It almost seemed like the market didn't trust in McDonald's Corporation ( NYSE: MCD ) before the Earnings report, yet the world's largest franchise network surprised, once again improving its bottom line.

Check our latest analysis on McDonald's.

Q3 2021 results

The company reported a strong third-quarter result with improved earnings, revenues, and profit margins.

- Revenue: US$6.20b (up 14% from 3Q 2020).

- Net income: US$2.15b (up 22% from 3Q 2020).

- Profit margin: 35% (up from 33% in 3Q 2020).

The increase in margin was driven by higher revenue. Over the last 3 years, on average, earnings per share have increased by 5% per year, but its share price has risen by 12% per year, which means it is tracking significantly ahead of earnings growth.

Analysts reacted positively to the earnings, pushing the targets up. Oppenheimer was leading the pack with a price target boost to US$280, Cowen sees it at US$275 while UBS has it at US$270. All 3 have it at either "Outperform" or "Buy."

Meanwhile, labor problems are becoming persistent across multiple industries. CEO Chris Kempczinski reflected on this, saying that it causes restaurants to cut their working hours and reduce service speed.

However, the company plans to fight this problem with tech solutions, turning to IBM (NYSE: IBM) for AI solutions. IBM will take over McD Tech Labs to develop voice-recognition ordering in McDonald's drive-thru lanes.

This, in turn, doesn't seem to worry the employees in multiple cities who carried out a one-day strike to protest the company's response to sexual harassment in the workplace. The protestors are calling for a safer and more respectful work environment in McDonald's restaurants.

45 Years of Dividend History

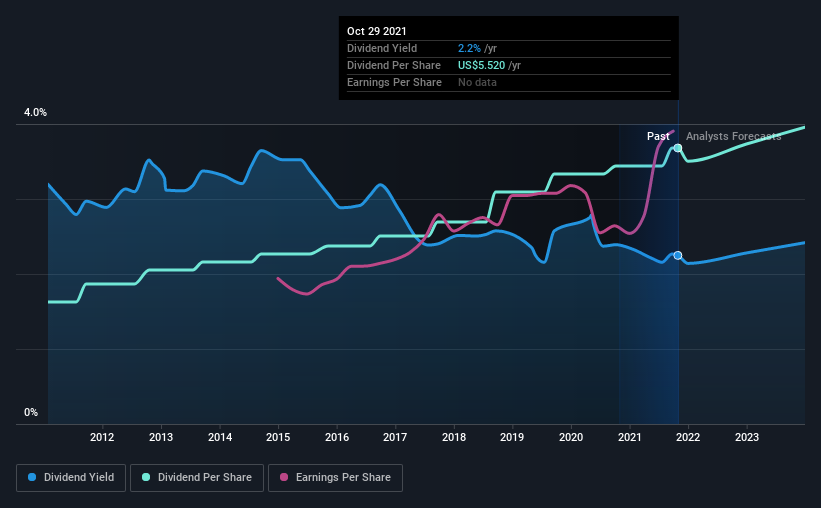

While McDonald's' 2.2% dividend yield is not the highest, we think its lengthy payment history is quite interesting. The company has been an impressive dividend aristocrat, on a 45-year growth streak.

Click the interactive chart for our full dividend analysis

Payout ratios

We should always investigate whether a company can afford its dividend, measured as a percentage of its net income after tax.McDonald's paid out 53% of its profit as dividends over the trailing twelve-month period.This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

The company paid the same amount, 53% of its cash flow as dividends last year, which is within a reasonable range for the average corporation.It's positive to see that profits and cash flow cover McDonald's' dividend since this is generally a sign that the dividend is sustainable. A lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Consider getting our latest analysis on McDonald's' financial position here.

Dividend Volatility

McDonald's has been paying dividends for a long time, but we only examine the past 10 years of payments for this analysis.The dividend has been stable over the past 10 years, which is great. We think this could suggest some resilience to the business and its dividends.

During the past 10-year period, the first annual payment was US$2.4 in 2011, compared to US$5.5 last year.This works out to be a compound annual growth rate (CAGR) of approximately 8.5% a year over that time.

Dividends have grown at a reasonable rate over this period, and without any significant cuts in the payment over time, we think this is an attractive combination.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend.Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see McDonald's has grown its earnings per share at 13% per annum over the past five years.

Earnings per share have been growing rapidly, but given that it is paying out more than half of its earnings as dividends, we wonder how McDonald's will keep funding its growth projects in the future.

Conclusion

To conclude, McDonald's fairs well in our dividend checklist.

For a start, its dividend payments are relatively stable. It also has decent prospects in growing its earnings and dividends - given an established business model with excellent profit margins. Finally, the company pays out a healthy percentage of its profits, keeping the safe buffer zone for various risks. At an acceptable price, the stock could be a part of multiple dividend-oriented portfolios.

However, there are other things to consider for investors when analyzing stock performance. For example, we've picked out 1 warning sign for McDonald's that investors should know about before committing capital to this stock.

Are you looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:MCD

McDonald's

Owns, operates, and franchises restaurants under the McDonald’s brand in the United States and internationally.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives