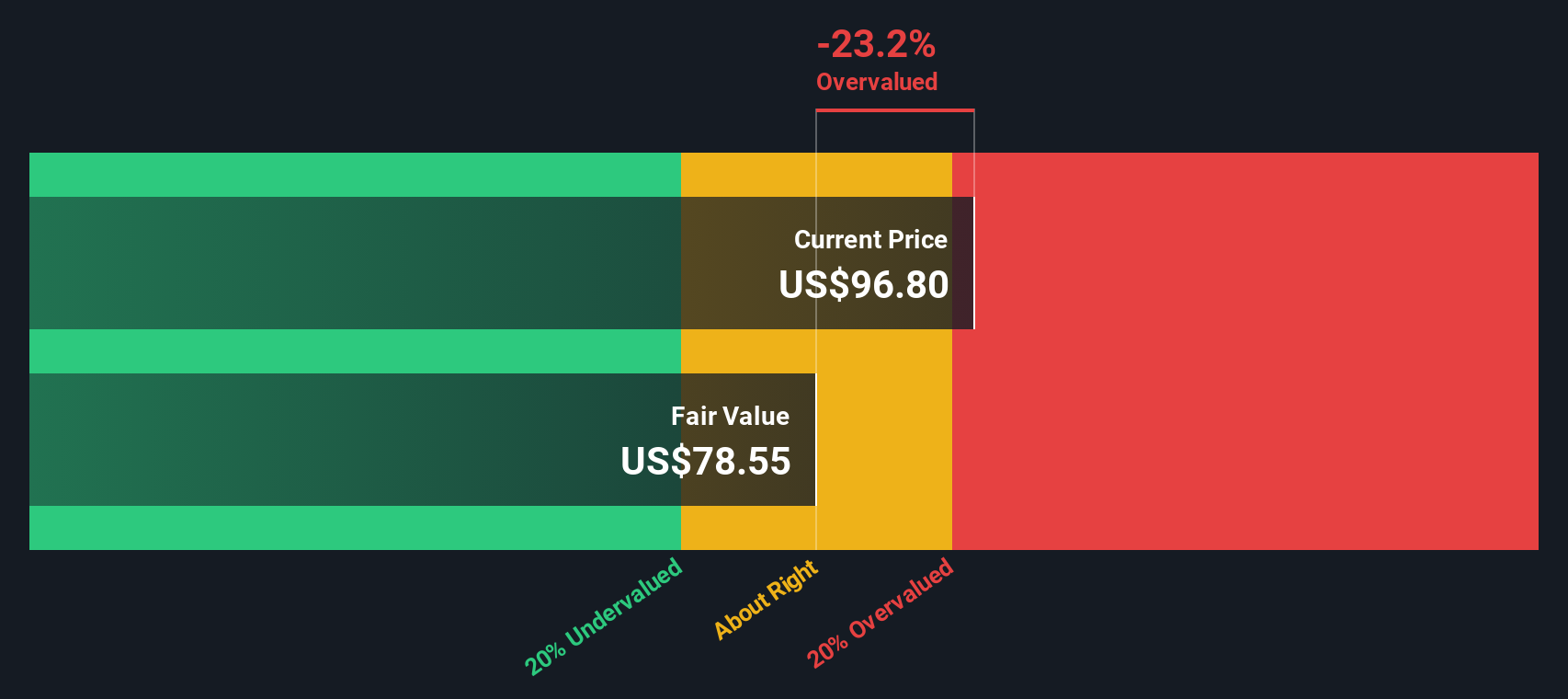

When these projected cash flows are discounted back to today's terms using the 2 Stage Free Cash Flow to Equity method, Planet Fitness’s intrinsic value is calculated at $79.10 per share. Given the current share price of $97.96, this DCF suggests the stock is trading about 23.8% above its estimated fair value and may be overvalued on this basis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Planet Fitness may be overvalued by 23.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Planet Fitness Price vs Earnings

Price-to-Earnings (PE) ratio is widely considered a go-to valuation method for profitable companies like Planet Fitness, since it provides a clear snapshot of how much investors are willing to pay for each dollar of earnings. Because Planet Fitness has a consistent profitability track record, analyzing its PE multiple can yield real insight into market expectations.

