- United States

- /

- Hospitality

- /

- NYSE:LTH

Should Life Time's Boston Flagship and Fortune 100 Ranking Prompt Reassessment by LTH Investors?

Reviewed by Sasha Jovanovic

- Life Time Group Holdings recently opened its first downtown Boston location at the Prudential Center, offering nearly 60,000 square feet of luxury wellness amenities and marking its seventh club in Massachusetts.

- The company was also named to the 2025 Fortune 100 Fastest-Growing Companies list, reflecting its market recognition and momentum in expanding wellness services and community offerings.

- We'll explore how the opening of Life Time Prudential Center enhances the company's growth outlook in the premium health and wellness sector.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Life Time Group Holdings Investment Narrative Recap

Shareholders in Life Time Group Holdings must believe in the longevity of premium wellness experiences and club expansion as key drivers of membership and recurring revenue growth. The debut of the Life Time Prudential Center solidifies the company’s presence in urban, affluent communities, reinforcing its growth catalyst, but the risk remains that elevated construction costs or tighter real estate capital markets could narrow margins and slow further development. For now, this opening boosts near-term visibility without materially changing the largest risk to the business.

Among recent announcements, the new strategic partnership with Aion stands out for its direct link to member engagement and high-margin ancillary services. By integrating Aion products into nationwide training programs and supplementing the in-club experience, Life Time strengthens its revenue per member and deepens brand positioning, tying together two central growth drivers: club scale and ancillary offerings.

But while club openings like Boston’s Prudential Center may generate buzz, investors should not overlook the possible impact of shifting capital markets and higher financing costs on...

Read the full narrative on Life Time Group Holdings (it's free!)

Life Time Group Holdings' narrative projects $3.8 billion revenue and $457.9 million earnings by 2028. This requires 10.7% yearly revenue growth and a $231.1 million earnings increase from the current $226.8 million.

Uncover how Life Time Group Holdings' forecasts yield a $39.91 fair value, a 53% upside to its current price.

Exploring Other Perspectives

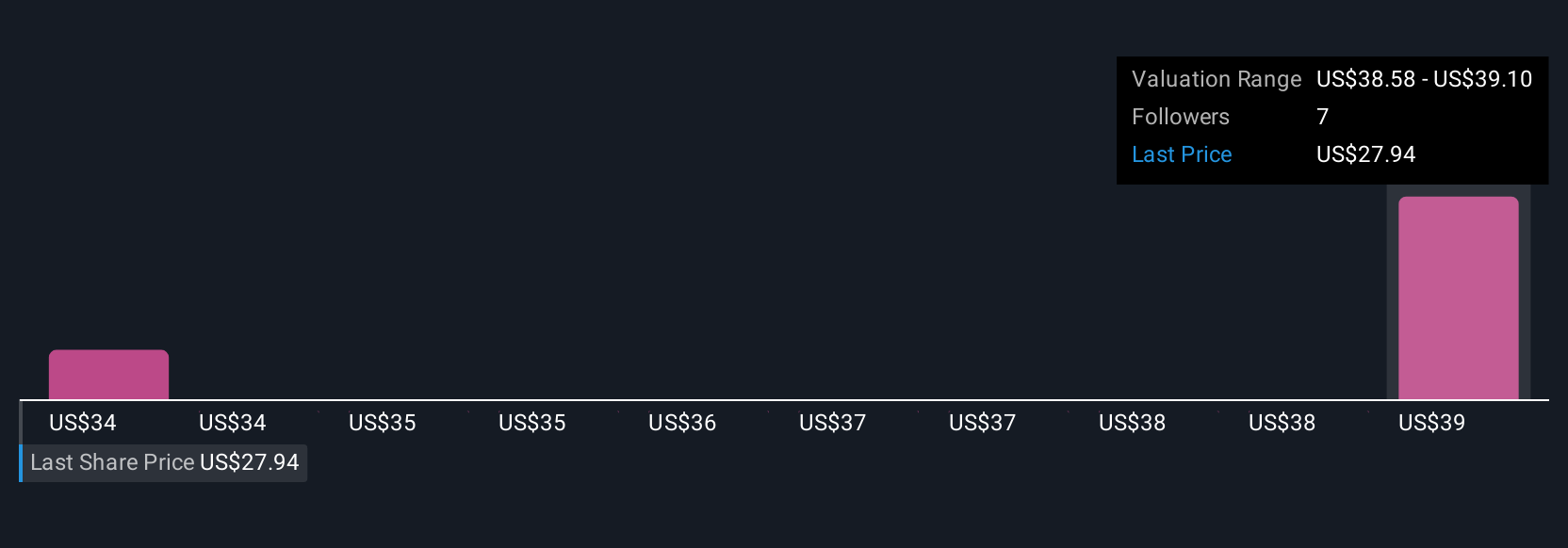

The Simply Wall St Community’s fair value estimates for Life Time Group Holdings range from US$34.05 to US$39.91, with just two perspectives informing the analysis. While some point to undervaluation, many are closely tracking risks tied to construction spending and access to capital, which could shape operating margins going forward.

Explore 2 other fair value estimates on Life Time Group Holdings - why the stock might be worth just $34.05!

Build Your Own Life Time Group Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Life Time Group Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Life Time Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Life Time Group Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LTH

Life Time Group Holdings

Provides health, fitness, and wellness experiences to a community of individual members in the United States and Canada.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives