- United States

- /

- Hospitality

- /

- NYSE:MGM

Here's Why We Think MGM Resorts International (NYSE:MGM) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like MGM Resorts International (NYSE:MGM). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for MGM Resorts International

MGM Resorts International's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. Shareholders will be happy to know that MGM Resorts International's EPS has grown 22% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

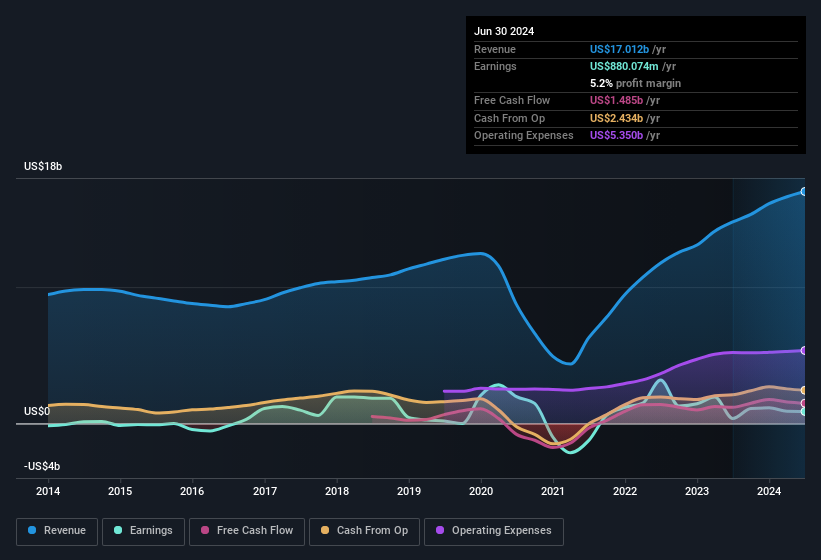

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of MGM Resorts International shareholders is that EBIT margins have grown from -8.5% to 10% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for MGM Resorts International's future EPS 100% free.

Are MGM Resorts International Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Although we did see some insider selling (worth US$2.8m) this was overshadowed by a mountain of buying, totalling US$7.3m in just one year. We find this encouraging because it suggests they are optimistic about MGM Resorts International'sfuture. We also note that it was the Independent Chairman, Paul Salem, who made the biggest single acquisition, paying US$5.0m for shares at about US$33.80 each.

The good news, alongside the insider buying, for MGM Resorts International bulls is that insiders (collectively) have a meaningful investment in the stock. We note that their impressive stake in the company is worth US$118m. This comes in at 1.0% of shares in the company, which is a fair amount of a business of this size. So despite their percentage holding being low, company management still have plenty of reasons to deliver the best outcomes for investors.

Does MGM Resorts International Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into MGM Resorts International's strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. It is worth noting though that we have found 2 warning signs for MGM Resorts International that you need to take into consideration.

Keen growth investors love to see insider activity. Thankfully, MGM Resorts International isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MGM

MGM Resorts International

Through its subsidiaries, owns and operates casino, hotel, and entertainment resorts in the United States and internationally.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives