- United States

- /

- Hospitality

- /

- NYSE:HGV

Market Still Lacking Some Conviction On Hilton Grand Vacations Inc. (NYSE:HGV)

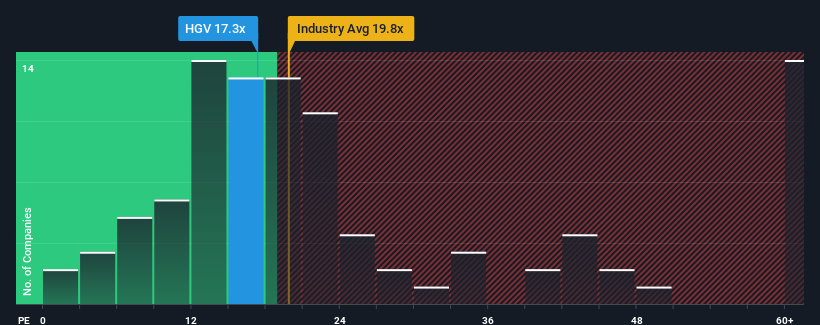

There wouldn't be many who think Hilton Grand Vacations Inc.'s (NYSE:HGV) price-to-earnings (or "P/E") ratio of 17.3x is worth a mention when the median P/E in the United States is similar at about 17x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times haven't been advantageous for Hilton Grand Vacations as its earnings have been falling quicker than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Hilton Grand Vacations

Does Growth Match The P/E?

In order to justify its P/E ratio, Hilton Grand Vacations would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 32%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 41% over the next year. With the market only predicted to deliver 12%, the company is positioned for a stronger earnings result.

In light of this, it's curious that Hilton Grand Vacations' P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Hilton Grand Vacations' P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Hilton Grand Vacations currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Hilton Grand Vacations (1 is a bit concerning!) that you need to be mindful of.

You might be able to find a better investment than Hilton Grand Vacations. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hilton Grand Vacations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HGV

Hilton Grand Vacations

A timeshare company, develops, markets, sells, manages, and operates the resorts, plans and ancillary reservation services under the Hilton Grand Vacations brand.

Reasonable growth potential slight.