- United States

- /

- Consumer Services

- /

- NYSE:LRN

Stride (LRN): Evaluating Whether Recent Share Price Pullback Reveals a Valuation Opportunity

Reviewed by Kshitija Bhandaru

See our latest analysis for Stride.

Stride’s share price lost steam this past month, but longer-term, momentum is still strong, with a 1-year total shareholder return just shy of 80%. The pullback could reflect a shift in growth expectations or investors locking in previous gains. Still, the company’s broader trajectory remains impressive.

If you’re looking to expand your search beyond individual names, now is the perfect moment to discover fast growing stocks with high insider ownership.

With analysts still setting price targets well above the current level and the company trading at a notable discount to its estimated value, investors may wonder if Stride is offering a compelling entry point or if the market has already taken its future growth into account.

Most Popular Narrative: 14.3% Undervalued

Stride’s fair value, as inferred by the most widely followed narrative, sits well above its recent close. This suggests notable upside still on the table. This view hinges on the company’s ability to convert enrollment demand and investments into lasting revenue and margin growth.

Persistent double-digit enrollment growth and robust application volumes signal accelerating demand for flexible, digital, and alternative education offerings. This implies sustainable revenue growth as families seek personalized, remote learning options. Expansion of tutoring and career-focused learning solutions, both internally and as externally monetizable offerings, positions Stride to capture additional revenue streams amid rising emphasis on lifelong learning and workforce reskilling.

Curious what bold projections fuel this price target? The narrative builds its higher fair value on a combination of strong revenue momentum and future profit margins most expect from top-tier tech disruptors. Want to know which specific financial milestones set the stage for Stride’s potential rerating? You’ll want to dive deeper to unpack the full story.

Result: Fair Value of $167.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory caps on enrollment and shifts in education funding could quickly challenge Stride’s current growth trajectory and positive outlook.

Find out about the key risks to this Stride narrative.

Another Perspective: Comparing Valuation Ratios

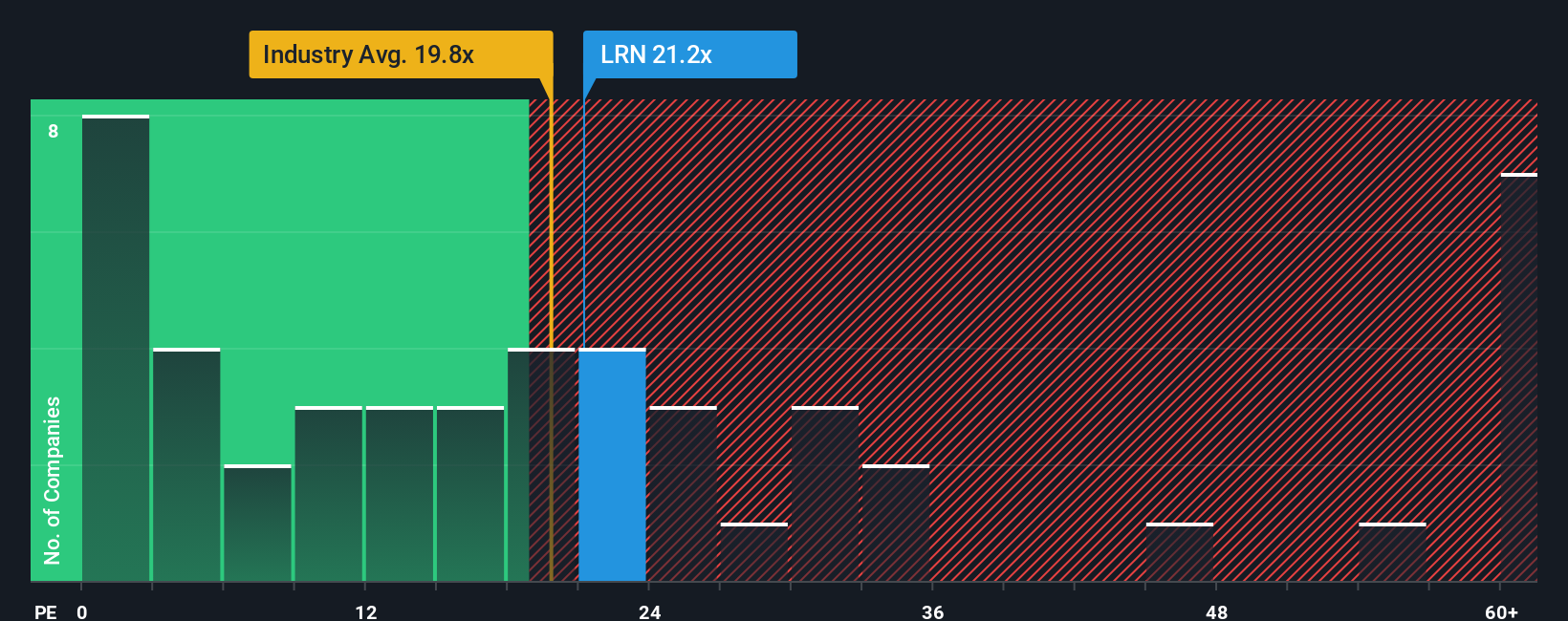

While the most popular narrative points to Stride being undervalued, a look at its price-to-earnings ratio provides a different angle. Stride currently trades at 21.5x earnings, higher than the US Consumer Services industry average of 18.3x. This can sometimes signal overvaluation. However, compared to peer companies averaging 36.9x, Stride actually appears attractively priced. The fair ratio, estimated at 24.1x, suggests the market could eventually see more upside. So, is Stride expensive or on sale? The answer may depend on which comparison feels most relevant for your investing approach.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stride Narrative

If you see the story differently or want to test your own ideas, it only takes a few minutes to build your own perspective. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Stride.

Looking for more investment ideas?

Set yourself up for smarter investing by checking out other exciting opportunities found with the Simply Wall Street Screener. Don’t miss trends that could power your portfolio.

- Start building lasting wealth with stocks offering steady yields by checking out these 19 dividend stocks with yields > 3% that consistently reward investors with dividends above 3%.

- Uncover tomorrow’s market leaders by exploring these 24 AI penny stocks making waves as artificial intelligence reshapes entire industries and business models.

- Catch the momentum of the digital assets movement by looking at these 78 cryptocurrency and blockchain stocks poised to benefit from advances in cryptocurrency and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LRN

Stride

Provides proprietary and third-party online curriculum, software systems, and educational services in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives