- United States

- /

- Hospitality

- /

- NYSE:HLT

Will Hilton (HLT)’s New Lifestyle Brands Strengthen Its Competitive Edge in Boutique Hospitality?

Reviewed by Sasha Jovanovic

- In recent days, Hilton Worldwide Holdings unveiled its 25th brand, Outset Collection by Hilton, targeting the upscale and upper midscale segment, and opened two new properties: Hilton Jacksonville at Mayo Clinic and The George at Columbia in Harlem.

- These moves highlight Hilton's expansion in lifestyle and boutique hospitality, with unique developments designed to appeal to both local communities and global travelers.

- We'll examine how Hilton's focus on new lifestyle brands and immersive property experiences could influence its investment narrative going forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Hilton Worldwide Holdings Investment Narrative Recap

To believe in Hilton Worldwide Holdings as a shareholder, you’d need confidence in the company’s ability to drive long-term growth through aggressive expansion, especially by introducing new brands and experiences in attractive segments like lifestyle and boutique hotels. While recent property and brand launches reinforce Hilton’s strategy to grow its footprint and capture shifting travel demand, they do not remove near-term pressures, such as muted RevPAR growth and competitive incentives, that remain the most important short-term catalysts and risks for the business. At this stage, the incremental impact on Hilton’s topline and earnings outlook from the latest news is not material but demonstrates continued execution of its pipeline.

The launch of the Outset Collection by Hilton stands out as a directly relevant development, since it expands the company’s reach into the independent boutique hotel space, a segment where evolving customer preferences and rapid conversion activity are emerging catalysts. This initiative links closely to Hilton’s pursuit of unit growth through conversions and new openings, which the company views as an answer to sluggish growth in traditional segments, even as competitive pressures around costs and incentives persist.

By contrast, investors should keep in mind that heightened competition for conversions could ...

Read the full narrative on Hilton Worldwide Holdings (it's free!)

Hilton Worldwide Holdings is projected to achieve $14.8 billion in revenue and $2.5 billion in earnings by 2028. This outlook assumes an annual revenue growth rate of 45.4% and an earnings increase of $0.9 billion from current earnings of $1.6 billion.

Uncover how Hilton Worldwide Holdings' forecasts yield a $273.50 fair value, a 5% upside to its current price.

Exploring Other Perspectives

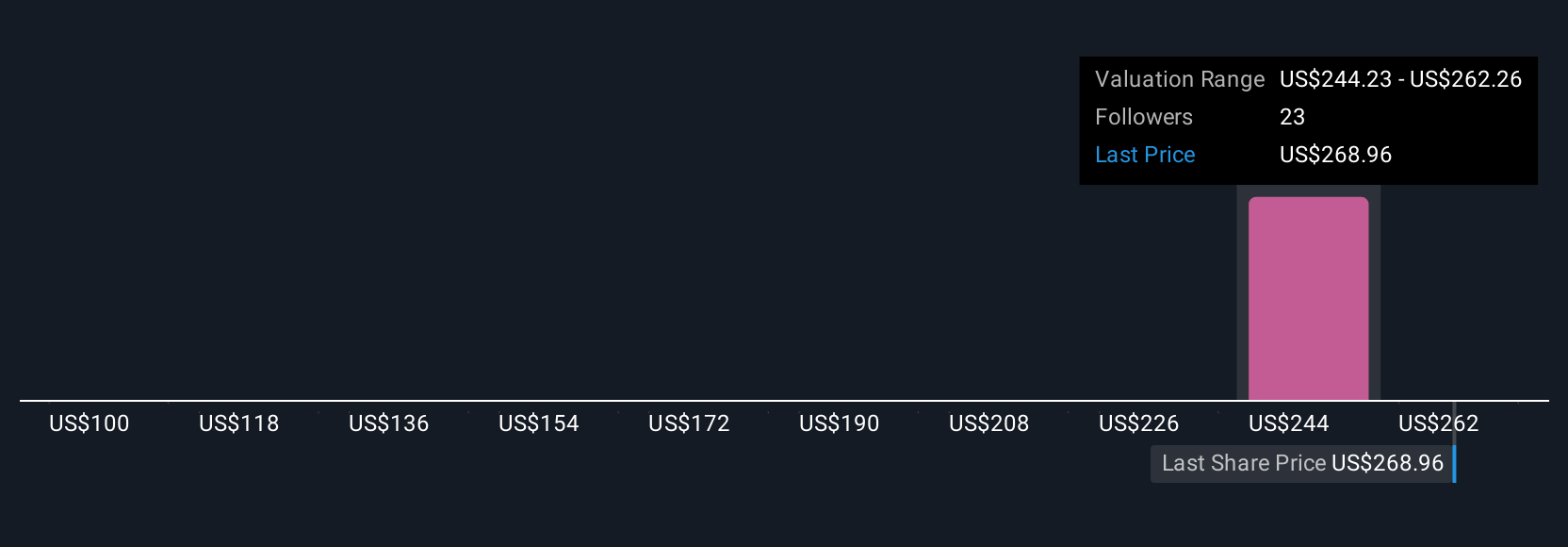

Estimates from four individual members of the Simply Wall St Community value Hilton between US$100 and US$280.29, with strong views at both extremes. This diversity in outlook stands alongside ongoing industry competition and rising costs tied to new brand conversions, both of which could influence Hilton’s ability to deliver future earnings as it expands, explore several alternative perspectives before making up your mind.

Explore 4 other fair value estimates on Hilton Worldwide Holdings - why the stock might be worth less than half the current price!

Build Your Own Hilton Worldwide Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hilton Worldwide Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hilton Worldwide Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hilton Worldwide Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Worldwide Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLT

Hilton Worldwide Holdings

A hospitality company, engages in managing, franchising, owning, and leasing hotels and resorts.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026