It’s important to remember that growth prospects and business risks both influence what an appropriate, or “fair,” PE ratio should be. High-growth or low-risk companies generally deserve a higher PE, while those facing obstacles or uncertain outlooks typically trade lower.

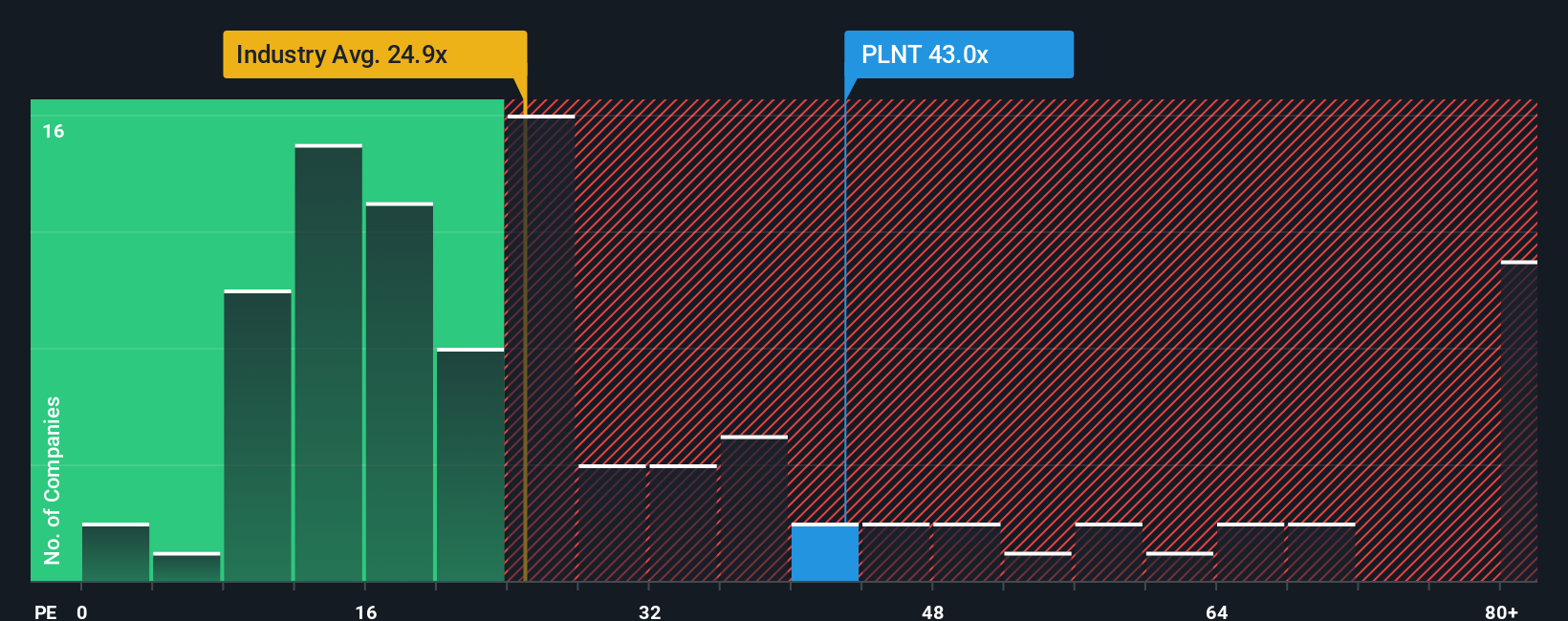

Currently, Planet Fitness trades at a PE ratio of 43.5x. Compare this to the hospitality industry average of roughly 24.9x and a peer group average of 31.2x, and it is clear that the stock commands a premium. At first glance, this premium might suggest the stock is expensive relative to both sector and direct competitors.

To cut through these raw comparisons, Simply Wall St applies its "Fair Ratio" metric. This proprietary calculation estimates what a reasonable PE should be, given Planet Fitness’s specific earnings growth profile, profit margins, market capitalization, and inherent risks. Unlike plain peer or industry benchmarks, the Fair Ratio is designed to be a more personalized and accurate measure.

For Planet Fitness, the Fair Ratio works out to 25.3x, which is sharply lower than its actual PE of 43.5x. This substantial gap indicates the stock is trading at a level that may not be fully supported by its underlying fundamentals, after accounting for growth, risk, and profitability factors.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Planet Fitness Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Rather than relying solely on traditional metrics, Narratives allow you to wrap your unique perspective around the numbers by creating a story that explains how and why Planet Fitness should be valued a certain way. Each Narrative connects what you believe about the company’s future, such as expansion plans, industry trends, and risks, to a set of projected financial outcomes and a resulting fair value. This approach is easy to use and fully accessible at Simply Wall St’s Community page, where millions of investors share and update their Narratives as new information (such as earnings releases or major news) becomes available.

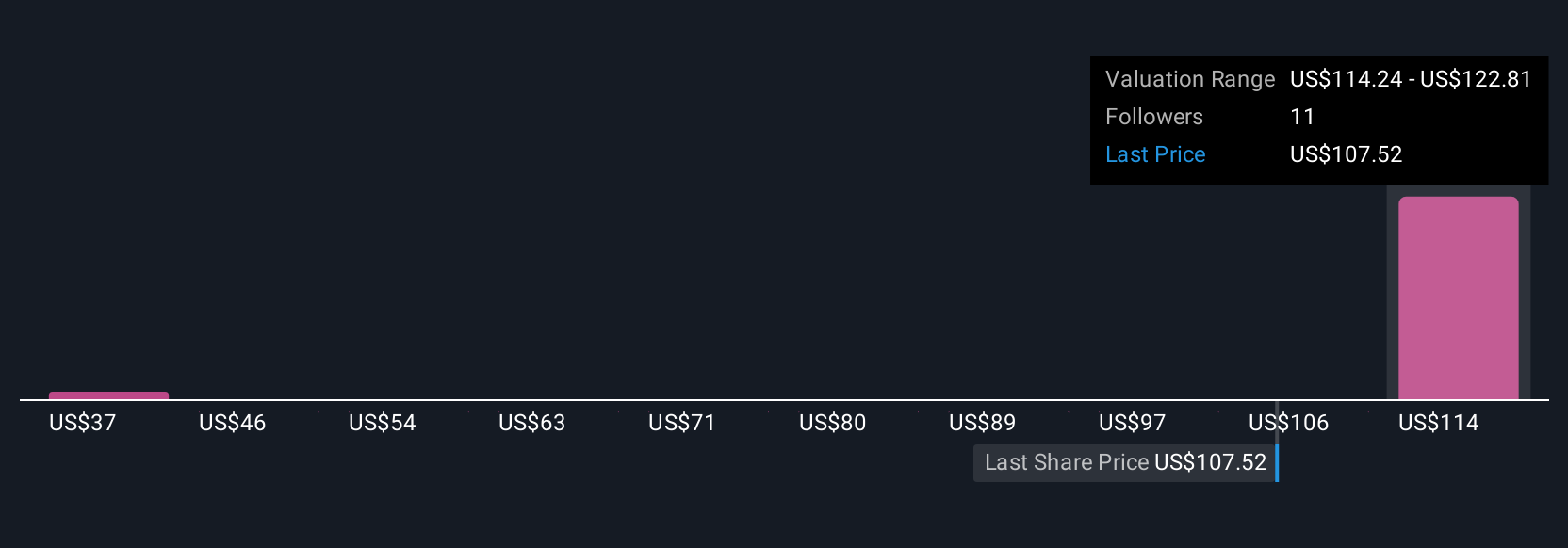

With Narratives, you can decide when to buy or sell by tracking how your fair value compares to the current share price and see how your view stacks up alongside others in the community. For example, the most optimistic Narrative for Planet Fitness forecasts a fair value of $175 per share, based on rapid global expansion and margin growth, while the most cautious sees fair value near $105, emphasizing risks like increased attrition and industry competition. By using Narratives, you get a tool that makes complex valuation understandable, dynamic, and truly personalized.

Do you think there's more to the story for Planet Fitness? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLNT

Planet Fitness

Planet Fitness, Inc., together with its subsidiaries, franchises and operates fitness centers under the Planet Fitness brand.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives