Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Stride, Inc. (NYSE:LRN) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Stride

What Is Stride's Net Debt?

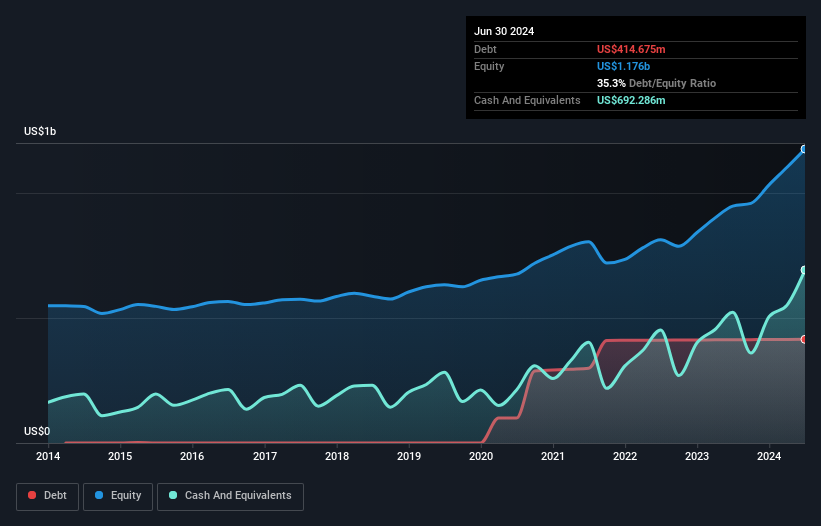

As you can see below, Stride had US$414.7m of debt, at June 2024, which is about the same as the year before. You can click the chart for greater detail. But on the other hand it also has US$692.3m in cash, leading to a US$277.6m net cash position.

How Strong Is Stride's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Stride had liabilities of US$244.3m due within 12 months and liabilities of US$500.2m due beyond that. On the other hand, it had cash of US$692.3m and US$472.8m worth of receivables due within a year. So it can boast US$420.6m more liquid assets than total liabilities.

This surplus suggests that Stride has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Stride boasts net cash, so it's fair to say it does not have a heavy debt load!

In addition to that, we're happy to report that Stride has boosted its EBIT by 47%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Stride can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Stride has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Stride recorded free cash flow worth a fulsome 84% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Stride has net cash of US$277.6m, as well as more liquid assets than liabilities. The cherry on top was that in converted 84% of that EBIT to free cash flow, bringing in US$217m. So we don't think Stride's use of debt is risky. We'd be very excited to see if Stride insiders have been snapping up shares. If you are too, then click on this link right now to take a (free) peek at our list of reported insider transactions.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LRN

Stride

Provides proprietary and third-party online curriculum, software systems, and educational services in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026